Production down in June 2025, foreign trade stable

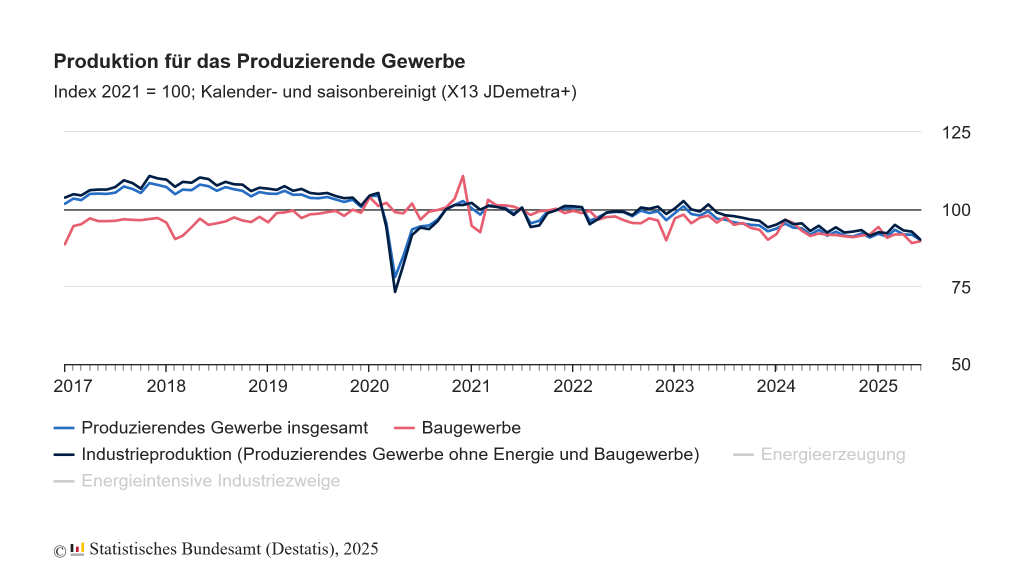

Industrial production in Germany fell noticeably in June 2025. According to the Federal Statistical Office (Destatis), price-adjusted production in the manufacturing sector fell by 1.9% compared to the previous month. Compared to the same month last year, the decline was as high as 3.6%. Energy-intensive industries and sectors such as mechanical engineering, pharmaceuticals and food production were particularly affected.

Industry at its lowest level since 2020

With the significant decline, industrial production reached its lowest level since May 2020, the peak of the coronavirus crisis. The three-month comparison also shows a negative trend: In the second quarter of 2025, production was 1.0% below the level of the first quarter.

The declines were spread across the industry: production of consumer goods fell by 5.6%, capital goods by 3.2% and intermediate goods by 0.6%. The only bright spot was the construction industry, which recorded an increase of 0.7% in June.

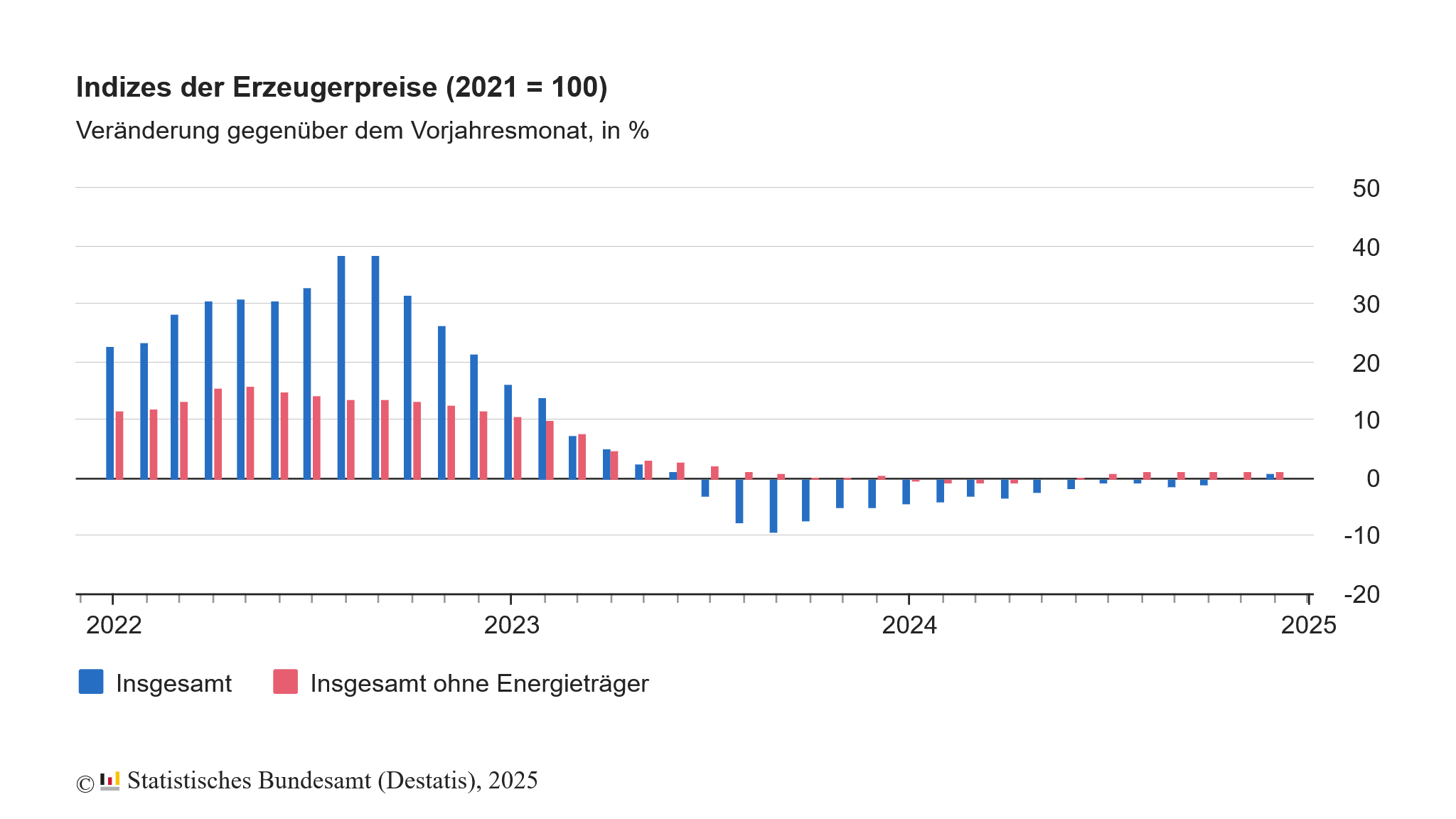

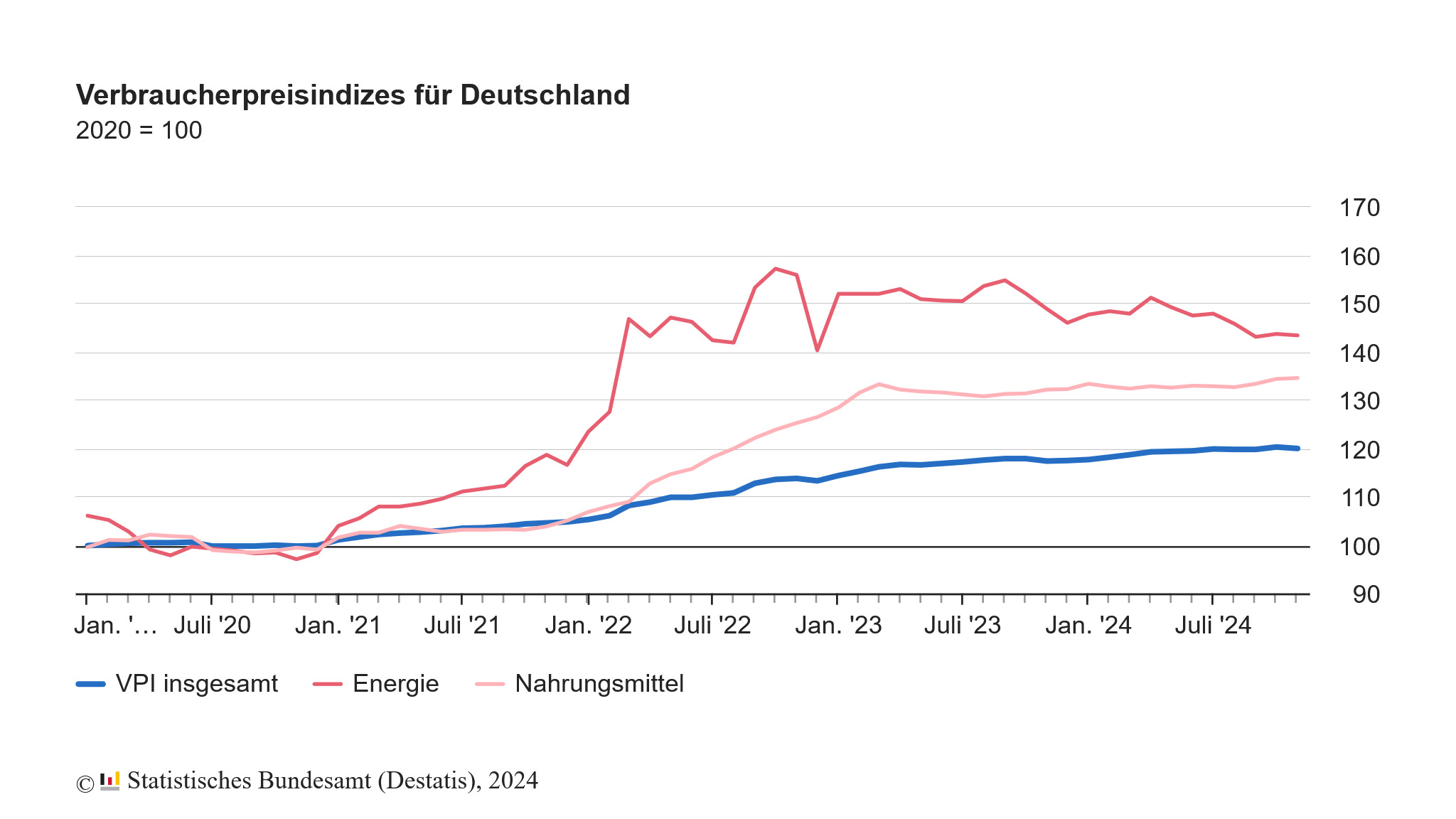

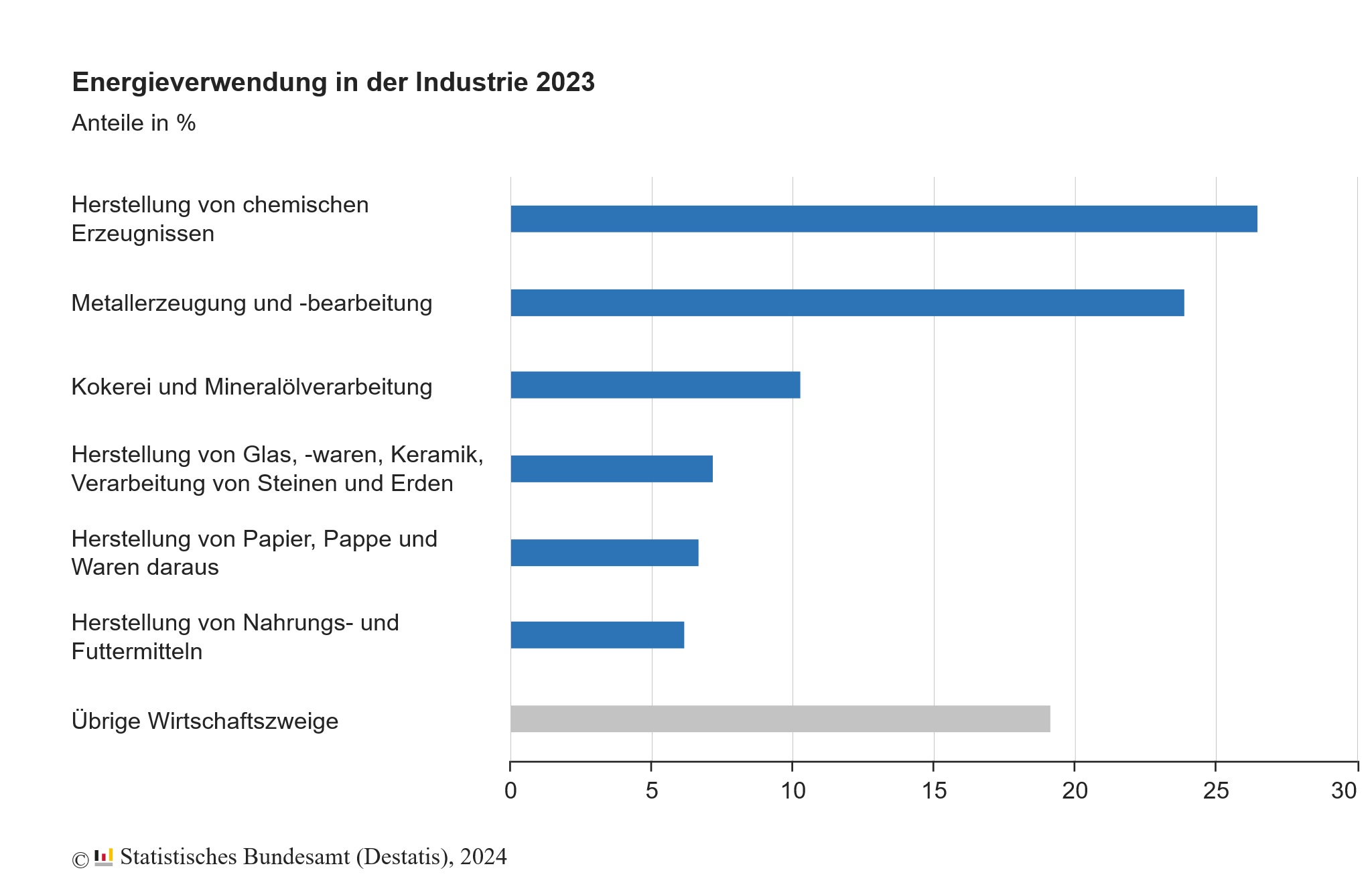

Burden on energy-intensive industries

In the energy-intensive industries, production fell by 2.2% in June compared to the previous month. In a quarterly comparison (Q2 to Q1), the drop was 2.3%, and compared to the previous year it was as much as 7.4%. This development affects the chemical, glass and metal industries, among others, and illustrates the ongoing burden of high energy prices and structural uncertainties.

Significant declines in key sectors

Three sectors in particular contributed to the decline in production:

- Mechanical engineering: -5.3% compared to May

- Pharmaceutical industry: -11.0

- Food industry: -6.3 %

These declines could indicate weak demand or sector-specific challenges. Factors that are particularly relevant for SMEs and start-ups in the industrial environment. As an example, we reported on the problems at the pharmaceutical site in Marburg as an example.

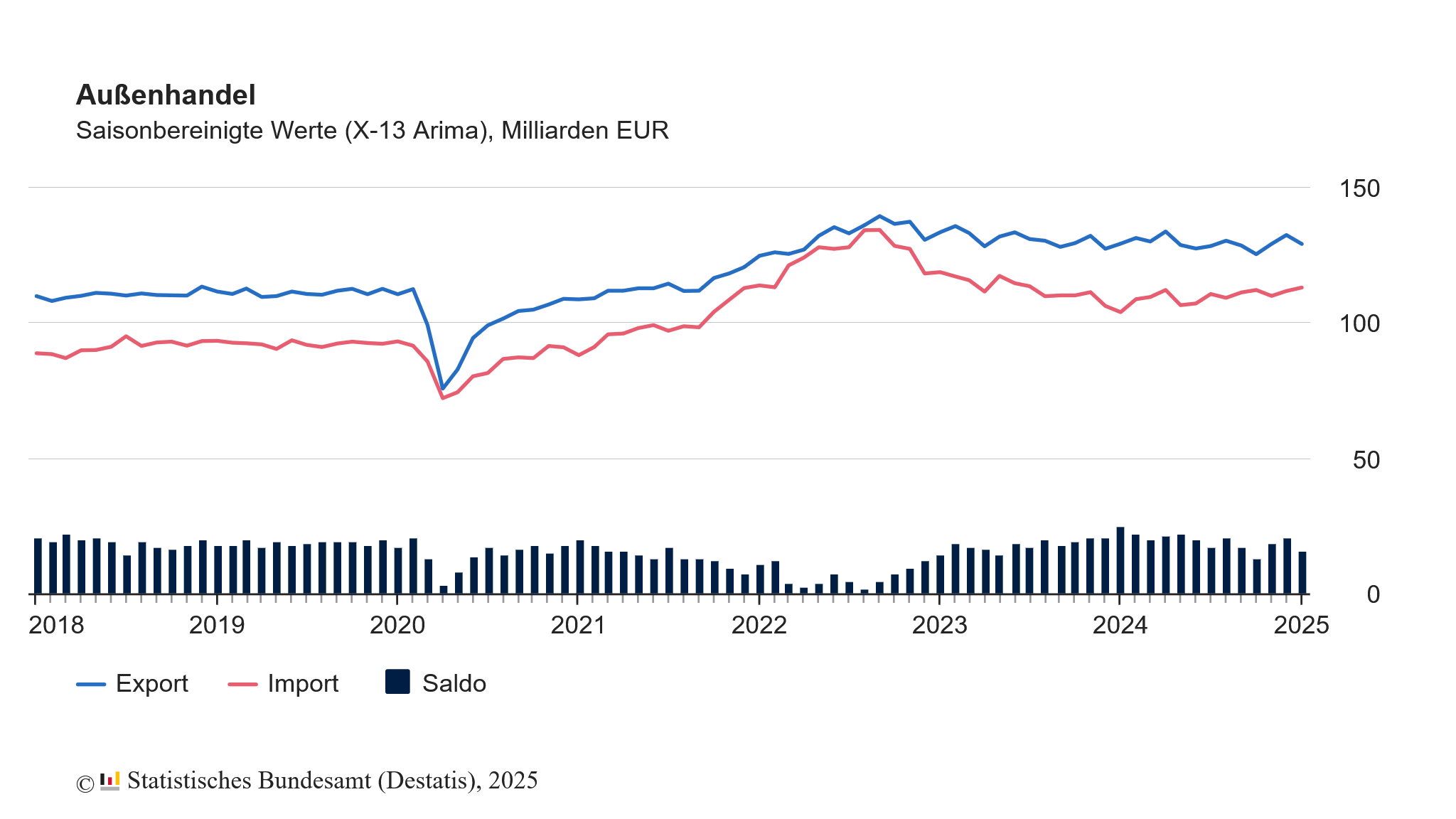

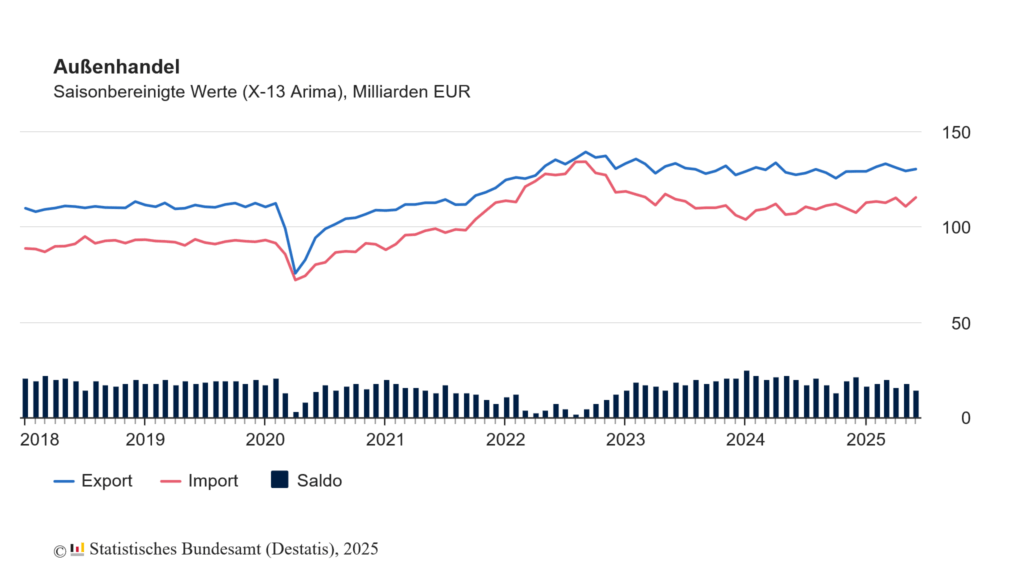

Foreign trade shows stability

Despite a decline in industrial production, German foreign trade increased in June 2025: exports rose by 0.8% compared to the previous month, while imports increased by 4.2%. The export volume amounted to 130.5 billion euros and the import volume to 115.6 billion euros. The foreign trade balance closed with a surplus of 14.9 billion euros, which is, however, below the previous year's figure of 20.3 billion euros.

Imports from China (+5.8%) and the USA (+19.8%) in particular increased strongly. Exports to the USA, on the other hand, fell again. A significant decline of 2.1% compared to the previous month and 8.4% year-on-year, which is likely to be directly related to the uncertain customs situation between the EU and the USA.

Classification for founders

For start-ups related to industry or energy-intensive sectors, the current figures are a sign of restraint in the market. The willingness to invest is likely to remain limited due to the persistently weak production. Founders should pay more attention to market and energy price trends when planning market entries, scaling or the supply chain. At the same time, foreign trade shows that international sales markets continue to function, particularly within the EU and with China. Companies with an export focus could take advantage of targeted opportunities here.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?