25 million euros for fintech Myos

Myos grants loans to small retailers. In a recent financing round, the fintech received 25 million euros from investors. But some of the money is being passed on.

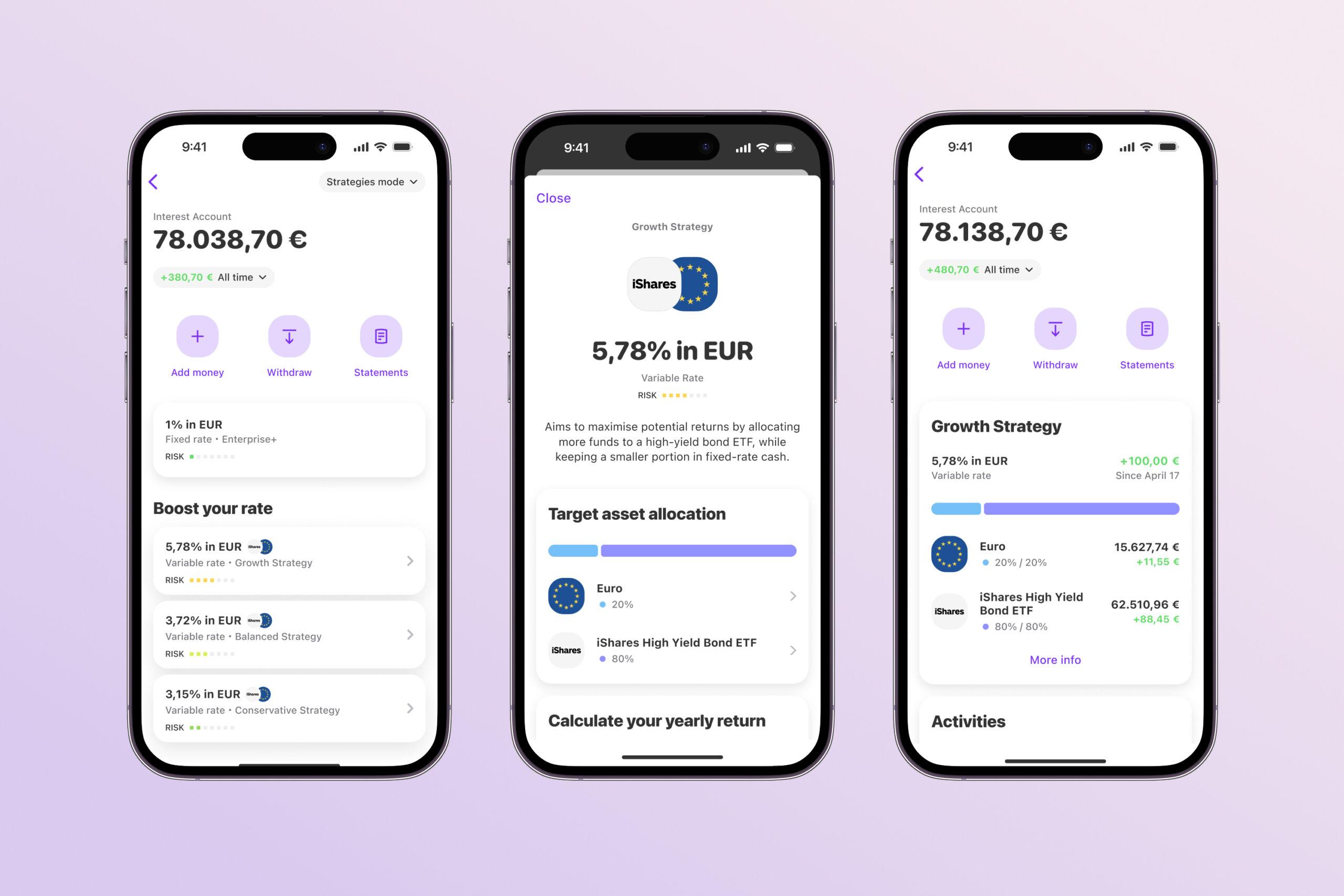

Fintech Myos lends money to small retailers who sell their products via Amazon or Shopify, for example. The fintech is now raising 25 million euros, as reported by Finance Forward. New investors include Xploration Capital and Fasanara Capital, as well as the VC Tomahawk fund from founder and investor Cédric Waldburger. The sum is a mixture of debt capital and investment in the company, the exact breakdown is not known. The money will also be used to grant new loans, and Myos is also looking to the UK for possible expansion.

The fintech was launched in 2018 and currently has 30 employees. So far, 30 million euros have been granted as loans. CEO Nikolaus Hilgenfeldt told Finance Forward that this volume is set to double each year in the future. "Borrowed capital is not the limiting factor for us, our investors are ready and waiting. We need to make the product better known," said Hilgenfeldt about the Myos concept. According to the company, the default rate is 1.8 percent.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?