Fewer fintechs, increasing willingness to invest

Germany Finance publishes the German Fintech Report 2021 with Startbase

In Germany, the willingness to found fintechs is declining. At the same time, investors have never been so keen to support financial start-ups. This is shown by the latest figures from Germany Finance and Startbase. Is Germany missing a huge opportunity here?

When the term fintech is mentioned, investors are keen. Many of them are prepared to invest millions in technical innovations on the financial market. These are the findings of the "German Fintech Report 2021" by Germany Finance in collaboration with Startbase. The study shows: It is currently particularly lucrative to develop a good idea in the field of financial technologies, and investors are significantly more generous than in previous years. The number of financings has risen by an average of six percent per quarter since 2018, one and a half times as much as in the start-up ecosystem as a whole (four percent per quarter). At the same time, fintechs have been able to close large financing rounds much more frequently than start-ups in general. This can be seen in fintech giants such as the online broker Trade Republic, which raised more than 4.4 billion euros from investors, or the direct bank N26 with 3.5 billion euros.

The study by Germany Finance was conducted as part of the Germany Finance initiative. The platform networks regional financial center initiatives across Germany and aims to make Germany more visible nationally and internationally as an attractive financial center. One problem is that there is currently no standard definition for fintechs. As a result, the number of fintechs across Germany varies greatly in different studies. For this reason, Germany Finance has developed a joint definition with the participating financial centers in order to set a future standard. The report collected over 1,100 companies listed as fintech from studies, lists, databases and start-up-related media. Only 639 of them meet the narrow definition of a fintech drawn up by Germany Finance. For example, so-called proptech start-ups, which deal with technologies in the real estate market, are not included - unlike in many other fintech studies.

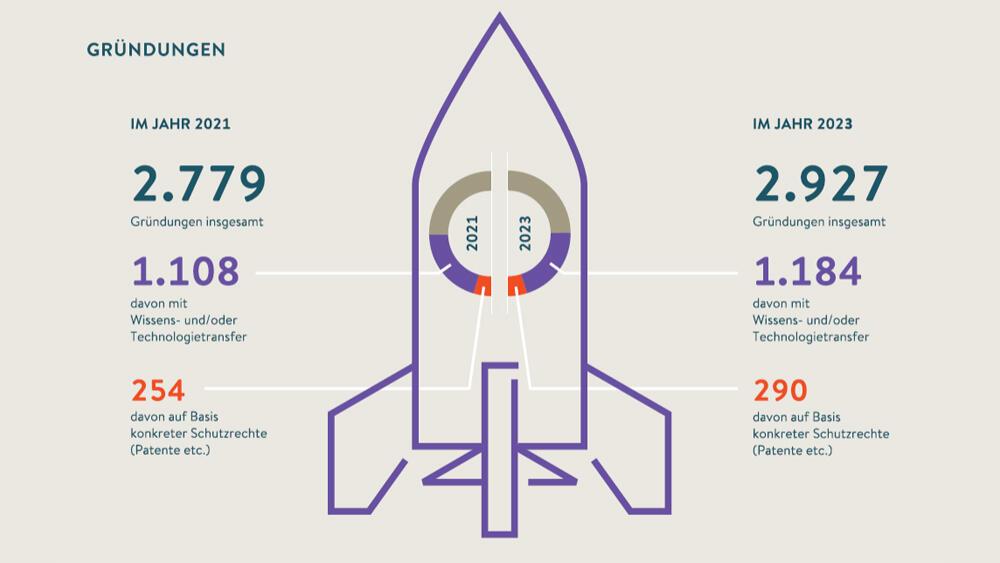

Another finding of the study is that the market appears to be less attractive for young entrepreneurs despite high investment sums. The trend of fintech start-ups has been declining over the past three years. Since 2018, the number of financial technology companies has fallen by an average of one percent per quarter - while the number of start-ups has risen by four percent per quarter over the same period. There were 243 fintech start-ups in Germany between 2018 and 2020.

According to the figures, the lifespan of fintechs is more promising than usual in the German start-up scene: only just over half (55%) of fintechs in Germany are less than five years old. This is below the German average for all start-ups, 60 percent of which are less than five years old.

One in ten start-ups is a fintech

Despite the decline in recent years, the importance of the sector remains enormous. Ten percent of all start-ups in Germany are fintechs. This makes them the second strongest sector in the German start-up ecosystem after information and communication technology.

Artificial intelligence, blockchain and digitalization are the main drivers of fintechs' market share and business model. According to a study by Sparkasse, this also makes fintechs influential drivers of digital innovation in the German economy.

German diversity: fintechs have different focuses

The locations of the German fintech scene vary greatly, according to the study by Germany Finance. Ninety percent of all German financial technology companies are based in one of the six major fintech hubs of Berlin, Hamburg, North Rhine-Westphalia, the Rhine-Main region, Baden-Württemberg and Bavaria.

It should come as no surprise that the start-up metropolis of Berlin is home to the most fintechs in Germany. 28 percent have settled there. At the same time, the capital also attracts a disproportionate amount of media attention. According to the latest study by Germany Finance, around 50 percent of start-up-related media coverage is about the fintechs based there.

Overall, however, the locations not only attract different levels of media attention, but also specific clusters and development trends. The smallest of the six German fintech hubs is located in Baden-Württemberg. Around eight percent of all fintechs have their headquarters there. The federal state does not yet have a clear cluster of its own with which it could identify. Young Baden-Württemberg fintechs are mainly active in the area of personal financial management. These are companies that, like the Berlin fintechs Fraugster or Bonify, want to help private customers keep an eye on and manage their personal finances. Young fintechs in North Rhine-Westphalia also focus mainly on this area.

In the Rhine-Main region, on the other hand, young fintechs tend to focus on the area of credit & factoring. This refers to companies that offer customers financing options, such as credits or loans. One well-known company in this area is Smava, an online credit platform whose name is often heard in eye-catching radio commercials.

Otherwise, the Rhine-Main region focuses on asset management and investment in the fintech sector. In other words, fintechs that manage customers' assets or sell securities and other investments. This is apparently a particularly lucrative sector - companies such as Scalable Capital, Trade Republic and Raisin DS have raised several hundred million euros for their business model in recent years. All three are considered unicorns, i.e. start-ups that have received a market valuation of more than one billion euros or US dollars. Two of them come from the Berlin hub, where the focus is already on asset management and investment. However, the fintechs newly attracted to the capital are more familiar with (API) banking. These include well-known names such as N26, which operates as a direct bank and enables account management via smartphone, and Solarisbank.

Hamburg as a strong location for fintechs

Although the most successful fintechs to date all originate from the metropolis of Berlin, this could change in a few years' time. In any case, a study by LinkedIn shows that Berlin is no longer the most popular location for start-ups. According to the Germany Finance Report, young fintechs are also currently mainly attracted to Hamburg. Especially in personal financial management.

At 61%, the Hanseatic city has the largest proportion of fintechs that are less than five years old. Young talent is therefore well represented there. And they are focusing on a new area: decentralized financial markets, or defi for short. This refers to financial services that are based on blockchain technology. It is also used for digital currencies such as Bitcoin. The aim of these fintechs is to use blockchain to eliminate the need for intermediaries in the financial sector, such as banks, stock exchanges or insurance brokers.

Hamburg is benefiting financially from the newcomers. Young fintechs account for 72 percent of fintech financing there. As in Berlin, a particularly large amount of investors' money ends up in the Hanseatic city, according to the report.

Stronger focus on private investors and specific products

However, even though the variety of fintechs is great and they sometimes differ greatly in the individual hubs, there is one trend that can be seen in all of them. Single service providers are currently the largest group of fintechs, 230 companies in total. According to this, 36 percent focus on offering a specific product - and are not active in several business areas at the same time. This is particularly evident in the areas of asset management & investment. However, in the area of credit & factoring, too, the scene is increasingly focusing on breaking down the traditional bancassurance provider into different areas. Advice, financing and investment are no longer offered together, but individually.

The report thus reveals a trend towards specialization in the financial sector. This makes cross-selling, i.e. the exploitation of customer relationships through the additional sale of complementary products or services, increasingly difficult. Due to the more individualized technologies, the target group of private investors is also increasingly becoming the focus of fintech founders.

For some areas, however, a pure focus is not the solution. Fintechs that continue to concentrate on several fields are called full-service providers. They are still mainly active in API banking. These include Solarisbank or the Munich-based fintech BanksAPI, which offers its customers not only a current account, but also loans or mobile payments, for example.Germany Finance, in collaboration with Starbase, thus shows in the study how diverse the German fintech sector is and where Germany is focusing its efforts. However, the declining number of start-ups gives cause for concern that diversity could decrease in the coming years - and that founders in the fintech scene will not be able to maintain their strength of recent years. The report also shows that there is certainly no shortage of potential investors.

The entire study is available here.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?