Venture capital sentiment clouds over

The business climate index for venture capitalists falls slightly in the fourth quarter of 2024 Positive: fundraising is becoming easier and willingness to invest is increasing

Frankfurt, February 11, 2025 - After a phase of recovery, the German venture capital market is once again experiencing a slump in sentiment. According to the latest Venture Capital Barometer by KfW Research, BVK and Deutsche Börse Venture Network, the business climate index fell by 3.7 points to -4.1 in the fourth quarter of 2024. The current business situation in particular is rated worse, while expectations for the future are more positive.

Another decline after recovery phase

Sentiment in the German venture capital sector had stabilized as recently as mid-2024, but the fourth quarter saw the business climate deteriorate again. In particular, investors are much more critical of the current situation than before. However, fundraising and willingness to invest are proving resilient - a sign that the sector is not in a downturn, but rather in a phase of uncertainty.

The recovery in sentiment was dampened at the end of the year, but the improved business expectations make us optimistic

Dr. Georg Metzger, economist for venture capital at KfW Research

More capital for investors, but exits remain difficult

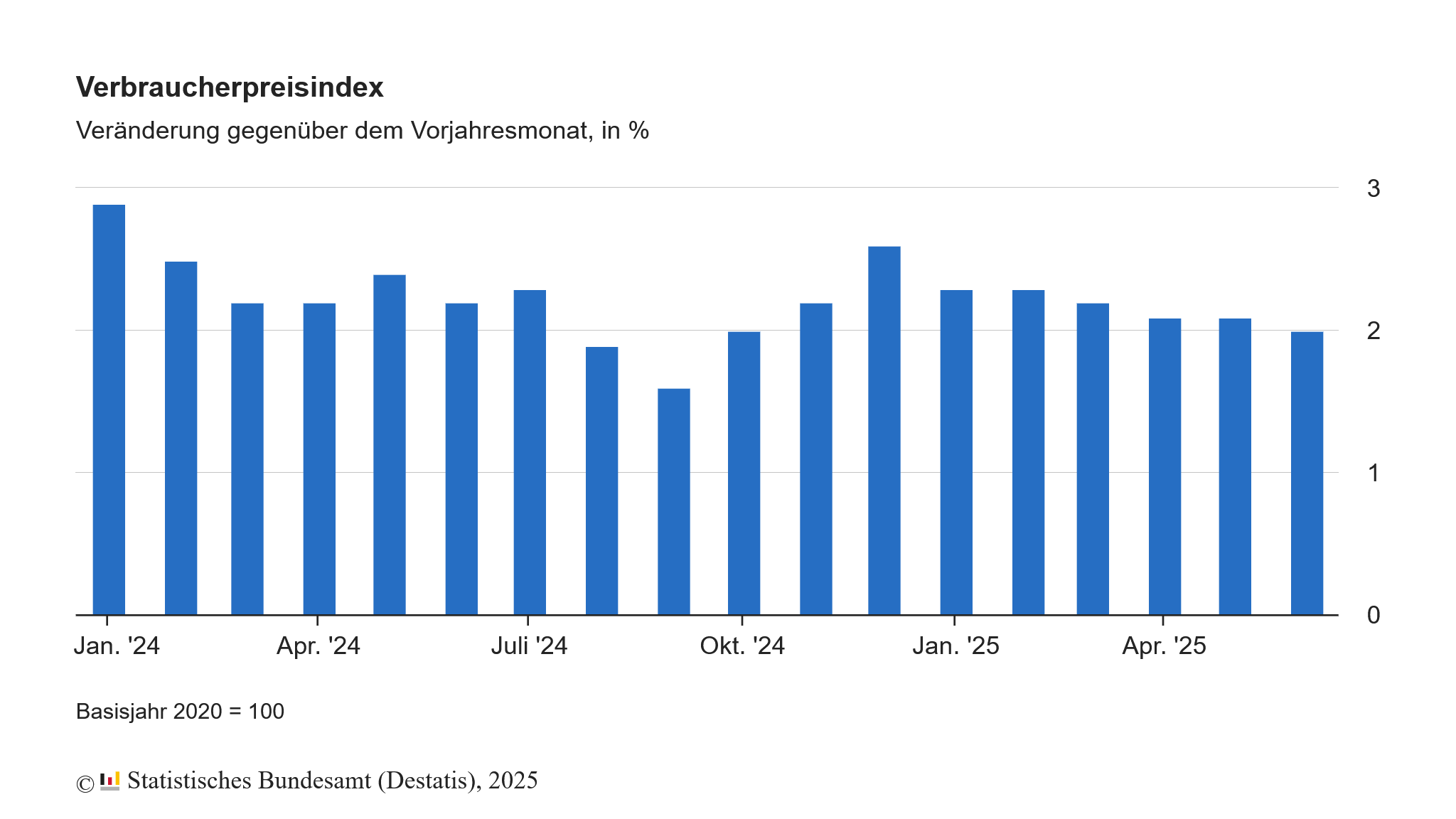

There is a positive trend in fundraising: the climate for raising capital has improved for the eighth time in a row. Investors have easier access to fresh capital again, partly due to the European Central Bank's interest rate cuts, which make fundraising easier.

The situation is different when it comes to exit opportunities. For eleven quarters in a row, venture capitalists have rated the opportunities to sell their investments as poor. Although the situation improved slightly in the last quarter, it remains deep in negative territory at -22.2 points. "The current dip in sentiment was probably just an interlude," says Ulrike Hinrichs, Managing Director of the BVK.

Startups need to become more innovative

Investors' assessment of the quality of start-ups is interesting: there is growing skepticism here. Many venture capitalists consider current start-ups to be less innovative and have higher expectations of scalable business models. Nevertheless, they expect an improvement in the medium term.

Optimistic view of the year 2025

Despite the current dampener, positive signs prevail in the long term. Investors expect a further recovery over the course of the year, primarily thanks to better fundraising opportunities and a growing willingness to invest.

"The rising assessments of fundraising, exits and investment activity give us hope for a successful venture capital year in 2025," says Metzger. If the market for exits stabilizes and start-ups once again impress with innovative business models, the venture capital market could gain significant momentum again in the coming quarters.

Conclusion: The short-term slowdown should not be a cause for concern for many investors - the decisive factor will be whether the positive expectations for the future materialize in the first half of 2025.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?