Ivy closes a seed round of over 7 million euros

Munich-based startup Ivy has secured €7 million in a seed round led by Creandum. Ivy offers a global API for instant bank payments that cuts out middlemen and enables more cost-efficient transactions.

Munich, - Ivy has secured €7 million in a seed investment round led by Creandum. The startup aims to build a better payments world by eliminating middlemen and enabling more cost-efficient payments via instant bank connections.

Traditionally, payment fees have caused companies to lose profits due to the middlemen in the 21st century payment infrastructure. In particular, credit card networks, payment gateways and digital wallets are involved in a standard online transaction. The transaction fees are around 1-3%. Ivy enables merchants to accept immediate bank payments at checkout to cut out these middlemen. In parallel to integration as a payment method at checkout, Ivy has also developed products such as instant payouts, refunds, payment by link, funding controls and advanced KYC (Know Your Customer) services. The startup serves use cases in various industries such as e-commerce, travel, gaming and marketplaces. They also work with payment service providers via their API.

In ten years, trillions of dollars will be paid via banks rather than credit cards - a significant change that Ivy will drive. More than 60 countries worldwide are currently introducing an infrastructure for instant bank payments.

Ferdinand Dabitz, Co-Founder Ivy

The round is led by Creandum. Other investors in this round include 10xFounders, Jens Lapinski from Angel Invest and leading business angels such as Jeppe Rindom (founder/CEO of Pleo), Daniel Krauss, Jochen Engert and André Schwämmlein (founders of FlixBus), Oliver Merkel (founder of Flink), Christian Grobe and Matthias Knecht (founders of Billie), Martin Blessing (former CEO of Commerzbank) and Nico Rosberg (F1 world champion).

Connection via API

Merchants who want to work with Ivy do not have to change their existing payment setup. The "Pay by Bank" option can be added to the checkout directly via the API or as a plugin for all common store systems such as Shopify, Shopware, Magento or WooCommerce. The payment option is uniquely focused on conversion and end users.

In line with this user focus, businesses can pass on some of the savings to their customers to further incentivize them to abandon credit cards and digital wallets. Behind the scenes, Ivy's technology routes between different instant bank connection systems and banking infrastructure providers, always selecting the connection with the highest probability of success. The API is currently available in Europe, the US, the Middle East and Africa, and the South East Asia region. In total, it is connected to over 500 million bank accounts in more than 50 countries.

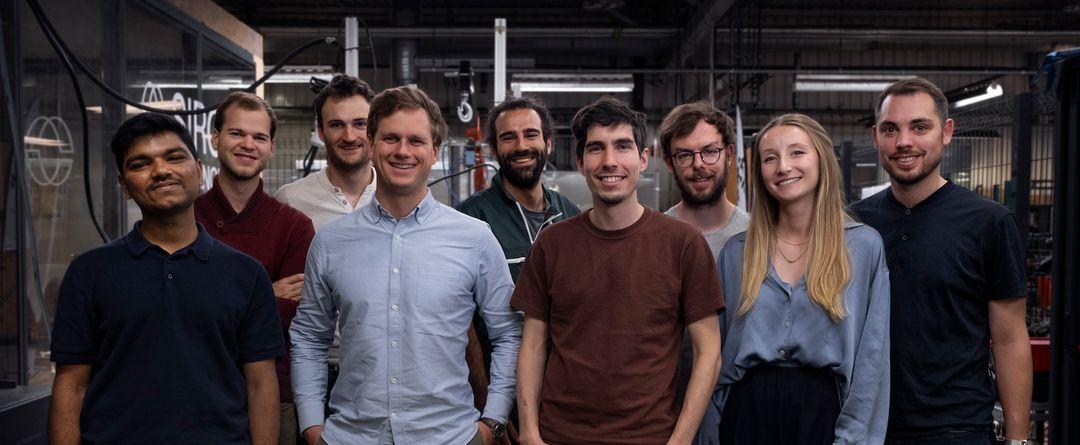

Ivy's current team is made up of talent from companies such as Klarna, AmazonPay and Worldpay. The company is currently hiring in the areas of partnerships, sales and technology.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?