Beyond Saving #FintechPortraits

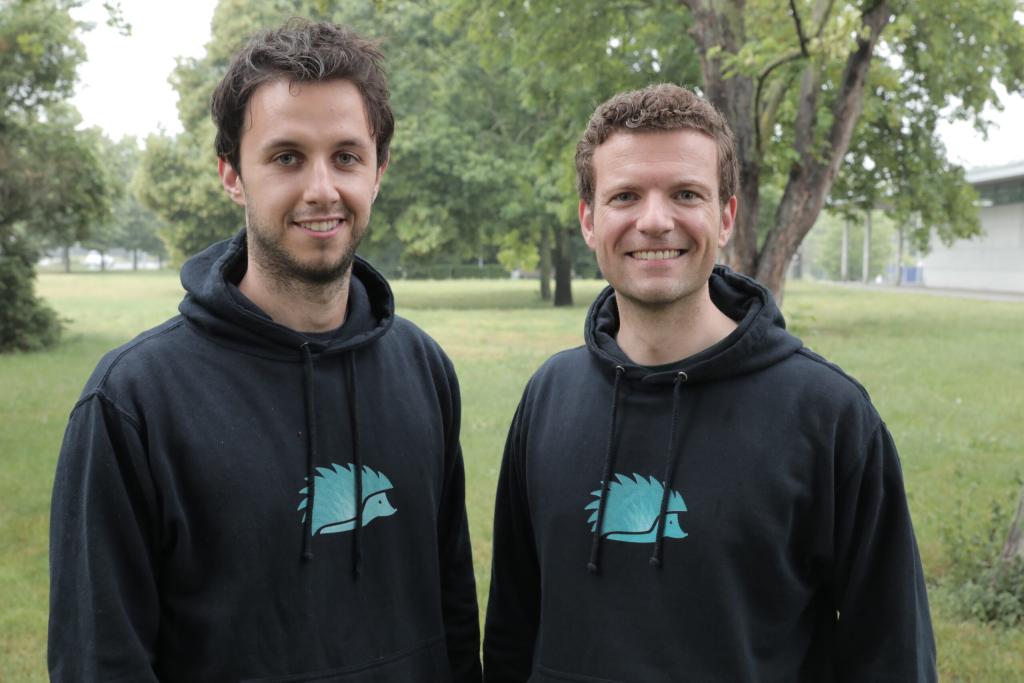

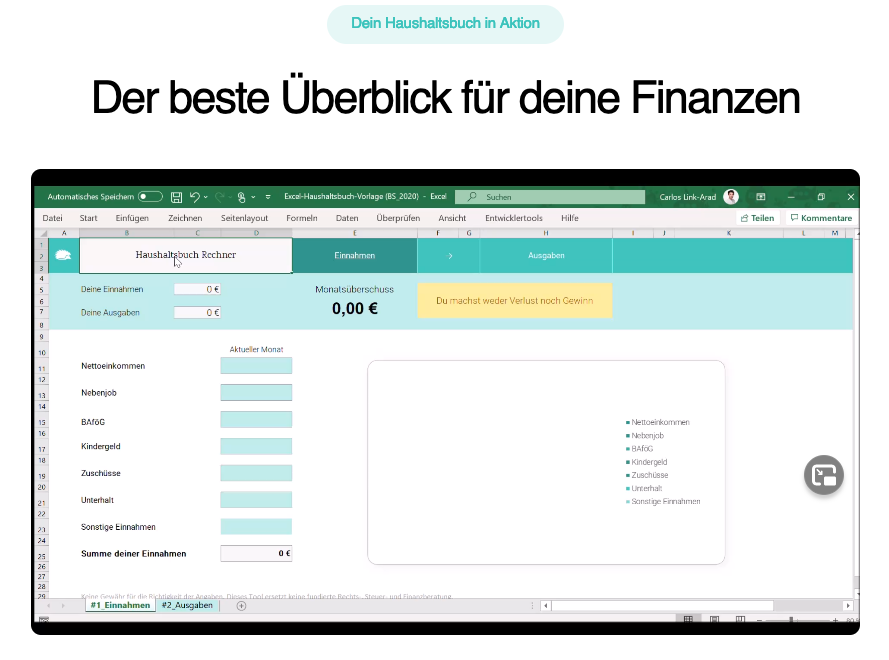

Making financial education accessible to everyone? That is the goal of Beyond Saving, the start-up founded by Carlos and Martin in 2020. Together with their team, they are tackling the topic of finance in a simple, understandable and digital way. From budget books and ETF savings plans to retirement planning, the educational platform covers all financial topics. Founder Carlos talks to us about brainstorming, funding and the development of the fintech market.

Why did you found your start-up?

We worked in the financial sector for years and experienced first-hand how difficult people find it to deal with their finances. Even the most basic questions often cause great difficulties. We also noticed the implications this has on people's everyday lives. Financial bottlenecks or problems have a significant impact on our physical and mental well-being. Our aim is to offer these people in particular a platform where they can be introduced to the world of finance step by step.

What is special about your business model?

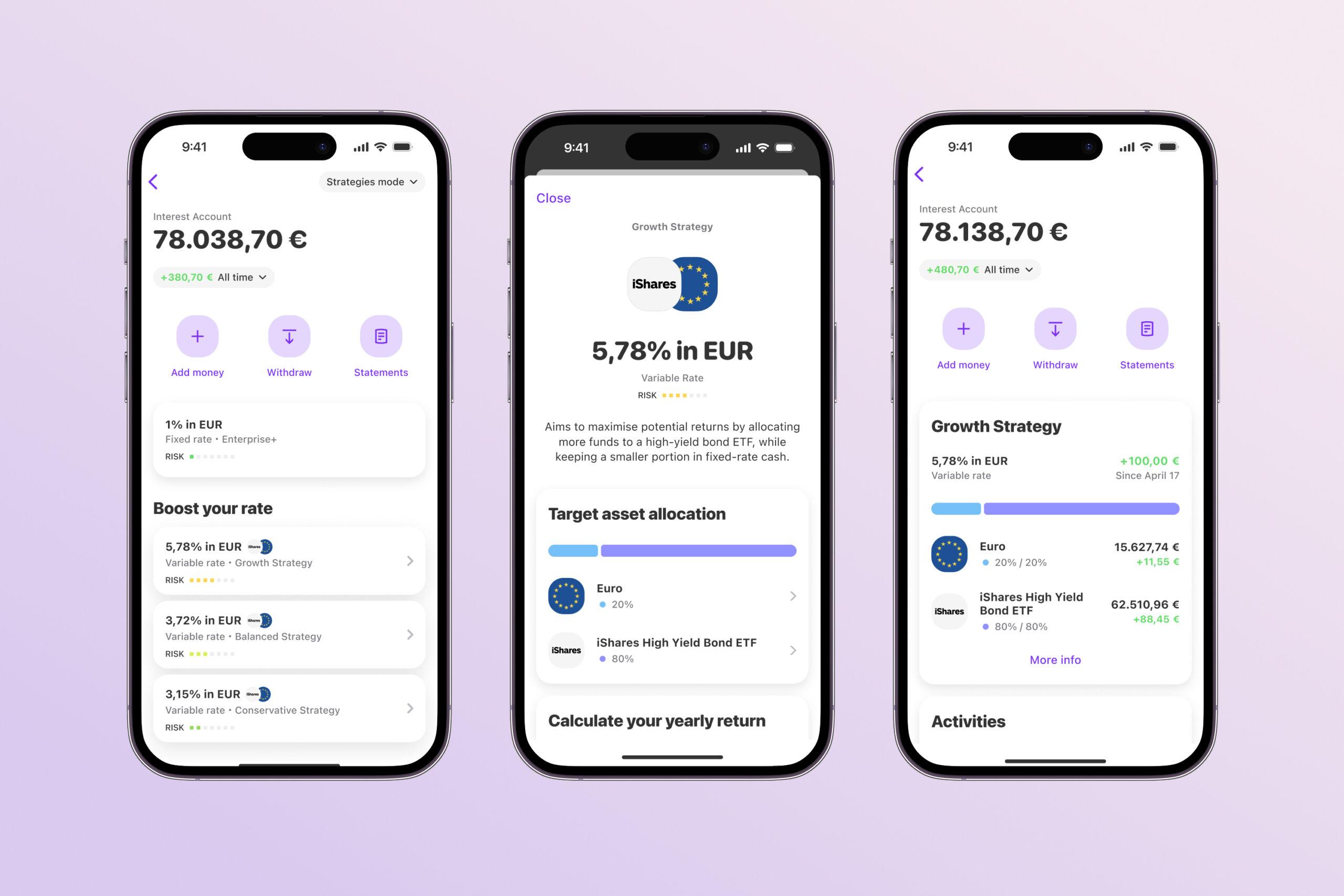

What makes us special is our independence from commissions. While other platforms are financed by affiliate commissions, we focus on genuine, objective and independent financial education. We also take a holistic view of the topic. We don't focus on specialist topics, but cover all financial topics that are relevant (for our users) - from budget books and insurance to retirement planning. Another USP will be launched in Q3 with our learning app. With the Fibi app, we want to lower the barrier to learning about finance even further. Fibi gives our users easy and entertaining access to all financial topics - regardless of time and place.

What was the most valuable piece of advice someone gave you during your start-up phase?

I can't remember any specific advice, but honest criticism helped us a lot as founders. You rarely hear "honest and tough" feedback from close acquaintances - but that's exactly what you need as a founder. People who not only say "yes" but also question and challenge the business model are extremely valuable in the young start-up phase. This includes other founders and experienced entrepreneurs in particular, with whom we are in regular contact.

People who not only say "yes" but also question the business model are extremely valuable in the young start-up phase.

What were the biggest hurdles you had to overcome at the beginning of your start-up?

There were no major hurdles. In Martin, I have a co-founder who believes in our vision just as passionately as I do. We overcame hurdles as a team - it was even fun (for the most part) because you can learn a lot from challenges. As a founder, you have to take care of a lot of things at the same time - especially at the beginning. It can be difficult to stay focused. For this reason, it makes a lot of sense to think about whether it might make sense to bring in reinforcements to the team during the start-up phase. The more focused you can work on your topics, the better the end result will be. Founders who want to do everything on their own quickly get lost in the workload and don't realize the full potential of their business idea.

What support do you wish you had or would have liked to have when you started your business?

We received a lot of support from our circle of friends. That really helped us to define our business model even more precisely. The topic of start-up financing and funding programs proved to be a (small) challenge. We would have liked to have had a more transparent overview of our options and the application process. It's still a little too complex and bureaucratic at the moment.

Did you work with an accelerator?

No, we made a conscious decision to start up independently of an accelerator in order to remain more flexible. However, we have heard a lot of positive things from many partners who are in accelerator programs. This is ideal, especially if you want to be in regular contact with mentors.

What would you have liked from working with an accelerator?

I personally find the mentoring and educational components of accelerator programmes very exciting, as they help founders to professionalize their start-ups. I have already exchanged ideas with many founders and they were able to gain a lot of inspiration, especially when it came to financial planning and marketing. I would hope for the same from a cooperation with an accelerator. Always having a contact person at hand who has experience in building start-ups. Google searches are relatively limited, especially for complex questions.

There are currently around 900 fintechs in Germany. How do you succeed in such a booming market?

You have to have a clear vision and be aware of the competition and your own USP. When we started out, we took a close look at the market environment and worked out where we still saw niches and potential for improvement. These findings were then incorporated into our product development.

How do you feel about the current funding opportunities for fintechs in Germany?

There are many opportunities for founders to access funding programs. Start-up competitions are also very popular - we recently won first place in the "BM Canvas" category at the Berlin/Brandenburg Business Plan Competition - that was a great experience and gives us more freedom. However, it is difficult to get an overview of all the options, especially in the day-to-day running of a business, which is why we recommend that young founders get a consultant on board to take care of the issue. Many advisors only charge a fee once the funding has been approved, so you don't have to pay in advance.

What direction do you think the fintech market will take?

In my opinion, the market is occupied by too many players. I can imagine that sooner or later there will be consolidation. Some fintechs will leave the market, others will merge with each other and others will be taken over by established financial service providers. In the DLT/blockchain/payments area in particular, I see many new players emerging in the coming years. There are likely to be more mergers in the "older" areas.

Thank you for the interview.

Personal details: Carlos Link-Arad was born in Portugal and studied economics and physics at Goethe University in Frankfurt. He then worked in various positions in the financial sector. In 2020, he and co-founder Martin Klatt founded their start-up - an educational platform for finance. Since then, the two have dedicated themselves to their passion project: making financial education accessible to everyone.

About our partner fintogether:

The state accelerator "fintogether" is an early-stage startup funding program in which FinTechs receive targeted support from their foundation to market entry. The aim is to build a lively and successful FinTech scene in Baden-Württemberg so that companies, start-ups and investors can benefit from it.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?