Due diligence

Definition

Due diligence is an examination and analysis of a company's legal, economic, tax and financial circumstances. In German, due diligence means "due care in business". This means that a company that you intend to buy or with which you would like to work within a business relationship is analyzed for its strengths and weaknesses as well as opportunities and risks as part of a due diligence review. A very detailed analysis is carried out, for which external consultants such as tax advisors, lawyers or auditors are usually consulted. There are many different forms of due diligence, such as financial due diligence, IT due diligence or commercial due diligence. Depending on the possible risks, different priorities are set here. For example, it is not necessary to carry out an IT due diligence in a company in which IT hardly plays a role.

When is due diligence carried out?

Due diligence is always necessary when a company maintains relationships with business partners or wants to acquire another company. It also makes sense for investors to carry out due diligence on the target object (company) before investing in it, in order to check the usefulness and possible risks associated with the purchased company. Due diligence audits are therefore a necessary part of Mergers & Acquisitions (M&A) activities in particular.

Why is a due diligence audit carried out?

A due diligence review is primarily carried out when entering into a joint business relationship with a new company and when purchasing a company. When working with new companies, it is also important to comply with legal frameworks such as anti-money laundering, anti-bribery and anti-corruption laws. However, there can be many reasons for a due diligence review.

1) Legal reasons

As already mentioned, legal reasons are a decisive factor in due diligence audits. This is primarily about protection against corruption and money laundering as well as a risk assessment. In particular, companies that are directly or indirectly represented in the UK or the USA must also comply with the UK Bribery Act or the US Foreign Corrupt Practices Act. Therefore, when entering into new business relationships, it is essential to check whether the business partner or subcontractor is associated with bribery or other forms of corruption and money laundering.

2) Financial consequences

Another important point is the financial consequences and sanctions that a company can suffer if it works with business partners who do not act with integrity. Due diligence is therefore also carried out here.

3) Reputational risks

In addition to legal and financial consequences, the reputation of your own company should not be ignored. Care should be taken to ensure that the new business partners cannot be associated with white-collar crime in any way.

4) Economic reasons

Last but not least, economic aspects should of course also be examined. These are an important reason for a due diligence review, because as soon as you cooperate with another company or plan to acquire it, all financial and economic aspects must of course be examined to ensure that the cooperation or acquisition is profitable.

Types of due diligence

There are two different types of due diligence. On the one hand, there is the so-called "vendor due diligence" and on the other, there is "buy-side due diligence".

Vendors due diligence

In vendor due diligence, the seller of a company commissions the audit. This is usually the case if there are several interested parties for the company. In this case, it makes more sense in terms of effort and cost to carry out the due diligence on the seller's side only once instead of having several due diligence reviews carried out by different buyers.

For the seller, this naturally has the advantage that he can recognize and eliminate any weaknesses in his company at an early stage. However, there is often a conflict of interest for the due diligence consultants carrying out the due diligence, as their client (i.e. the seller of the company) is usually not interested in uncovering any real weaknesses in their own company that could reduce the purchase price or need to be rectified.

In addition, this form of due diligence is also far more extensive and expensive, as different aspects have to be examined and checked depending on the interests of the buyer. The seller must anticipate these interests and carry out the right form of due diligence.

Buy side due diligence

Buy-side due diligence is far more common and easier to carry out. In this case, the buyer of a company commissions external consultants to carry out the due diligence for the respective object of purchase (company). The results of the due diligence are then incorporated into the buyer's purchase price proposal. The form of the corresponding due diligence reviews varies depending on the buyer, as each buyer has a different focus. For example, there are strategic buyers who have the goal of growing within their industry or diversifying into other industries, or financial investors who acquire the company for yield considerations. The different motives for the purchase therefore also lead to different interests and require different forms of due diligence.

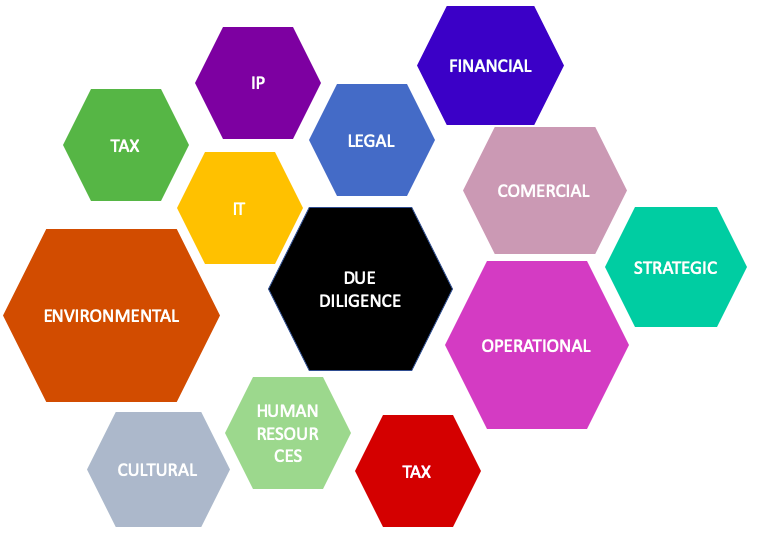

Forms of due diligence

In order to be able to carry out an analysis for every buyer interest and every possible risk, due diligence is divided into different forms. It is important to note that not every due diligence must or will be carried out for every company; it is often sufficient to limit the due diligence to the most important ones.

Legal due diligence

During legal due diligence, all legal aspects of the company to be purchased are examined. For example, existing cooperation agreements, employment contracts, severance agreements, rental and lease agreements, as well as existing legal disputes or legal risks.

Financial due diligence

Financial due diligence is responsible for checking company figures, account balances, debts, rental collateral, outstanding receivables, assets, cash flows and all other financial aspects.

Commercial due diligence

Another particularly important audit is commercial due diligence. This involves examining the respective business model of the company to be purchased. The sustainability of the respective business model is scrutinized and potential weaknesses are uncovered through an in-depth analysis of the market and competition, an examination of customers, products, the USP and pricing. This form of examination is particularly important as it determines whether it makes sense to buy this company at all.

Strategic due diligence

Strategic due diligence examines whether the intended deal has potential, is commercially attractive and therefore makes strategic sense for the investor.

Tax due diligence

The tax situation and perspective of the target company is examined and various tax factors influencing the transaction are taken into account. A risk analysis is also carried out with regard to taxes.

Market due diligence

In market due diligence, the entire market in which the company to be acquired is located is analyzed. Both an internal and external company analysis is carried out.

Human resources due diligence

Human resources due diligence includes an analysis of the employees and in particular their human capital as well as the organizational structure of the company.

Cultural due diligence

In this form of analysis, the corporate culture is examined in detail. This can be of central importance in some cases, as a cultural clash can lead to a number of problems and have far-reaching consequences. It is therefore advisable to thoroughly examine the respective corporate culture beforehand.

Technical due diligence

This involves examining the technical condition of the company's assets, such as equipment and buildings. Here it is particularly important to assess maintenance costs or modernization potential.

IT due diligence

In view of the constantly growing digitalization of various industries, it often makes sense to examine the IT of the target company. As part of an IT due diligence, both the opportunities and risks of the IT department are examined and the value contribution of the IT department within the company is analyzed.

IP due diligence

As part of an intellectual property (IP) due diligence, the company's patents, trademarks, designs and licenses are examined. It is also important to check the extent to which the existing property rights cover the company's own products and services or whether the products and services offered fall within the scope of protection of third parties.

Criticism

Although due diligence is very important and often unavoidable, there are also points of criticism. For example, due diligence can lead to problems as it is often carried out by external consultants who are remunerated on a performance-related basis. This means that if the transaction is successful, a higher fee is paid to the consultants than if the transaction is abandoned. As a result, the advisors often find themselves in a conflict of interest, as it can be a disadvantage for them to uncover potential risks that jeopardize the transaction.

Table of contents

- Definition

- When is due diligence carried out?

- Why is a due diligence audit carried out?

- Types of due diligence

- Vendors due diligence

- Buy side due diligence

- Forms of due diligence

- Legal due diligence

- Financial due diligence

- Commercial due diligence

- Strategic due diligence

- Tax due diligence

- Market due diligence

- Human resources due diligence

- Cultural due diligence

- Technical due diligence

- IT due diligence

- IP due diligence

- Criticism

Focus Topics

Deep dive into hot topicsFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?