Armilar completes first closing of fourth fund with EUR 120 million

The Portuguese venture capital company Armilar Venture Partners has announced the first closing of its new Armilar IV fund. Over 120 million euros are now available for investments in disruptive technologies in Portugal, Spain and throughout Europe. With the new fund, Armilar continues its successful series of flagship funds and underlines its position as one of the leading independent VC investors in Southern Europe.

Focus on deep tech and B2B innovation

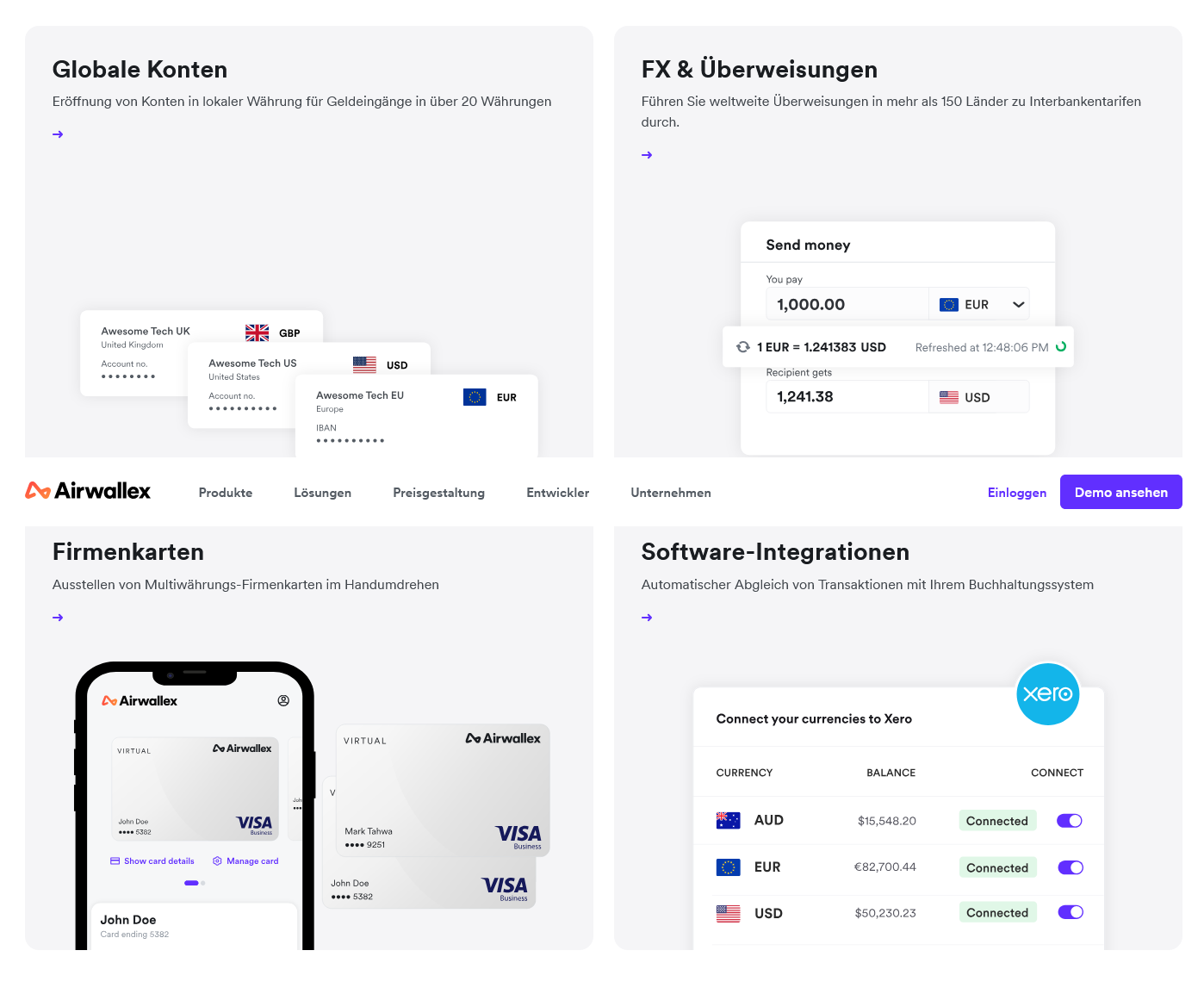

Armilar IV will primarily invest in B2B start-ups with a high technology content, directly at the intersection of digitalization and hard science. The spectrum ranges from artificial intelligence, cyber security, software development, automation and fintech to healthtech, spacetech and dual-use technologies. The fund focuses on Series A financing and plans to add around 20 companies to its portfolio.

"We see exceptional innovation in the Iberian region and across Europe. With Armilar IV, we want to support founders who are taking their technologies from proof-of-concept to scale.

Pedro Ribeiro Santos, Managing Partner at Armilar

Strong investor base despite difficult market environment

Despite the current tense financing landscape in Europe, Armilar has been able to attract well-known institutional investors, including the European Investment Fund (EIF) and the Sociedad Española para la Transformación Tecnológica (SETT), which invests through Spain's NextTech fund for deep tech innovation."In an environment of declining VC fundraising, we feel privileged to be able to close this fund," said Joaquim Sérvulo Rodrigues, founding partner of Armilar."While liquidity is decreasing, more exciting technological opportunities are emerging - this is exactly our moment."

Growth from Iberia for Europe

Armilar wants to use the fund's resources in a targeted manner to promote the growing innovation potential on the Iberian Peninsula. Portugal and Spain are increasingly becoming hotspots for deep-tech start-ups. This is also happening with a growing talent pool, increased R&D funding and growing support from public funds. Armilar is planning three new investments by the end of the year, with more to follow in 2026.

Successful history with global technology companies

Since its foundation in 2000, Armilar has accompanied companies such as OutSystems and Feedzai on their way to becoming international market leaders. With more than 600 million euros in capital under management, Armilar is one of the most experienced VC firms in Southern Europe. In the long term, Armilar IV is expected to grow to around 250 million euros by the end of 2026 and further expand the company's influence in the European deep tech segment.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?