lemon.markets secures 12 million euros

FinTech lemon.markets receives €12 million from CommerzVentures and other investors to further develop its digital brokerage and custody infrastructure and drive its expansion in Europe

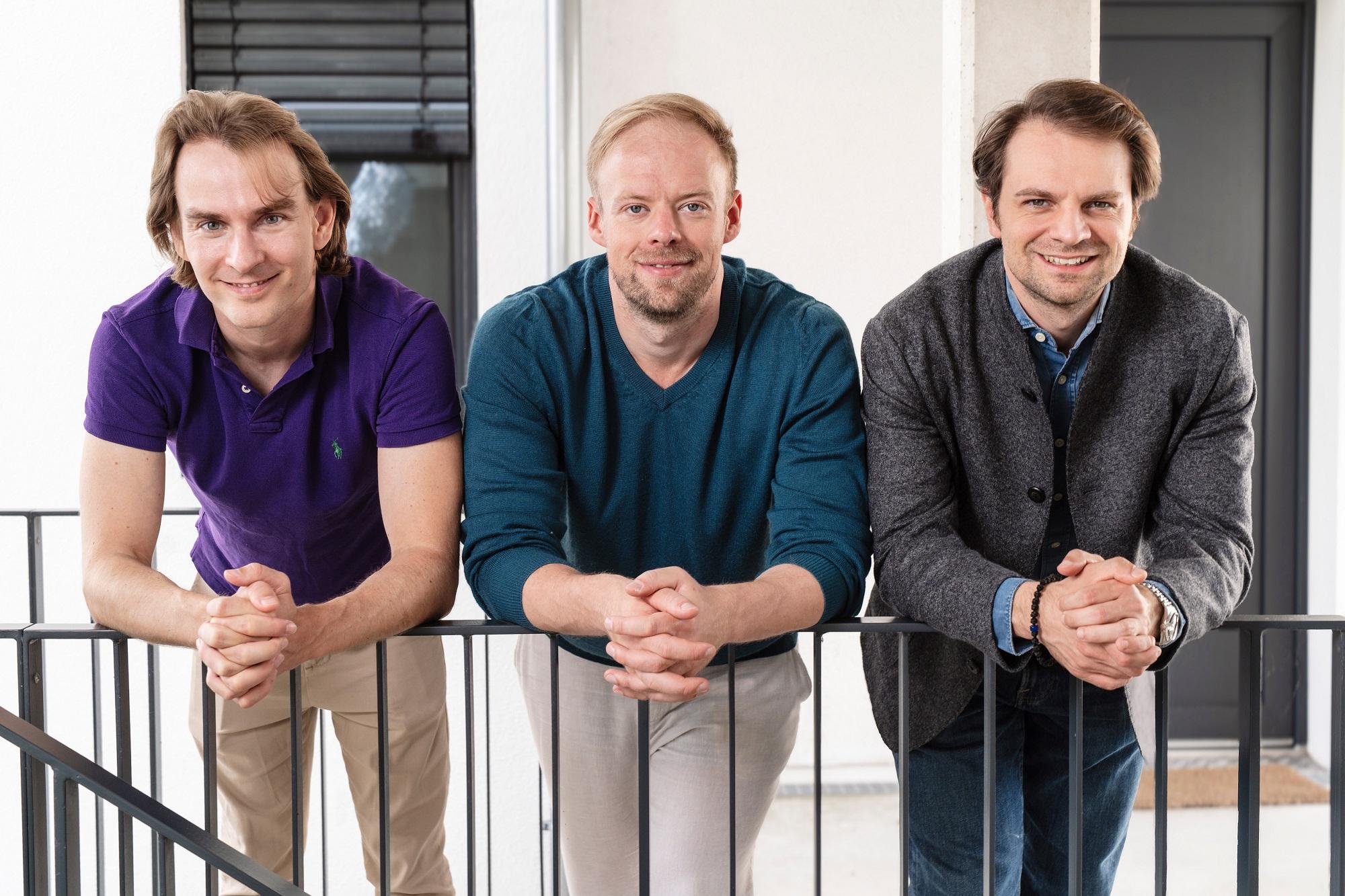

Berlin, July 11, 2024 - Berlin-based FinTech startup lemon.markets has successfully closed a €12 million financing round. CommerzVentures led this round, supported by existing investors such as Creandum, Lakestar, Lightspeed and System.one. This new financial injection brings lemon.markets' total funding to 28 million euros. The aim of the investment is to further expand the platform, introduce new partners and products and drive expansion into other European countries by 2025.

Expansion of the digital infrastructure

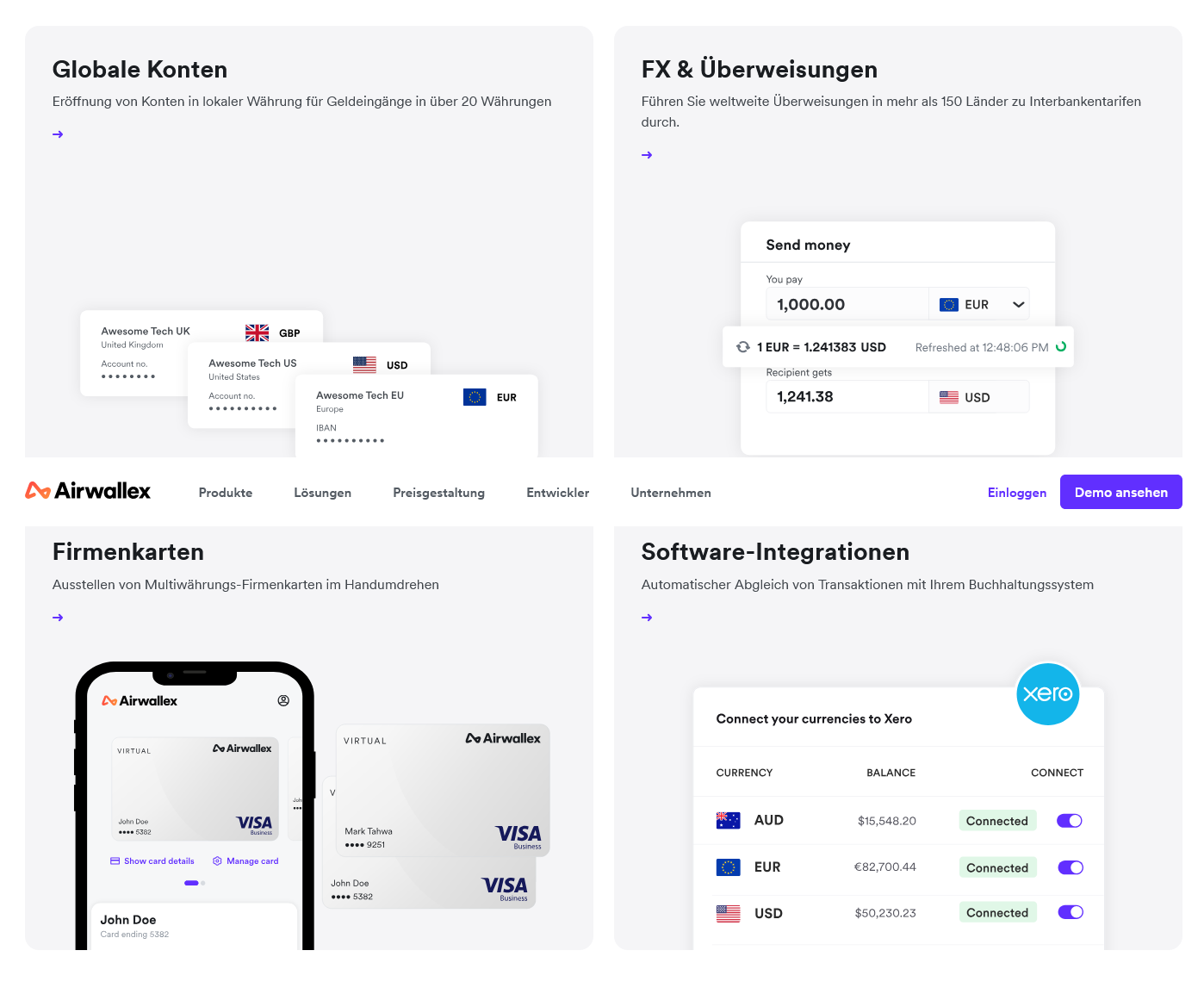

lemon.markets offers a digital brokerage and custody infrastructure that enables companies to offer investment solutions. The platform is modular and uses an API-first architecture, significantly reducing integration time for partners. This infrastructure supports FinTechs, banks and asset managers in the processing of securities transactions and includes solutions for ETFs, funds and, in future, equities.

In CommerzVentures, we have found a strong investor who shares our deep understanding of the market. Together we want to use the tailwind in the market to bring our next partners and products live in the coming months.

Max Linden, founder and CEO of lemon.markets

lemon.markets was founded by Max Linden in Berlin in 2020. As a brokerage-as-a-service platform, the BaFin-licensed company offers other financial service providers and FinTechs the IT infrastructure for processing securities transactions via an investment API. The company's mission is to become the infrastructure provider for the next 100 million European investors. Well-known international investors such as CommerzVentures, Creandum, Lakestar, Lightspeed and System.one have invested over 28 million euros in the FinTech.

Important milestones and partnerships

lemon.markets reached numerous important milestones in the first half of 2024. These include the extensive approvals from BaFin as a securities institution in January 2024 and the start of business in cooperation with industry giants such as Deutsche Bank, BNP Paribas and Tradegate. The official launch took place in March with the financial education app beatvest, which enables ETF investments for B2C users.

Our focus is on helping the most talented teams solve the most complex problems in finance. lemon.markets is a prime example of this.

Jonas Wenke, Principal at CommerzVentures

In addition, lemon.markets has announced a partnership with sustainable banking provider Tomorrow. As part of this cooperation, Tomorrow is moving its securities offering from Solaris SE to lemon.markets. With the fund marketplace Allfunds, lemon.markets is also expanding its range of services to include funds as a financial instrument.

The market for brokerage and custody infrastructure is very dynamic. Experts forecast a market volume of 63 billion US dollars in the next five years.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?