LS Power closes oversubscribed Fund V with 2.7 billion dollars

LS Power exceeds the target of its new fund with 2.7 billion dollars. Investing in renewable energy infrastructure to ensure the reliability and affordability of electricity in the U.S.

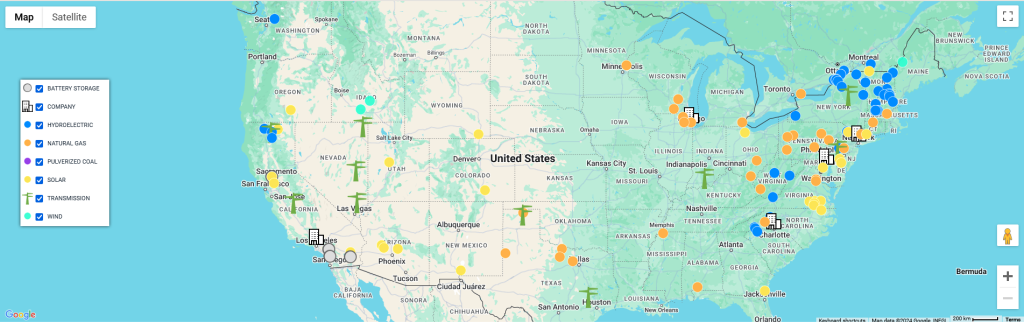

New York, August 2024 - In Germany and Europe, we tend to see ourselves as leaders in renewable energy and sometimes look down from our high horse. But companies like LS Power in the US are showing that a balanced mix of green technologies and traditional energy sources is not only possible, but can also be profitable. LS Power, a company involved in the development, investment and operation of energy infrastructure in North America, has successfully closed its latest fund, LS Power Equity Partners V, L.P. ("Fund V"), with a total volume of around 2.7 billion dollars. Fund V exceeded its original target of 2.5 billion dollars. The fund will invest in energy infrastructure, including renewable energy, conventional power generation and distributed energy resources.

Strengthening the US energy infrastructure

Demand for electricity in the U.S. is growing faster than it has in decades, driven by electrification, the growth of data centers and a renaissance in American manufacturing.

Paul Segal, CEO of LS Power

Since its inception, LS Power has raised $60 billion in debt and equity capital and developed or acquired more than 47 GW of power generation projects. In addition, LS Power Grid has completed 16 transmission projects, including six utilities in operation, serving 185 million people. These projects include over 780 miles of high-voltage transmission lines, with another 350 miles under development.

Fund V focuses on renewable energy and innovative technologies

To date, Fund V has invested or committed approximately $1.6 billion in projects including renewable and gas-fired generation, renewable fuels and green hydrogen. Recent investments include the announced acquisition of Algonquin Power & Utilities Corp.'s North American renewable energy business, which includes 3 GW of operating capacity and an 8 GW development pipeline.

Darpan Kapadia, COO of LS Power, emphasizes: "Over the past 30 years, LS Power has created a platform to drive the energy transition. The success of this capital raise is a testament to our team's deep expertise and strong track record through multiple market cycles."

Leading investors put their trust in LS Power

The need for capital in the US energy sector is immense. With Fund V, LS Power is well positioned to drive growth and innovation and capitalize on this historic investment opportunity.

David Nanus, President of LS Power Equity Advisors

Fund V investors include leading pension funds, insurance companies, sovereign wealth funds, asset managers, endowments, university funds and family offices. Many previous investors in LS Power funds have also invested in Fund V, and the firm has also attracted new global investors.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?