maincubes secures 2.5 billion euros in financing

maincubes, a European data center operator majority-owned by DTCP, has closed a EUR 2.475 billion long-term financing. The transaction significantly strengthens the company's capital base and lays the foundation for the next growth phase of its European data center portfolio.

The financing comprises credit lines of EUR 1.775 billion and an additional increase option of EUR 700 million. The capital is being provided by a consortium of eleven banks and an institutional fund. The funds will be used to refinance the existing portfolio as well as to finance new data center developments.

Expansion of central locations in Frankfurt and Berlin

With the transaction, maincubes is supporting, among other things

- the construction of the fourth Frankfurt data center (FRA04),

- the development of the mainHub campus in Berlin with 200 MW capacity plus expansion options,

- as well as the further expansion of existing locations.

With a platform of around 400 MW, maincubes is now one of the largest and fastest growing data center operators in Germany.

Positioning as an infrastructure partner for cloud and AI

The long-term financing structure enables maincubes to further scale its business and meet the rapidly growing demand for secure, sustainable and high-performance digital infrastructure. The company serves a broadly diversified customer base, including the public sector and global hyperscalers, positioning itself as a leading German infrastructure provider for mission-critical cloud and AI workloads.

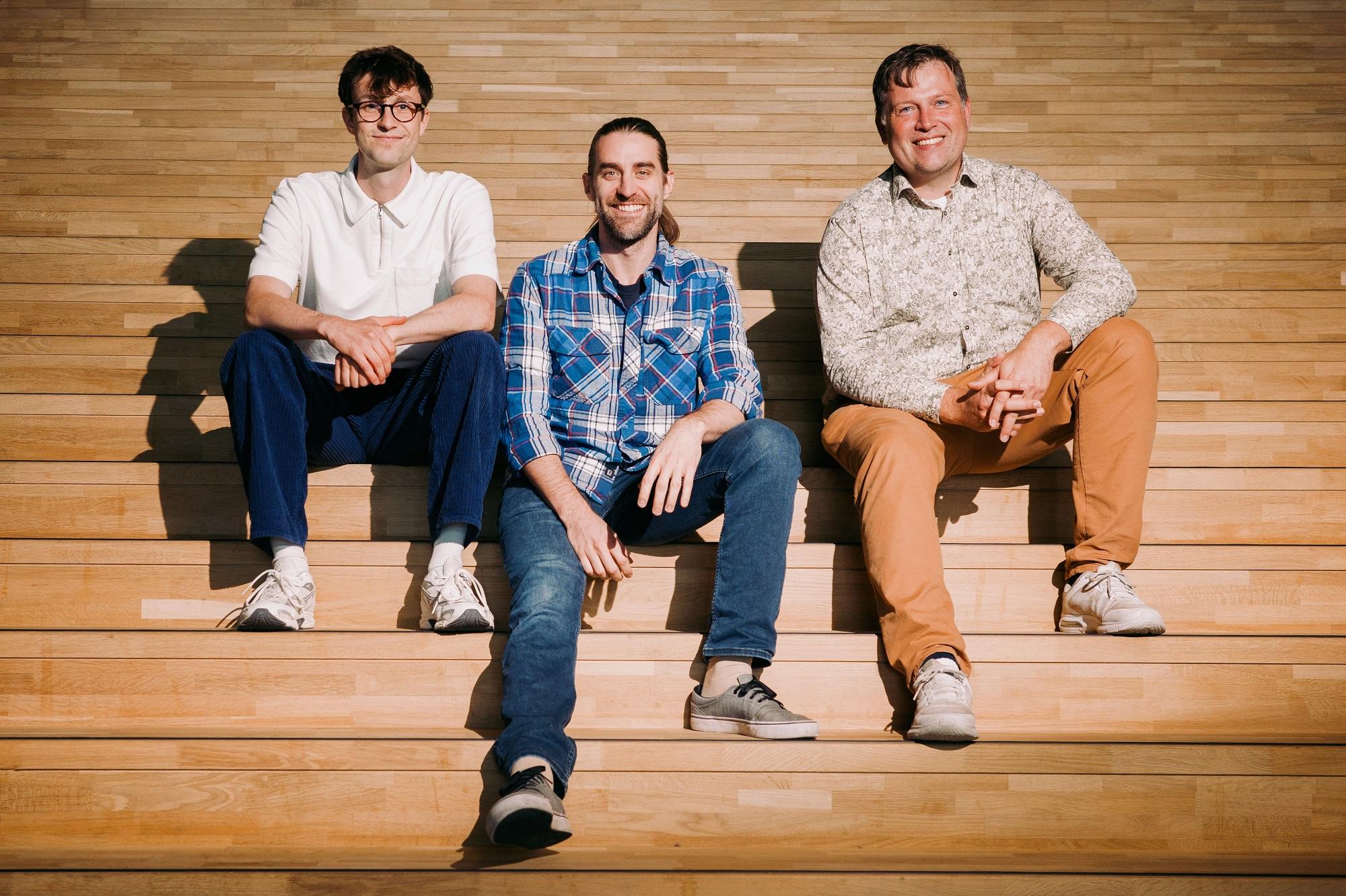

This financing is an important milestone for maincubes. It gives us the financial strength to consistently drive our growth and implement large-volume projects

Oliver Menzel, founder and CEO of maincubes

The broad participation of the financing partners underlines the high level of confidence in the business model, the operational excellence and the long-term growth strategy of maincubes.

Waldemar Maurer, Partner at DTCP, adds:"The successful financing impressively demonstrates how strongly maincubes has developed in recent years. We would like to thank our existing and new financing partners for their trust. Together with the management team, we will continue to consistently expand the platform."

Consulting

maincubes was advised on the transaction by RBC Capital Markets and A&O Shearman. The financing consortium received legal advice from Hogan Lovells.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?