NAO expands seed financing to 4.5 million euros

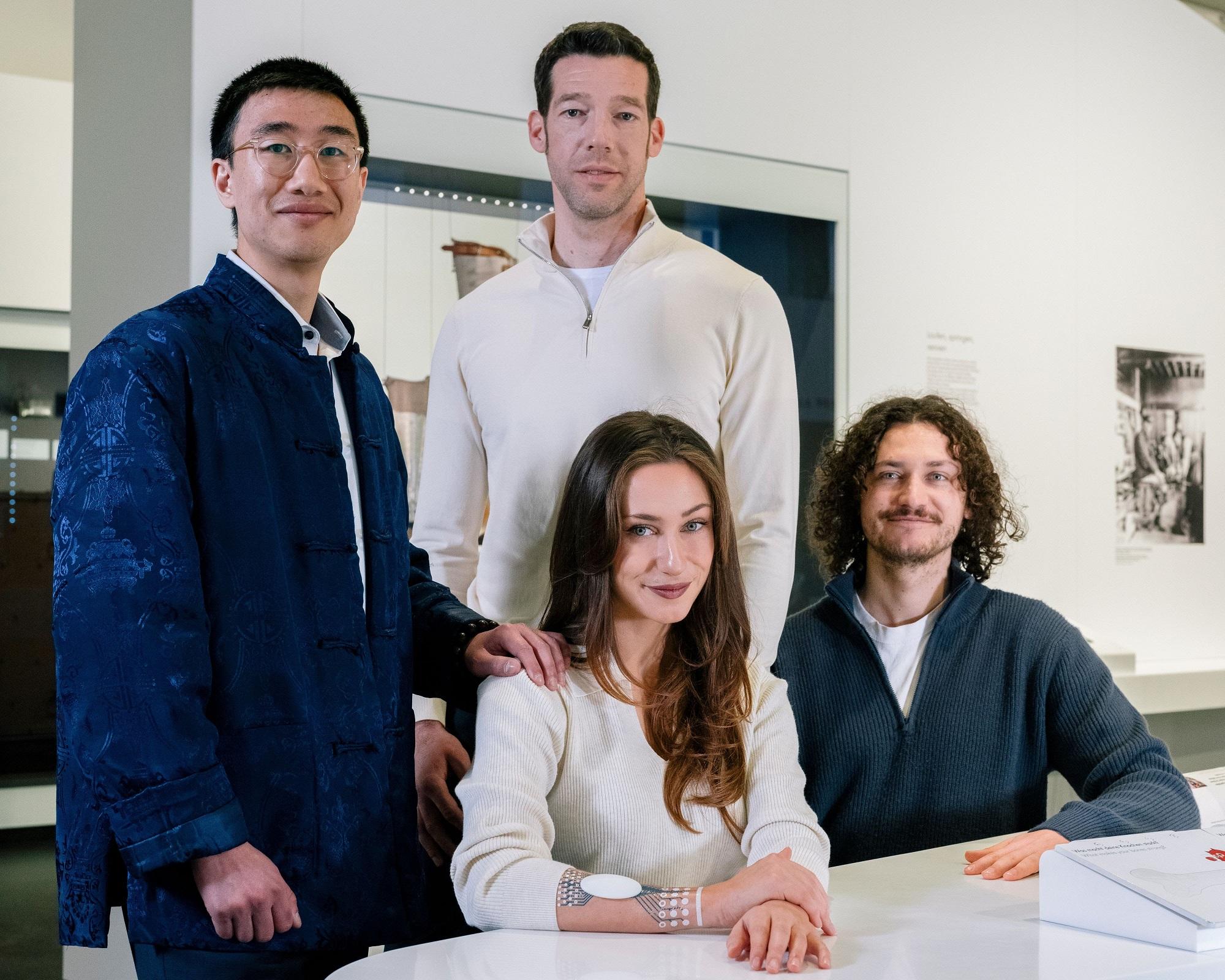

NAO continues to expand. Following a successful market entry in Germany and Austria, the FinTech is focusing on expansion and is strategically strengthening its team with Karl Alomar (M13) as an advisor.

Berlin, March 18, 2025 - Berlin-based WealthTech NAO has raised an additional one million euros in a second closing of its seed financing round. This brings the total volume of the round to 4.5 million euros. The new investors include Jens Hilgers, Founding General Partner of BITKRAFT Ventures. At the same time, NAO is strengthening its advisory board with Karl Alomar, Managing Partner of US VC M13, an internationally renowned expert for technology scale-ups.

Investor interest confirms NAO's growth trajectory

NAO is becoming the leading platform for private and alternative investments in Europe. The FinTech offers investors access to exclusive asset classes that were traditionally reserved for institutional investors from as little as EUR 1,000. With an intuitive app and just a few clicks, NAO enables a new investment culture.

The second closing enables us to further develop and expand NAO strategically. Our approach is setting a trend that major players are also picking up on. The trust of new investors confirms our vision.

Robin Binder, founder and CEO of NAO

Jens Hilgers also sees great potential: "A new generation of investors is managing their assets independently and is actively looking for alternatives to traditional investments. NAO offers a strong, easily accessible product with a high level of transparency and trust."

Karl Alomar strengthens the advisory board

With Karl Alomar, NAO has gained an experienced strategist and investor for its Advisory Board. The Managing Partner of the US VC M13 brings extensive knowledge of scaling technology companies.

NAO democratizes access to exclusive investments and has demonstrated an impressive product-market fit. The potential for international growth is enormous.

Karl Alomar, Advisory Board NAO

Binder adds: "The support of a globally successful investor helps us to scale more sustainably."

Successful expansion and growth

Since the market launch in Germany in 2023 and in Austria in 2024, several thousand users have opted for NAO - with average investments of EUR 10,000. In 2025, the focus will be on expansion and growth in existing markets.

NAO offers access to six different asset classes, supported by banks and asset managers such as Moonfare, UniCredit, BNP Paribas, UBS and Partners Group. In 2024, the FinTech also expanded its offering to include B2B solutions for venture capital investments. With the successful financing and strategic strengthening, NAO is continuing on its growth path - with the aim of making private and alternative investments accessible to a broad investor base. As early as 2023, we reported on a successful pre-seed for NAO.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?