News week 28 - 2024

AMD acquires Silo AI for around 665 million dollars. Xential takes over Eformity. Dr. Sebastian Schäfer takes over the management of HoFT.Berlin. Start-ups in Germany increase by 15%. Powercall receives six-figure early-stage financing. Eiffel Investment Group launches first European impact debt fund for SMEs. Beagle Systems and atmio cooperate. Dynelectro secures €11 million. BIRKENSTOCK appoints Evelyn Chua as Managing Director for Southeast Asia and Australia. Katjes Greenfood acquires majority stake in mymuesli. HERO Software raises 40 million euros for expansion.

Significant rise: start-ups in Germany increase by 15%

The startup landscape in Germany recorded a significant upswing in the first half of 2024, with a 15% increase in startups compared to the second half of 2023. This is according to the latest report "Next Generation - Startups in Germany" by the Startup Association. Start-ups grew particularly strongly in Berlin (up 28%) and North Rhine-Westphalia (up 25%). The software sector dominates, as one in five new startups was founded in this area. Munich and Berlin remain central hotspots, with Munich just ahead in terms of start-ups per capita. Smaller cities such as Aachen, Darmstadt and Heidelberg are also showing a positive trend, underlining the growing importance of regions away from the established startup centers.

Personnel

BIRKENSTOCK appoints Evelyn Chua as Managing Director for Southeast Asia and Australia

BIRKENSTOCK has appointed Evelyn Chua as Managing Director for Southeast Asia and Australia, effective July 1, 2024. In her new role, Chua will be based in Singapore and will lead a diverse region including Singapore, Malaysia, Indonesia, the Philippines, Thailand, Vietnam, Australia and New Zealand. She will report directly to Klaus Baumann, Chief Sales Officer of the BIRKENSTOCK Group. Chua brings over 15 years of retail experience spanning various categories including fashion, beauty, wines, spirits, watches and jewelry as well as online and offline channels. Prior to joining BIRKENSTOCK, she was Chief Commercial Officer at Synagie, where she was responsible for online retail and over 400 stores in six countries. Her task at BIRKENSTOCK will be to expand the market presence in this dynamic growth region and to promote innovative retail formats in order to strengthen the brand's positioning across all sales channels.

Dr. Sebastian Schäfer takes over management of HoFT.Berlin

Dr. Sebastian Schäfer, former head of TechQuartier in Frankfurt, will take over the management of the House of Finance and Tech Berlin (HoFT.Berlin) from September 1, 2024. This was decided following a transparent selection process organized by IBB Unternehmensverwaltung in cooperation with the Berlin Finance Initiative, Partner für Berlin and the Senate Department for Economics, Energy and Public Enterprises. Dr. Hinrich Holm, CEO of IBB, praised Schäfer's expertise and his successful development work in Frankfurt. Schäfer himself is looking forward to the task of further strengthening the German FinTech ecosystem from Berlin and raising it to a European level. HoFT.Berlin will serve as a central point of contact for FinTech players and will be financed by public funds and private commitment.

Partnerships and acquisitions

AMD acquires Silo AI for around 665 million dollars

AMD has announced the acquisition of Silo AI, Europe's largest private AI lab, for approximately 665 million dollars. This acquisition supports AMD's strategy to deliver comprehensive AI solutions based on open standards. Silo AI, headquartered in Helsinki with offices in Europe and North America, specializes in custom AI models and solutions for various industries. Silo AI's CEO and co-founder, Peter Sarlin, will continue to lead the team as part of the AMD Artificial Intelligence Group. This acquisition is expected to accelerate AMD's AI strategy and drive the development and implementation of AI solutions for global customers. The transaction is expected to close in the second half of 2024.

Katjes Greenfood acquires majority stake in mymuesli

Katjesgreenfood GmbH & Co. KG has increased its stake in mymuesli AG from 10.1% to around 56%. This transaction, which involves both a capital increase and the acquisition of shares from existing investors, is still subject to an antitrust review and final agreement with the financing banks. Katjes Greenfood is currently evaluating various options for financing the transaction, including capital market instruments. MyMuesli, founded in 2007, is the world's first provider of individualized organic muesli and one of the market leaders in the German online muesli trade. This is Katjes Greenfood's second majority investment following the acquisition of the British gluten-free bakery products manufacturer Genius. This investment strengthens Katjes Greenfood's position in the market for future food concepts.

Xential acquires Eformity to strengthen its market position

Xential has announced the acquisition of the Dutch company Eformity, a specialist in document creation and template management. This acquisition is part of Xential's buy-and-build strategy, which has been pursued in collaboration with Main Capital Partners since June 2023. Eformity offers a multi-tenant SaaS platform that integrates seamlessly with the Microsoft suite and other software systems. With this acquisition, Xential expands its reach and strengthens its position in the Benelux and DACH regions. The merger is expected to broaden the customer base and improve the offering for existing and new customers. The executives of both companies emphasize the strategic and cultural fit and see great potential for further growth and internationalization.

Beagle Systems and atmio cooperate

Beagle Systems, a Hamburg-based air data collection specialist, and atmio, a developer of methane emissions reporting software solutions, have partnered to offer a complete solution for methane emissions monitoring. By combining Beagle Systems' long-range inspection drones and atmio's portable measurement technology and atmioOS software platform, methane data can be collected and analyzed in real time. This solution is aimed at natural gas companies and network operators and supports them in complying with the EU Methane Regulation. The partnership aims to improve the accuracy and efficiency of methane emissions monitoring while contributing to climate protection.

Main Capital Partners acquires US DevOps software provider Flexagon

Main Capital Partners has acquired US DevOps software provider Flexagon to expand its presence in the infrastructure software market. Flexagon, founded in 2014 in Green Bay, Wisconsin, offers automated solutions for software development and deployment processes in complex environments such as Oracle, Salesforce, SAP and Open Systems with its flagship product FlexDeploy. Flexagon serves customers in a variety of industries, including manufacturing, public sector and healthcare, and has an average annual growth rate of 25%. With Main's support, Flexagon plans to strengthen its market share in North America and expand its international presence in Europe. CEO Dan Goerdt and Main Capital Partners are optimistic about driving long-term innovation in the DevOps market through organic and inorganic growth strategies.

Funds and rounds

Powercall receives six-figure early-stage financing

The sales SaaS solution Powercall from Bad Doberan has received six-figure early-stage financing, supported by four new investors, including Mittelständische Beteiligungsgesellschaft Mecklenburg-Vorpommern mbH (MBG MV), ROKA 1825 GmbH, business angel Reginald Stadlbauer and the venture capital company ESB Invest. Powercall, founded by Elias Elgin Esen, revolutionizes sales through automated prioritization of leads and direct calls from the software. The investors see great potential in the solution, which uses AI technology to convert calls into text in real time and store them in an organized manner. The aim is to promote the growth and further development of Powercall and to strengthen innovation in Mecklenburg-Vorpommern.

Eiffel Investment Group launches the first European impact debt fund for SMEs with the support of the European Investment Fund

Eiffel Investment Group, with the support of the European Investment Fund and the InvestEU program, has launched the Eiffel Impact Direct Lending fund, the first European impact debt fund for small and medium-sized enterprises (SMEs). The fund has raised 200 million euros in its first financing round and is targeting a total volume of 400 million euros. With its innovative approach integrating Impact Covenants®, the fund aims to help around 25 French and European SMEs improve their ESG strategies and accelerate the transition to a more sustainable economy. The fund's first investment was made in SATEP SAS, a company active in the installation and maintenance of energy systems.

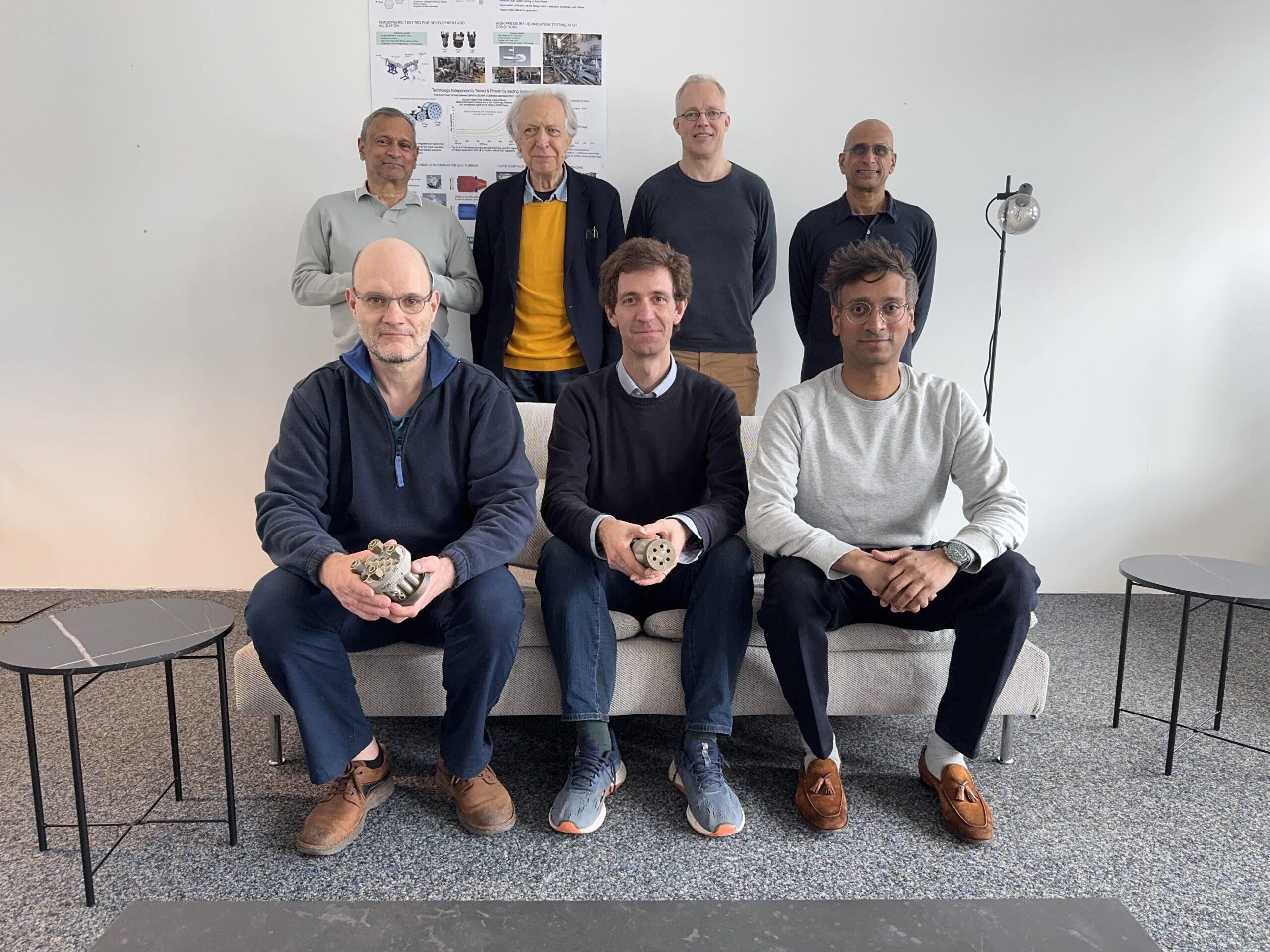

Dynelectro secures €11 million

Dynelectro has successfully closed an €11 million investment round to develop its advanced 1 MW Dynamic Electrolyzer Unit (DEU). The funding, which also includes €9 million in grants from the European Innovation Council and the Danish Energy Technology Development and Demonstration Program (EUDP), aims to scale up DEUs from 150 kW prototypes to commercially scalable 1 MW units. Dynelectro uses solid oxide electrolysis (SOE) to efficiently produce hydrogen and utilize industrial waste heat, contributing to decarbonization in hard-to-decarbonize sectors. The first installation of a 1 MW unit at Europäische Energies' Danish renewable energy plant is planned for the first half of 2025, demonstrating the practical application of this advanced energy solution.

HERO Software raises 40 million euros for expansion

HERO Software, a leading provider of business software for craft businesses in the DACH region, has raised €40 million in a Series B financing round. The round was led by Eight Roads Ventures, with existing investor Cusp Capital also participating. HERO plans to use the fresh capital to grow its team, expand into new markets and further develop its software. HERO Software was founded in 2020 and has established itself as a leading provider of cloud-based software for tradespeople with over 20,000 users. The investment is intended to drive forward the digitalization of the skilled trades sector and thus contribute to achieving European climate targets.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?