Startupnews KW 4-25

Aleph Alpha presents new tokenizer-free architecture - Neko Health secures 260 million dollars - Fusebox receives 2.6 million euros - Startups: Changing terms and differences in perception - CargoCast with new Sales Director - Tech Tour: Nine German companies among the "Top 50" in Europe - Urwahn Bikes expands product range - INNO INVEST in cooperation with UBS Germany - Matchory secures 6 million euros - zinsbaustein.de and Wiwin cooperate - finmid pushes ahead with European expansion - N26 introduces free trading in shares and ETFs - Boldyn Networks acquires Smart Mobile Labs

Fusebox receives 2.6 million euros for expansion in Europe

The Estonian company Fusebox, leading provider of flexibility solutions in the Baltic States, secures 2.6 million euros to expand in the European energy market. The financing round was led by Soulmates Ventures with participation from SmartCap, Eneco Ventures and PKO Bank. The funds are intended to accelerate the company's growth, improve the SaaS platform and attract new talent. Fusebox offers innovative solutions such as virtual power plants and energy management systems that reduce energy costs, stabilize grids and integrate renewable energy. Active in 13 markets, Fusebox is now planning a stronger European market presence.

Matchory secures 6 million euros

The ProcureTech startup Matchory has raised 6 million euros in a seed extension financing round. The round was led by Munich-based VC Capmont, while existing investors such as Earlybird-X participated again. Matchory, part of the Factory-X project, is committed to the digitalization of supply chains, the development of industry standards and funding initiatives together with partners such as SAP and Siemens.

N26 introduces free trading in shares and ETFs

From January 27, 2025, N26 will offer its customers in Europe trading in more than 4,000 US and European stocks and global ETFs without fees or commissions. This makes the Berlin-based neobank the first financial services provider in Europe to offer this service free of charge. Free savings plans are also available. The decision is intended to make investing accessible to more people and encourage customers to actively shape their financial future.

Neko Health secures 260 million dollars

Swedish Neko Health, specializing in preventive health technology, has closed a Series B financing round of 260 million dollars. Lightspeed Venture Partners was the lead investor, accompanied by General Catalyst, Atomico and other investors. The funds are intended to drive expansion in Europe and the USA as well as the research and development of new diagnostic technologies. Since its foundation in 2023, Neko Health has performed 10,000 health scans in London and Stockholm and has over 100,000 people on its waiting list. The company focuses on non-invasive, rapid scans to detect diseases early and make prevention more accessible. CEO Hjalmar Nilsonne sees this as a fundamental shift from reactive to proactive healthcare.

Startups: Changing terms and differences in perception

Although start-ups are generally defined as innovative, growth-oriented, young companies, many founders refer to their companies as start-ups, even if these characteristics are missing. A KfW study shows that around 27% of founders perceive their company as a startup, while only 6% fulfill the classic startup criteria. Factors such as sector, company size and degree of innovation have a strong influence on self-perception. This discrepancy reflects a change in the term, which is increasingly being used more generally. Despite the imprecise definition, positive startup narratives could help to promote start-up activity by reinforcing existing preferences for self-employment.

Personnel

CargoCast underlines growth with new Sales Director

The Paderborn-based start-up CargoCast, which specializes in AI-supported resource and demand planning, is strengthening its management team: Freshta Farzam has been in charge of strategic sales activities as Strategic Sales Director since January 2025. The experienced sales and strategy consultant brings extensive expertise from international projects in the mobility industry. Her goals are to expand in Europe and the USA and to position CargoCast as the standard in the logistics market. Farzam, who previously led successful initiatives in the fields of electromobility and green hydrogen, was co-founder of an aircraft start-up and will use her network to drive CargoCast's growth ambitions forward.

More exciting news

Tech Tour: Nine German companies among the "Top 50" in Europe

The Tech Tour Growth has selected the fastest-growing tech companies in Europe. France (13) and Germany (9) top the list, with German companies raising the highest amounts of funding: On average, they raised 350 million euros - significantly more than their European peers. The frontrunners are Aleph Alpha (AI) and the space startup The Exploration Company. The top 50 attract capital in digital, sustainable and healthcare sectors in equal measure. Nevertheless, gender diversity remains low, with only 12% female leadership. The three best companies will be honored in Paris in March 2025.

Urwahn Bikes expands its range with new urban and gravel bikes

The Urwahn Engineering GmbH from Magdeburg has introduced new models for urban and gravel bikes, which are available both with and without electric assistance. The new SOFTRIDE 2.0 product series combines an additively manufactured steel frame with drive systems from renowned manufacturers such as MAHLE, Gates and Pinion. The aim of the further development is to increase riding comfort while reducing weight and improving modularity.

The e-bike versions use the lightweight X20 rear motor from MAHLE with a range of up to 100 kilometers. Further innovations include integrated lighting, a modular luggage rack and anti-theft systems. Urwahn continues to focus on regional production with 3D printing and a closed product life cycle, including repair and recycling services.

INNO INVEST expands its offering through cooperation with UBS Germany

The Darmstadt-based securities institute INNO INVEST is now working with UBS Germany to expand its asset management and liability umbrella business. The integration of the renowned UBS as custodian bank underlines the strategic focus on services for wealthy clients. In addition to individual investment solutions and private equity access, clients benefit from global investment expertise and optimized international tax and currency strategies. The cooperation also expands the connectivity options of the Wealthtech platform, which already includes partners such as DAB BNP Paribas, V-Bank and Interactive Brokers.

zinsbaustein.de and Wiwin cooperate for sustainable investments

The digital investment platforms zinsbaustein.de and Wiwin are entering into a partnership to offer a broader range of sustainable investment opportunities. zinsbaustein.de is contributing its expertise in real estate investments, while Wiwin is contributing its experience in financing energy transition projects. Together, the partners are developing new financing strategies, including integrated neighborhood developments with combined energy and real estate concepts. The collaboration will provide greater access to various asset classes and offer project developers advantages in terms of the speed and volume of financing. The first joint projects are already in preparation.

finmid drives European expansion forward

Fintech company finmid is expanding its reach to 20 European markets, including Austria, Italy and the Czech Republic, to enable platforms to seamlessly provide financing solutions for small and medium-sized enterprises (SMEs). With a modular financing infrastructure, B2B platforms can develop customized offerings that accelerate access to capital. In underserved markets, finmid closes financing gaps and supports the growth of SMEs.

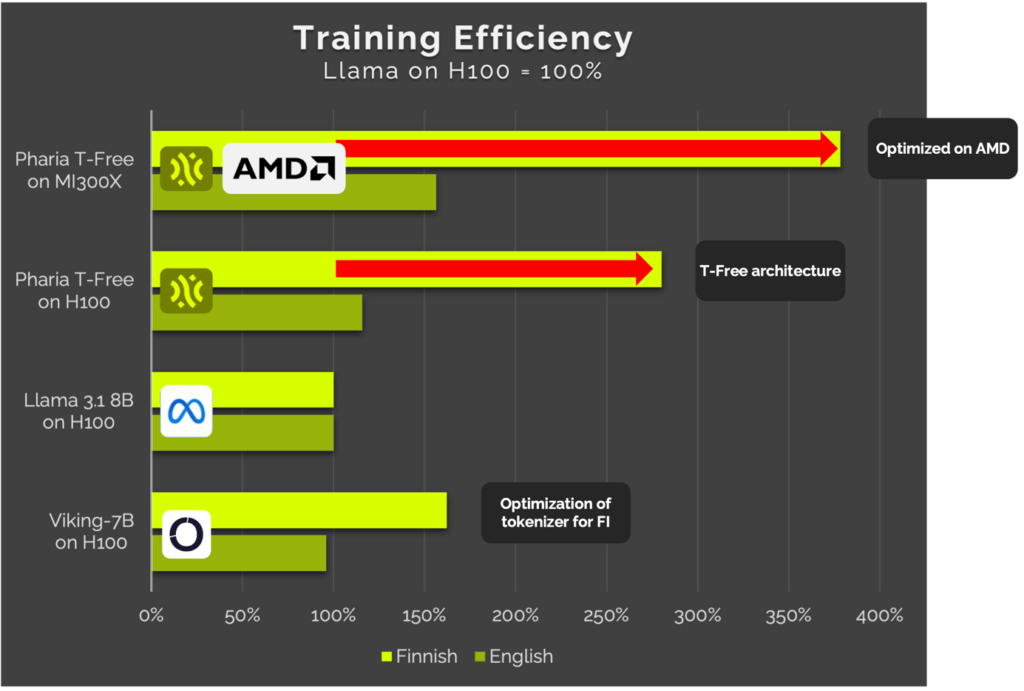

Aleph Alpha introduces new tokenizer-free architecture and partnerships

AI company Aleph Alpha has unveiled a new architecture for Large Language Models (LLMs) that does not require a tokenizer. This innovation improves adaptation to different languages and domains and addresses the limitations of traditional models for less common languages and specialized data. A collaboration with AMD and Schwarz Digits complements the development with powerful computing infrastructure and cloud solutions. The new technology is expected to enable more efficient and sustainable AI applications for companies and public authorities and contribute to strengthening European sovereignty in the field of artificial intelligence.

Boldyn Networks acquires Smart Mobile Labs

Boldyn Networks, a provider of network infrastructure, has announced the acquisition of the German company Smart Mobile Labs (SML). This move expands Boldyn's presence in the fast-growing German market and strengthens its offering in the area of private 5G networks. SML brings extensive expertise in sectors such as industry, logistics, healthcare and security and complements Boldyn's portfolio with its patented live video streaming solution EVO. The acquisition increases Boldyn's track record to over 110 private cellular networks in Europe and the US and supports its global expansion. The transaction is expected to close in the first quarter of 2025.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?