Tapline secures 20 million euros in pre-Series A financing round

The company receives a €20 million Pre-Series A funding round to support SaaS and subscription businesses with flexible and non-dilutive financial solutions

Berlin, January 22, 2025 - Tapline, a fintech startup reimagining financial solutions for SaaS and subscription-based businesses, has closed a €20 million funding round. This round, which includes both equity and debt, will enable Tapline to further expand its platform and support the growth of SaaS companies in Europe.

Financing solutions for SaaS companies

Tapline provides non-dilutive financing to SaaS and subscription companies by pre-financing future receivables. Using AI-driven lending technology, Tapline provides flexible financing solutions that enable companies to scale efficiently. Companies with a monthly recurring revenue (MRR) as low as €15,000 can receive financing of up to €2 million.

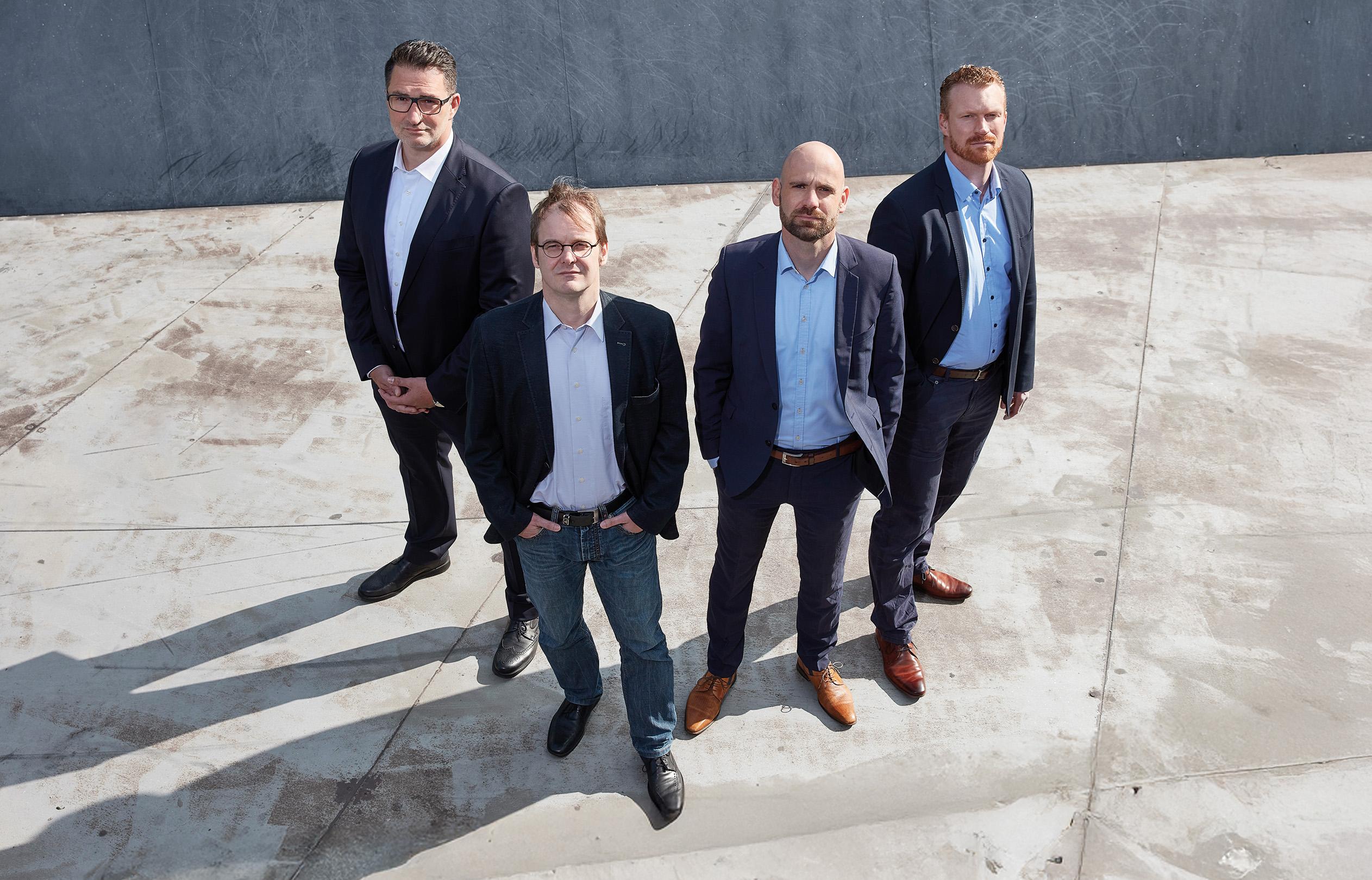

Our approach combines scalability with improved analytics and larger funding limits to help our clients achieve sustainable growth

Dean Hastie, Co-Founder and CEO of Tapline

Support from experienced investors

The equity investment in the financing round was led by Karim Beshara, General Partner at A15 Venture Capital and Managing Partner at Accelero Capital. Further investments came from Antler, one of the most active early-stage venture capital firms in Europe, as well as several strategic business angels. In addition, Tapline secured debt financing from WinYield to fund its debt portfolio and provide non-dilutive capital for SaaS and subscription businesses.

Expansion and market presence in Europe

Tapline currently supports customers in Germany, Estonia, the Czech Republic and Poland and plans to expand into other European markets in the near future. With a robust credit model and multi-currency platform, Tapline is well positioned to support SaaS businesses across Europe as they grow.

The customized debt financing offers benefits such as lower operational costs, new credit scoring capabilities and credit risk transfer. Tapline is the first company in the sector to implement this model

Fabricio Mercier, Director at WinYield

With a capital-light business model, Tapline strives for efficiency and scalability to offer competitive pricing and exceptional flexibility. In addition to non-dilutive financing, the platform also provides advanced, AI-powered analytics that give clients insights into their financial position, cash flow projections and growth strategies. Tapline continues to be an innovative partner for SaaS and subscription businesses in Europe, helping to bridge the gap between financial sustainability and growth.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?