Verdane closes Freya XII fund at 2 billion euros hard cap

The European investment company Verdane has successfully closed the Freya XII fund with a hard cap of 2 billion euros. This is the largest fund in the company's 22-year history. The fundraising was completed less than six months after the first closing. In total, Verdane has raised capital commitments of 9 billion euros since its foundation.

Hard cap reached again

This is the ninth time in a row that Verdane has reached the hard cap with a fund. Around 80 percent of the commitments came from existing investors, which underlines the strong bond with the investors. New commitments came from international private and public pension funds, university funds, foundations, insurance companies and family offices.

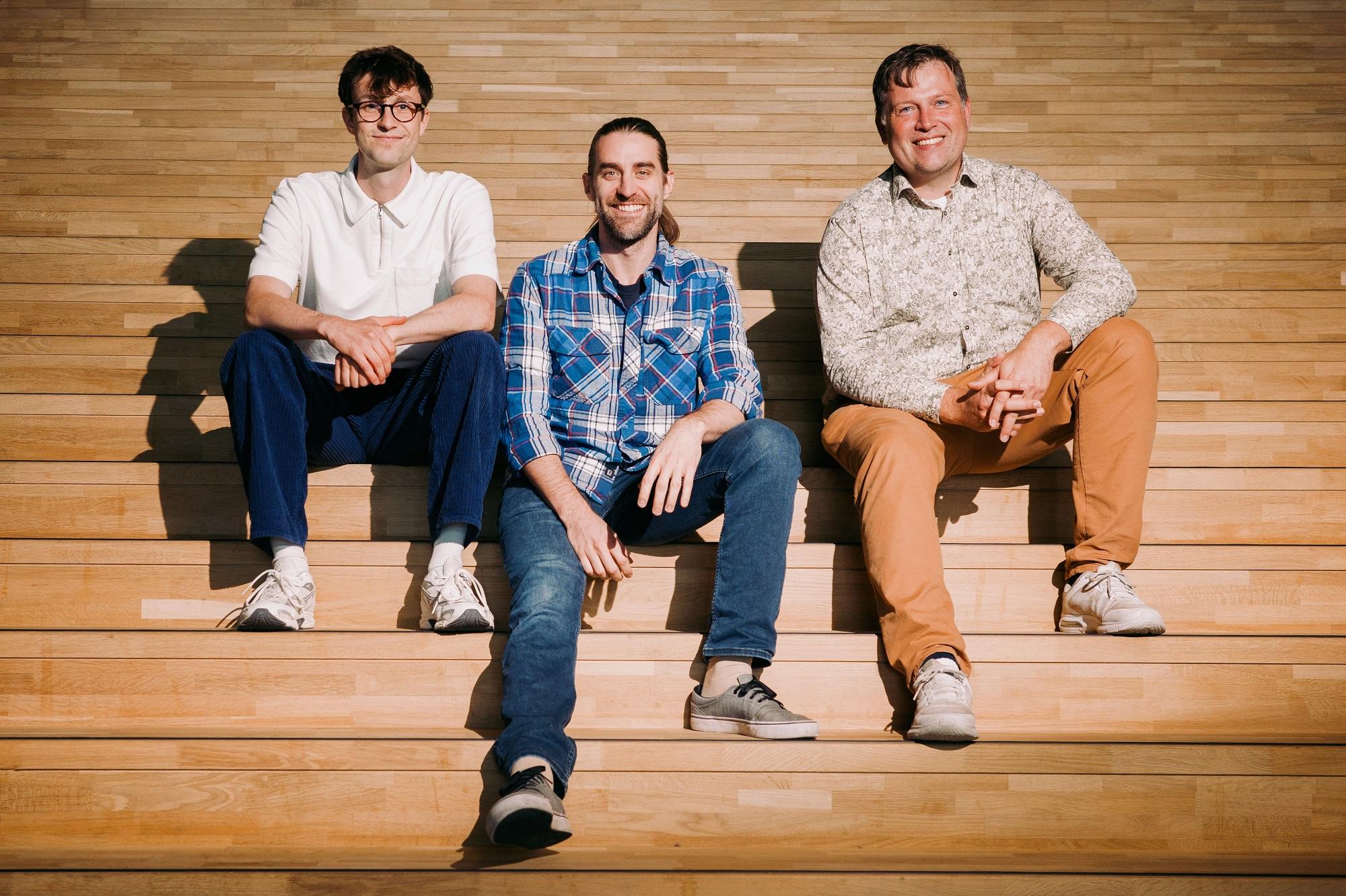

The growing number and quality of technology-oriented European companies in our pipeline makes us more confident than ever before - both in terms of the prospects for the European economy and the return opportunities for our investors.

Bjarne Kveim Lie, Founder and Managing Partner of Verdane

The investor base is globally diversified: Investors from 18 countries participated for Freya XII, including a quarter from the USA.

Focus on digitalization and sustainable growth

Freya XII will invest in innovative European growth companies through direct investments and portfolio transactions. The thematic focus remains on digitalization and decarbonization of the European economy.

With Freya XII, we can invest even more specifically in our talents, systems and technologies - and thus further increase the value of our investments.

Carl Nauckhoff, Partner and Chief Commercial Officer

Verdane pursues a flexible strategy that includes both minority and majority investments as well as replacement and growth financing.

Strong pipeline and successful transactions

The closing of the fund coincides with a strong year for Verdane. In 2025, the company recorded several transactions, including

- the sale of Hornetsecurity to Proofpoint,

- the sale of Danalec to GTT,

- as well as partial sales of Voyado and Lumene.

Verdane expects a high number of further transactions in the coming years, supported by its network of seven offices in Europe, including Berlin and Munich.

Verdane in Germany

Verdane has been active in the DACH region for nine years and has invested almost one billion euros. Recent investments include Urban Sports Club, Fiskaly and Cropster. Other well-known investments include Momox and Smava.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?