Volve Capital closes first fund with EUR 9 million for early-stage tech start-ups

Dutch early-stage investor Volve Capital has successfully finalized its first fund vehicle with 9 million euros. The fund is aimed at technology-oriented start-ups in the earliest stages of development in the Benelux region as well as in Germany, Austria and Switzerland.

Founders with day-zero experience as investment partners

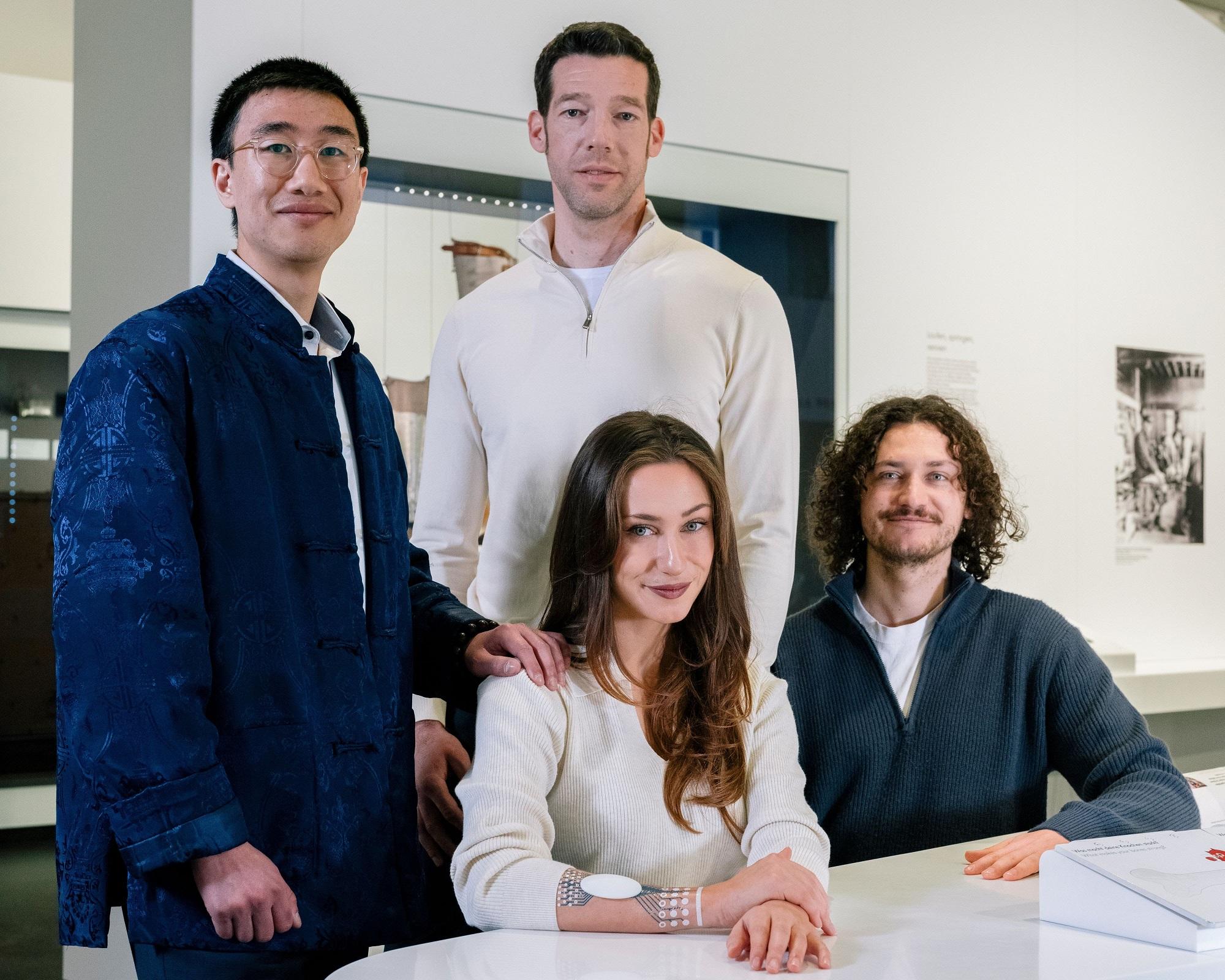

Volve Capital was founded in 2024 by entrepreneurs Joost Bijlsma and Maurits Hovius. With their fund, both want to close a gap that they know from their own experience. Support for founders who are still orienting themselves on the market before product launch or sales. The two investors contribute both operational start-up experience and VC know-how and deliberately position themselves as partners at eye level.

Fast, practical support instead of classic VC logic

In contrast to traditional venture capitalists, Volve Capital focuses on high implementation speed and pragmatic, operational support. Through a network of experienced operators, start-ups receive help in areas such as technology, data, go-to-market, marketing, operations and finance.

Fund structure: pre-seed focus with lead readiness

After twelve months of fundraising, Fund I is now officially launched. Volve Capital is investing sums between 150,000 and 500,000 euros in the pre-seed phase, with potential follow-up investments of up to 1 million euros per company. A total of 12 to 15 investments are planned, seven of which have already been realized. These include Eddygrid, NOX Energy, Stippl, Conservio, Whisper, Twindo and Supplied.

There's plenty of funding available in the ecosystem once founders start to show traction, but at day zero it's still often hard to find.

Maurits Hovius, Co-Founder Volve Capital

Co-founder Bijlsma emphasizes that the most difficult step in building a company is the transition from zero to one and this is exactly where Volve wants to come in as an active sparring partner. Hovius emphasizes that early rounds are often difficult to fill and that Volve is consciously prepared to invest in pre-product and pre-revenue leadership roles.

Strong support from entrepreneurs

Around 30 Dutch entrepreneurs are participating in the fund as limited partners. These include prominent personalities such as Henk Jan Beltman (Tony's Chocolonely), Roelof Bijlsma (Conclusion), Heleen Dura van Oord (Peak Capital) and Mathieu Zwinkels (formerly Waterland). They also support Volve Capital on the Advisory Board. The financing was also supported by the RVO Seed Capital Program.

Establishment of a second fund planned

Once all planned investments have been completed, Volve Capital plans to launch a second fund to continue supporting young tech founders in the long term and further expand the network.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?