XAnge reaches 200 million euros in the first closing of the new early-stage fund XAnge 5

The European early-stage investor XAnge has completed the first closing of its new fund XAnge 5 and raised 200 million euros in the process. The fund has already outperformed its predecessor XAnge 4 at the start and continues the investor's European expansion strategy. Fundraising will continue until the final closing.

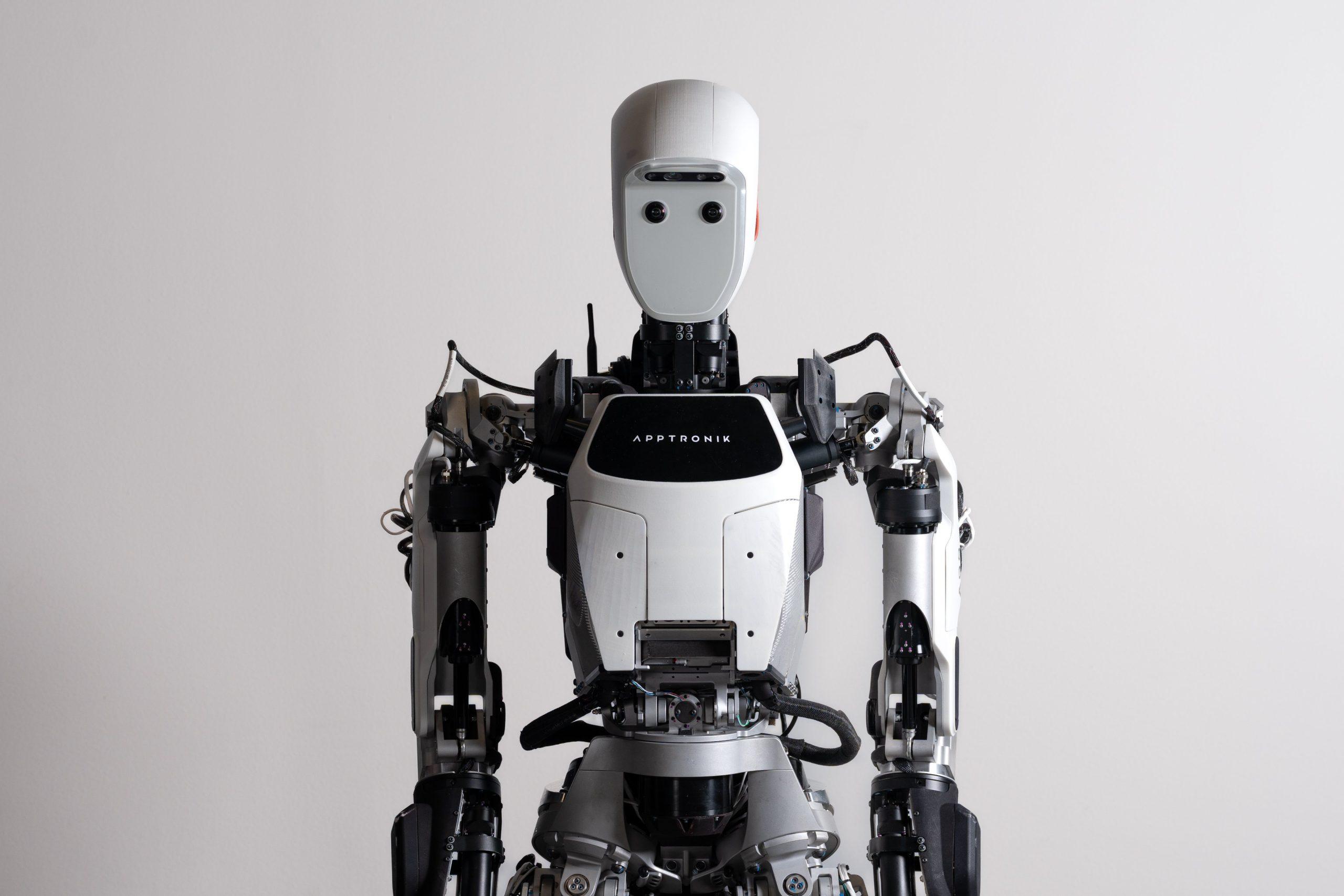

Early-stage fund with future-oriented themes

With XAnge 5, the fund is concentrating on three strategic investment focuses:

- Applications and transformation through artificial intelligence

- deep tech innovations

- Sustainable technologies

Lead investments in the early-stage segment of between EUR 1 and 15 million are planned throughout Europe.

Investor signals strengthen Europe's competitiveness

The first investors in the new fund include the European Investment Fund (EIF), Siparex Associés, Bpifrance, CNP and other institutional investors and family offices. The EIF has doubled its commitment compared to the previous fund.

This first commitment shows how strongly investors are backing Europe. XAnge 5 will be one of the strongest funds in the market and is a clear signal for the future viability of the European ecosystem.

Valerie Bures, Partner and Managing Director DACH

The response illustrates the growing confidence in Europe's technology ecosystem and XAnge's role as an experienced early-stage investor. The team has been supporting founders who shape markets and drive social change for 20 years.

Portfolio with European success stories

In recent years, XAnge has invested in European growth companies such as

- Lydia

- Ledger

- Odoo

- Believe

- 360Learning

- Skello

- Greenly

- GreenFusion

- Gleamer

- Knowunity

- Aerospacelab

This makes the fund one of the most active European early-stage investors.

Europe has the talent and prerequisites to form a globally competitive tech ecosystem. With XAnge 5, we want to support companies that can survive internationally.

Cyril Bertrand, XAnge CEO and Managing Partner

XAnge is a European early-stage investor with offices in Paris, Berlin and Brussels. The fund invests in seed to Series C stages and supports founders in building internationally scalable business models. The tickets are typically between 1 and 15 million euros.

The portfolio focuses on the areas of deep tech, SaaS, AI, energy transition, digital finance and healthcare. XAnge is the innovation brand of the Siparex Group.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?