The corona crisis checklist for startup CEOs

Your job is no longer to find the strategy with the best opportunities - but the one with the lowest risks.

This article was originally in the original from Feliks Eyser (tech founder and investor) and we have the kind permission to publish the German version.

Dear startup CEO, it's time to change your mindset.

Last week might have been about growth and new, unusual initiatives. It was about hiring employees, closing the new funding round and launching a new product. Last week was about beautiful things. Growth was your religion, and your North Star was closing deals and booking revenue. Amen.

But we have woken up to a different world, a world where part of the population is (or soon will be) shielded from normal social life by the spread of the coronavirus. This new world demands new rules. Your new religion is now survival, and your new god is liquidity.

I would wager that none of you had a "global pandemic" section in your financial planning for 2020.

I spoke to a VC today who summed it up nicely: "In 12 months, it will be easy for you to explain why your startup hasn't grown in the last six months. But it will be very hard to explain why your startup is dead."

Whatever your priorities have been in the last few months, your new top priority must be liquidity. But in times like these, there are more things to consider. Crisis management can be difficult, especially if it's your first crisis and is on the scale of the current crisis. The following points should give you some guidance and at least give you some direction:

1. throw away your 2020 strategy and business plan and start on a blank page

Most plans for 2020 have been created based on a more or less normal world view. None of you have a "global pandemic" section in your financial planning sheet. So you might as well throw out the entire document and start with a blank page. New circumstances require new plans.

The only problem is, there isn't enough information and clarity about the whole situation yet to create a robust new plan. Steering your ship in times of crisis will require a lot of course corrections and minor maneuvers. So make planning a part of your daily crisis meeting and adjust the forecast as you get new information. Your new focus in the planning process will be liquidity.

2. create a safe working environment - home office

This may be a no-brainer by now, but I'll repeat it anyway. Most startup CEOs I know have sent their employees home to work remotely. And the CEOs who haven't done so yet should. Given that many countries are implementing various social distancing measures, it seems the safest and most sensible thing to do in the current situation. Of course, this means that productivity will fall temporarily. But let's be realistic: what would productivity look like if people were sitting in their offices afraid of catching the virus? Or if employees simply called in sick and didn't show up at all?

You don't need to reinvent the wheel to implement a home office policy for your company.

You don't need to reinvent the wheel to implement a home office policy for your company. Others have already done this and shared their experiences. Research best practice first, do a test run and then implement your homeworking policy. The quicker the better.

3. overcommunication, especially when working from home

My friend Steli Efti, CEO at Close, has worked remotely with over 50 people in the last five years. His number one piece of advice: overcommunicate! With an ongoing crisis, which in itself requires more communication, and the transition to remote working, you have all the more reason to communicate a lot.

In my experience, turbulent times require different levels of communication. There is the so-called "hall-style" communication, where you as CEO have to provide the entire workforce with updates and answer questions. Such a meeting can initially take place once a week. In addition, take the time to address individual team members directly.

You will spend an enormous amount of time in the coming weeks and months talking to people and listening to their fears. Don't be afraid to repeat yourself, proactively address employees and generally over-communicate, over-communicate, over-communicate.

4. set up a daily COVID-19 war room

The concept of "war rooms" obviously came out of the military and means setting up a single physical (or virtual) room to gather all mission-critical information and bring relevant people together to make quick decisions.

Set up your own "war room" to bring all relevant people together to recognize the impact of the coronavirus on your startup and your employees and make decisions quickly. You need to bring your co-founders and management team together regularly to review new information and make decisions. Use these meetings to carefully monitor your incoming orders and revenues and, most importantly, to track your cash flow and cash on hand.

The greater the impact of the crisis, the more often these meetings will take place and the longer they will last. Let the meetings take place daily at the beginning and then reduce them if necessary.

5 Stabilize your business operations and supply chain

Use the first meetings in the "War Room" to answer the following questions: How are your business operations and supply chain affected by the crisis? Do you sell physical products whose flow is or could be restricted? Is the distribution of your products affected? Many warehouses will have a shortage of labor and lower capacity than in regular times.

If you don't have physical products: What critical business functions could suffer from people getting sick, staying home or being temporarily overwhelmed by the transition to home office? In which parts of your business are you dependent on third-party suppliers, and how can you ensure that they continue to supply you?

Regarding new initiatives: I would (at least for now) pause developing new projects, selling new products, opening new locations and generally question anything "new" until the situation becomes clearer and your core business is sustainable and stable.

6. inform customers about your situation

As much as you rely on your suppliers, your customers are just as dependent on you. So take the time to thoroughly communicate how you will handle your processes and whether customers will have to expect any restrictions. Remember, it's better to communicate too much than too little!

7. realize that your revenue can (and probably will) plummet.

Your sales are probably already affected by the new situation. A small number of businesses will see their revenues skyrocket (think online education, video conferencing, e-commerce for household goods, etc.), but most will stagnate or decline, at least temporarily. In the B2B space, acquiring new customers could prove particularly difficult due to the lack of physical interactions as well as a general freeze on spending.

The new reality is: you can no longer control your revenue, so hold on to your cash and work on your cost structure.

One VC told me about a portfolio company that employs 35 sales people and typically wins 20 new customers per month. The number for the last two weeks was... exactly zero. The same can be true for B2C companies: I heard from an acquaintance who runs an e-commerce fulfillment center that orders are down 30-40% across all industries since last week.

The psychological strain of quarantine lockdowns and uncertainty will undoubtedly impact consumer behavior in the short term. As for medium and long-term planning: of course, certain industries such as e-commerce may benefit from the new situation, but it's simply too early to tell. The new reality is: you can't control your sales, so you better prepare to work on your liquidity and cost structure. And do it now.

8. forecasts using scenarios

Cash is king in every crisis. The opposite is also true: if you have no money, you can quickly become a fool. Take a look at your cash position today and estimate your survival time based on various scenarios.

In my experience, it is most pragmatic to create three scenarios:

- best case,

- average case,

- and worst case.

In an ordinary world, the "best case" would mean growing revenue (the 2020 plan you just dropped). In today's world, the "best case" should probably mean stable revenue. The average and worst case would be some level of revenue loss, for example -20% and -40%. Unfortunately, there are already companies where the respective declines are approaching -100% (think of the event or hospitality industry).

The actual numbers depend very much on the first signs you draw from your sales and how much your business depends on new customers (compared to existing ones). Monitor sales and marketing carefully to find out which scenario is most realistic for you. This is what your "war room meetings" will be for.

The shorter your survival period, the more drastic the following actions you should take. If you can survive for more than 12 months, even in the average or extreme case, you have enough time to observe the situation and could allow yourself to correct course in a few months' time. If you are between 6 and 12 months, you should be very careful and have a contingency plan ready. If your survival period in the average scenario is less than six months (which will be the case for many startups), now is the time to act.

At this point, you may have an "Oh sh****" moment. It's the moment when you realize that you have less money and your survival time is shorter than you initially thought. Things may look a lot bleaker than at first glance. Welcome to the part that sucks the most about entrepreneurship. Your job is no longer about figuring out the best option. Your job is now to find the option that is the least bad. And that option will probably still hurt, but less than all the other options available.

With the new reality around us, a new goal is emerging: the preservation of cash. This requires a different way of doing things than implementing a growth strategy and builds on other measures.

9 Don't count on VC funding

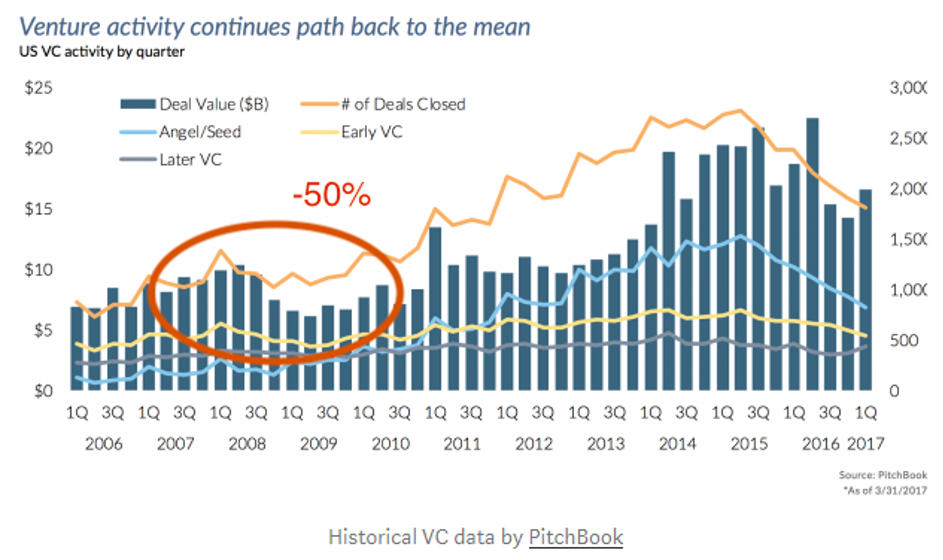

After the 2008/2009 financial crisis, venture capital investment fell sharply, by more than 50% from its 2008 peak:

It took over two years for funding to return to previous levels in early 2011. Look at it from a VC perspective: hoarding cash in times of uncertainty might be the dominant strategy. No one wants to invest in a "falling knife", even if the macroeconomic environment causes it. So don't rely on your local rocket fuel dealer to provide you with enough liquidity to navigate through the crisis. This time, you're probably on your own.

If you are currently raising funds, try to get clarity as soon as possible. Be open about your concerns and get a realistic picture of whether or not your partners are able and willing to invest. At first glance, most VCs state that they will invest no matter what the weather is like. History and statistics show us that most of them do not actually invest.

10. get liquidity

Focus on the most common steps to obtain and attract liquidity in times of crisis. This won't be easy: many other companies are in the same situation as you, so quick and decisive action is paramount.

One important thing to keep in mind when optimizing your cash flow: Every euro you retain or don't pay out comes from somewhere. So please always remember who you are dealing with. If you owe a large company a few thousand euros, it probably won't make much difference to them whether you pay later or not. But if you owe it to a freelance subcontractor whose income may have already imploded and who has a family to support, that's a whole different story. I've seen companies speed up their payout cycles in these situations, or even extend their collection cycles for harder-hit industries like restaurants. So please always remember who you are impacting on the other side of the transaction.

With this in mind, let's come back to the ways to optimize your cash flow:

- Credit: If you have access to a committed line of credit, now is the time to consider it. Whether it's from your house bank, your investors or from a PayPal business loan. It's better to activate it now before systems become overloaded or programs are withdrawn.

- Trade receivables: Your customers may be short of cash in the future, so better talk to them today about outstanding invoices. I've heard from several sources that payments from customers are starting to get delayed because accounting departments are simply understaffed. The best method in such situations is to call customers calmly and kindly one by one, clarify matters and collect as much cash as possible early. In addition to regular debt collection, consider offering discounts or better terms for customers' advance payments.

- Payables: Try to renegotiate longer payment terms and defer payments. If possible, implement payment plans over several installments. Go through your suppliers and ask for concessions now. Of course, they won't like it, but it's likely that they are already expecting such demands.

- Taxes: Delay tax payments for as long as possible. Some governments have already introduced looser rules for tax collection. Take advantage of this and perhaps even accept penalties for late payments.

- Reduce inventory: You can do this either by ordering less new stock or by selling your inventory, even at discount prices. It can be an excellent opportunity to clear your stock and generate cash, even if this involves a loss of margins.

11. create a capital-saving plan through cost savings

It's never fun to do this, but it's better to be prepared now than to regret it later. Look at the cost breakdown of your profit and loss statement, start with the most important items (usually payroll or marketing) and work your way down. Ask yourself where the biggest levers are to save money and reduce costs. For each of your scenarios, you should plan which costs should be reduced if revenue falls below the respective scenario threshold.

- Rent: Can you rent less space during the crisis?

- External suppliers: Which projects can be postponed?

- Working hours: It is always better to reduce working hours and retain employees than to simply lay them off. As a rule, employees show understanding with good communication (i.e. over-communicate).

- Number of employees: How can you achieve the same with fewer employees? It shouldn't be your first choice, but you should know what scenarios and income levels lead to layoffs.

- Founders' salary: Is there flexibility here to support the company?

- Product and R&D: What projects or product launches can you postpone to save money?

What I currently see with other startup CEOs: Most companies have frozen hiring and salary increases. Many companies have cut external suppliers and freelancers for non-critical projects. Some companies have started to reduce working hours and salaries accordingly. Some CEOs are preparing or implementing layoffs.

12. question your marketing spend and ROI

If conversion rates drop and sales calls don't happen, your customer acquisition costs could skyrocket in the coming days and weeks. In addition, higher customer churn and defaults can lead to lower customer lifetime values. Pay close attention to both metrics in your war room meetings. Adjust your spending according to your new reality. In some cases, it may make sense to increase marketing budgets and generate more revenue. More often, however, cutting the budget will lead to longer survival.

Opportunities will still arise in a few months' time. There is no need to rush unless your core business is doomed. If this is not the case, focus all your energy on stabilizing and maintaining what you have built so far.

Watch CAC and CLV carefully in your war room sessions and adjust your spending according to your new reality. About ROI: If you're currently low on cash (<12 months survival in your average case), it might make sense to raise the bar on "required return" in any ad or sales campaign to make your marketing more profitable in the short term.

13. find out about government assistance programs and talk to other entrepreneurs

Depending on your local government, there may already be measures in place to stabilize the economy. The various measures I have come across in recent days include:

- Deferral of tax payments,

- reduction of employees' working hours and a partial reimbursement of salaries by the government,

- "rescue funds" for certain industries (e.g. hospitality) that provide uncomplicated loans,

- relaxation of bankruptcy laws and reduction of personal liabilities.

The easiest way to find out about these types of programs is to talk to other entrepreneurs. In recent days, many WhatsApp groups have formed around sharing best practices and accessing these assistance programs. Join the conversation, ask others for help and share what you've learned yourself.

14. inform your investors about the situation

With all the day-to-day challenges, this one might slip your mind. Inform your investors too. If things are really bad and you need new money quickly, let them know early on. If you have bad news, you'd better deliver it quickly and thoughtfully.

15 Think about possibilities later

Every crisis brings a thousand opportunities. The same will no doubt apply to this crisis. Before you pivot your business into the production of organic face masks, you should wait a moment. Opportunities will arise in a few months' time. There is no need to rush unless your core business is doomed. If that's not the case, focus all your energy on stabilizing and maintaining what you've built so far and put yourself in a stable situation to evaluate new opportunities down the road.

16. reduce optimism

There is a German proverb that says: "An ounce of prevention is worth a pound of cure". Your newly founded company in the middle of a crisis is like a box full of fragile china. Prepare yourself, act calmly, carefully but decisively and proceed with caution. Avoid reckless rushing and make sure you keep a cool head in the event of a disaster.

We all hope that the current situation is not so damaging, but we also know that as entrepreneurs we tend to be a little too optimistic in many cases. How else could we have started our businesses in the first place! Consider temporarily toning down that optimism for the next few weeks. Remember the mother of the china box, prepare yourself, your team and your business because "better safe than sorry".

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?