BayBG sells stake in IDnow

Successful exit for BayBG. IDnow gains a new majority investor in Corsair Capital for international scaling.

Munich, April 30, 2025 - BayBG Bayerische Beteiligungsgesellschaft mbH has sold its entire stake in IDnow GmbH, a leading European provider of digital identity verification solutions, to Corsair Capital. The global investor is acquiring a majority stake in IDnow and intends to further drive the company's international expansion.

Long-term support from BayBG

BayBG was the first institutional investor to invest in the then young Munich-based fintech in 2015. Since then, the investment company has supported IDnow for over ten years in building its platform, developing its own AI-supported verification processes and internationalization.

IDnow has developed into a European market leader thanks to a strong team, technological innovation and a clear growth strategy. We wish the team around CEO Andreas Bodczek continued success.

Andreas Heubl, Investment Manager at BayBG

In 2022, we reported on a €60 million round for IDnow on Startbase.

New growth partner Corsair Capital

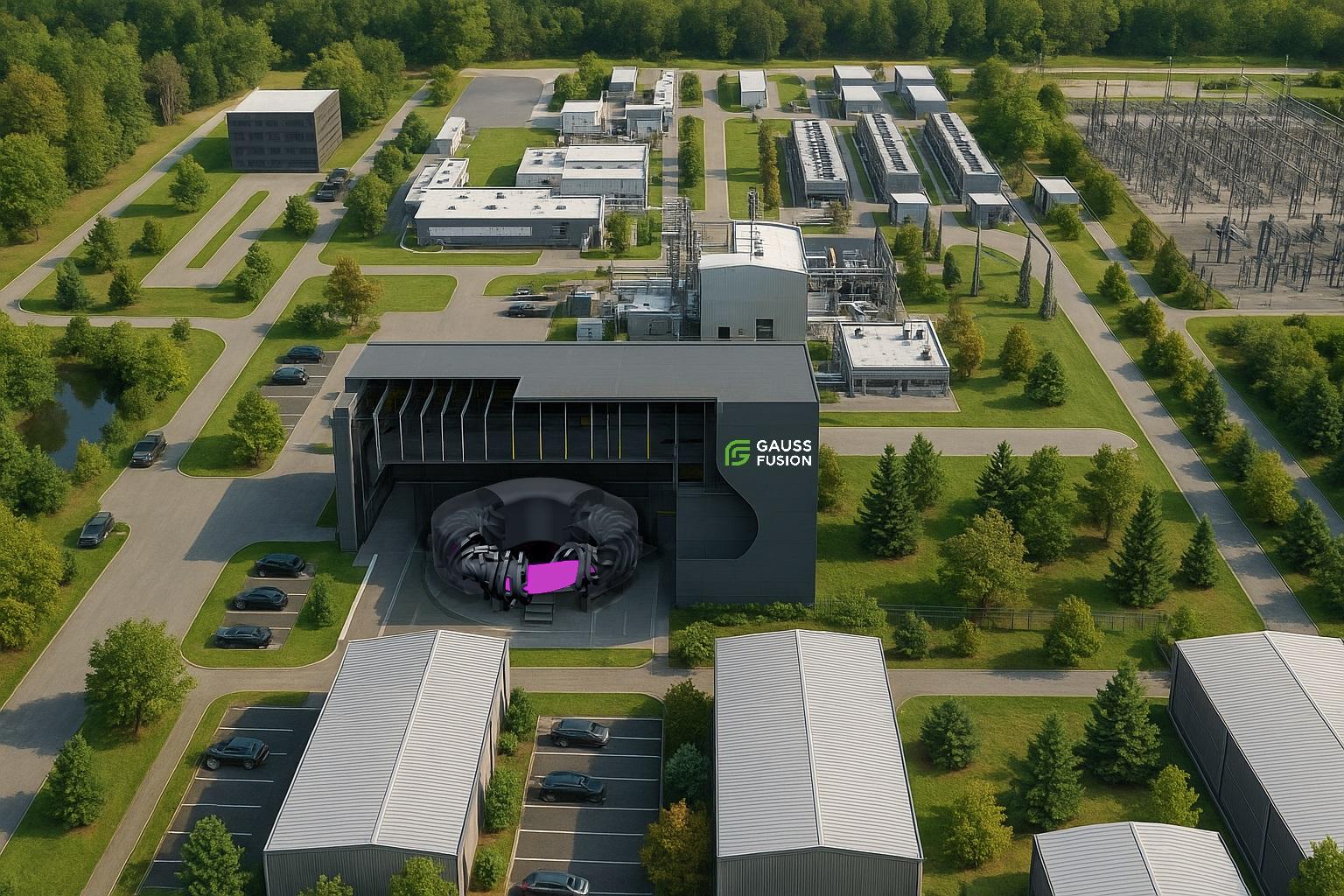

Corsair Capital, an international financial investor specializing in software, payment and financial services, announced the acquisition of the majority stake in March 2025. With Corsair's investment, IDnow aims to initiate the next phase of expansion and further strengthen its leading market position in Europe and other regions.

IDnow was founded in 2014 and develops proprietary technologies for AI-supported identity verification. The platform is used across industries, including financial services, telecommunications, travel, mobility and gaming. Companies rely on IDnow to meet regulatory requirements, prevent fraud and optimize customer onboarding processes.

BayBG remains an innovation-oriented investor

The exit underscores BayBG's strategic focus: as a long-term partner to SMEs, it supports technology companies through growth phases and transformations. BayBG's invested volume currently stands at around 400 million euros. The focus is on minority shareholdings and mezzanine capital, particularly in the Bavarian market. We recently reported on a €5 million round for ChargeOne.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?