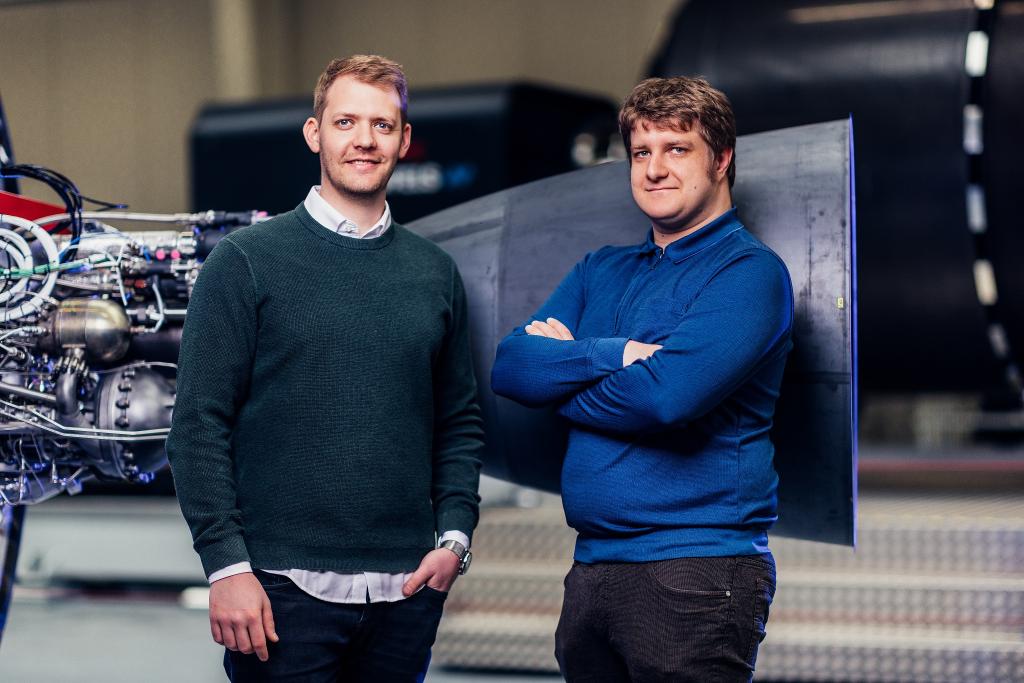

Bayern Kapital participates in financing round for space start-up Isar Aerospace

The German company Isar Aerospace has raised 155 million euros in the largest SpaceTech financing round worldwide from international investors such as Porsche SE, Lombard Odier, HV Capital and others.

Isar Aerospace develops and produces launch vehicles for small and medium-sized satellites and is valued at over 310 million euros following the financing round. The money will be used to develop and expand the production of launch vehicles and engines. Isar Aerospace already has a solid customer base consisting of commercial companies, new space companies and government institutions. The company is working towards the maiden flight of its launch vehicle "Spectrum", which is scheduled for the second half of 2023 from Andøya in Norway. In addition, the "Aquila" engine, which was developed and manufactured entirely in-house, is currently undergoing engine tests. The rocket will transport satellites into space to support applications such as environmental monitoring and protection, earth observation, telecommunications, agriculture, disaster management, transportation, scientific research and security.

Access to space is the key to innovation, technological development and security - today and even more so in the future.

Daniel Metzler, co-founder and CEO of Isar Aerospace

In addition to current projects, the additional funds will be used to intensify development and expand automated and therefore cost-efficient production capacities. The additional financing round underlines the investors' confidence in Isar Aerospace's vision and technological capabilities. Isar Aerospace already has a strong customer base and has signed firm contracts with customers around the world, including large commercial companies, new space companies and government institutions.

Start-ups like Isar Aerospace are taking Bavaria to a new level as a space technology location.

Hubert Aiwanger:, Bavarian Minister of Economic Affairs

Bayern Kapital is a venture/growth capital company of the Free State of Bavaria that supports high-tech companies in Bavaria. The company invests equity capital of 0.25 to 25 million euros in companies from seed to later stage, and often closes gaps in the VC sector in proven consortium constellations with private investors. Bayern Kapital manages specialized investment funds with a volume of around 700 million euros and has so far invested around 400 million euros in around 300 start-ups and scale-ups from various sectors. These include the areas of life sciences, software & IT, materials & new materials, nanotechnology and environmental technology. Bayern Kapital has created over 8,000 jobs in companies and currently has over 80 companies in its active portfolio. This includes companies such as EOS, Proglove, Fazua, SimScale, Scompler, egym, Parcellab, Cobrainer, Quantum Systems, Casavi, Riskmethods, Tubulis, Catalym, Immunic, Sirion and tado.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?