FINOM secures 92.3 million euros from the General Catalyst Customer Value Fund

Digital finance platform for SMEs aims to drive expansion in the eurozone. Financing without dilution of shares

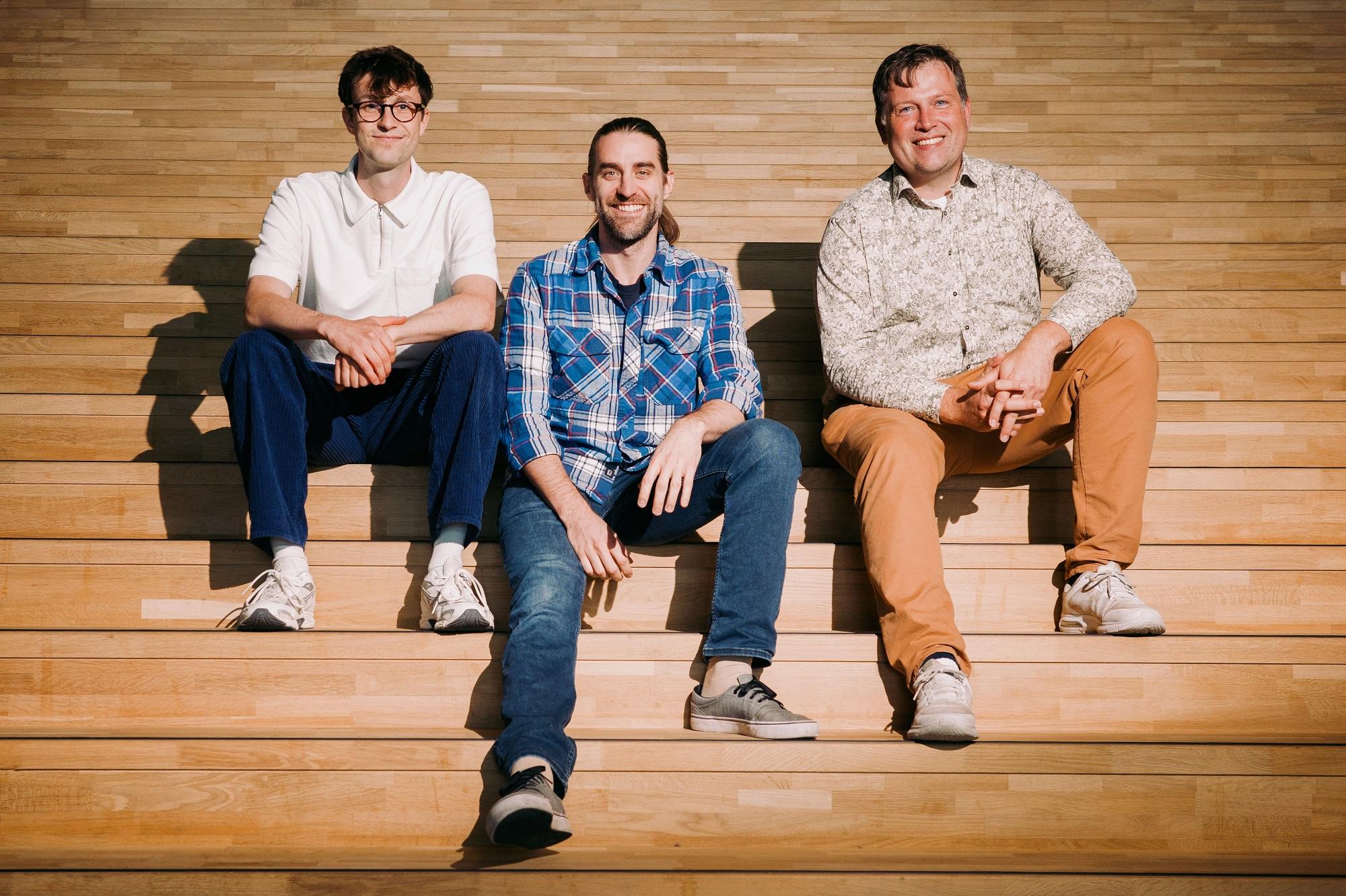

Amsterdam, May 7, 2025 - FinTech FINOM has received growth financing of 92.3 million euros from the General Catalyst Customer Value Fund (CVF). The investment is intended to accelerate growth in existing and new European markets. The capital comes from a special financing structure that gives the company additional flexibility: unlike traditional equity rounds, the CVF's commitment does not lead to a dilution of shares.

Partnership with General Catalyst to be expanded

General Catalyst is one of FINOM's earliest supporters and has been invested in the company since its foundation. The investment via the Customer Value Fund now represents a further deepening of the cooperation.

The Customer Value Fund goes beyond a pure capital injection - it is about bringing in expertise and creating a close strategic alignment.

Kos Stiskin, Chairman and co-founder of FINOM

In addition to capital, the investment also includes operational and strategic support. General Catalyst provides its know-how and resources without directly intervening in the operational business. This should help FINOM to implement its expansion faster and more efficiently.

Almost 190 million euros raised

The current financing brings FINOM's total funding since its foundation in 2020 to almost 190 million euros. As recently as February 2024, the company raised 50 million euros in a Series B round - also with the participation of General Catalyst and Northzone.

The new form of financing via the CVF is specifically aimed at financing growth measures such as customer acquisition without additional risks or loss of control for the company. General Catalyst bears the risk of loss - a model that is becoming increasingly established among high-growth start-ups.

Expansion despite macroeconomic challenges

FINOM currently supports over 100,000 small and medium-sized companies in five core European markets: Germany, France, Italy, Spain and the Netherlands. In these markets, the company offers local IBANs, invoice management, payment solutions and expense tracking, among other things - via a fully digital platform.

Despite a challenging economic environment, FINOM was able to double its turnover in 2024. The company is aiming for comparable growth in 2025. The fresh capital will be used in particular to enter additional EU countries, localize products and scale customer acquisition.

Goal: Eurozone-wide presence by the end of 2025

FINOM is pursuing a long-term growth strategy with a focus on sustainable unit economics and high customer satisfaction. The declared aim is to achieve full market coverage in the eurozone by the end of 2025 by continuously adapting its offering to the requirements of local markets - both functionally and in terms of regulation.

With its e-money license, which is valid throughout Europe, FINOM believes it is well positioned for this next growth step. The new financing provides the necessary scope for this without compromising on independence or control.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?