Lemon.markets launches Brokerage-as-a-Service platform

In cooperation with Deutsche Bank, BNP Paribas and Tradegate, the Berlin-based FinTech company launches its operational business. The BaaS platform enables financial service providers and FinTechs to trade securities efficiently.

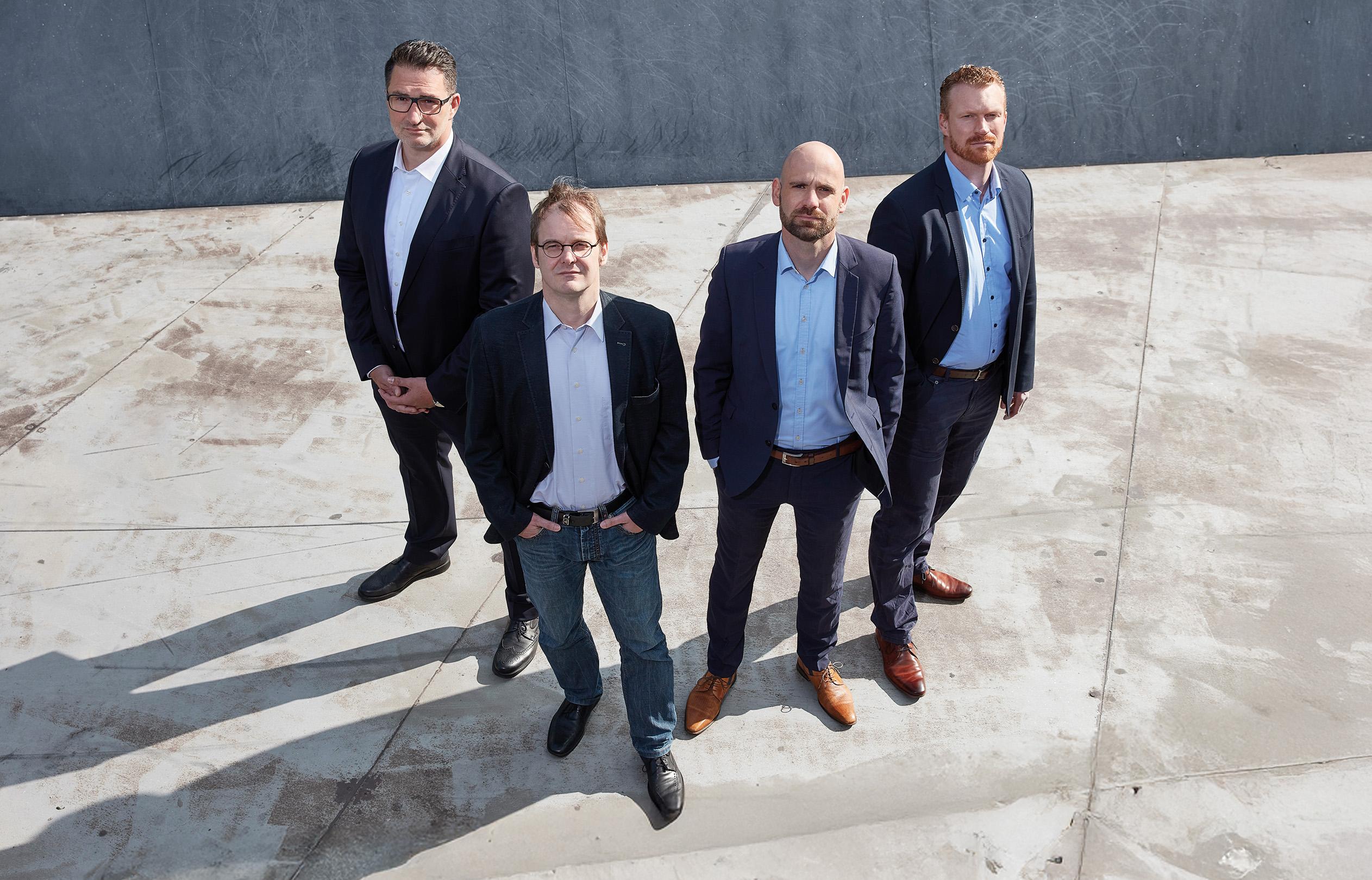

Berlin, 14.03.2024 - The Berlin-based FinTech company lemon.markets has commenced operations. The BaFin license in January paved the way for cooperation with industry giants such as Deutsche Bank, BNP Paribas and Tradegate. Together, they aim to become the infrastructure providers for 100 million European investors.

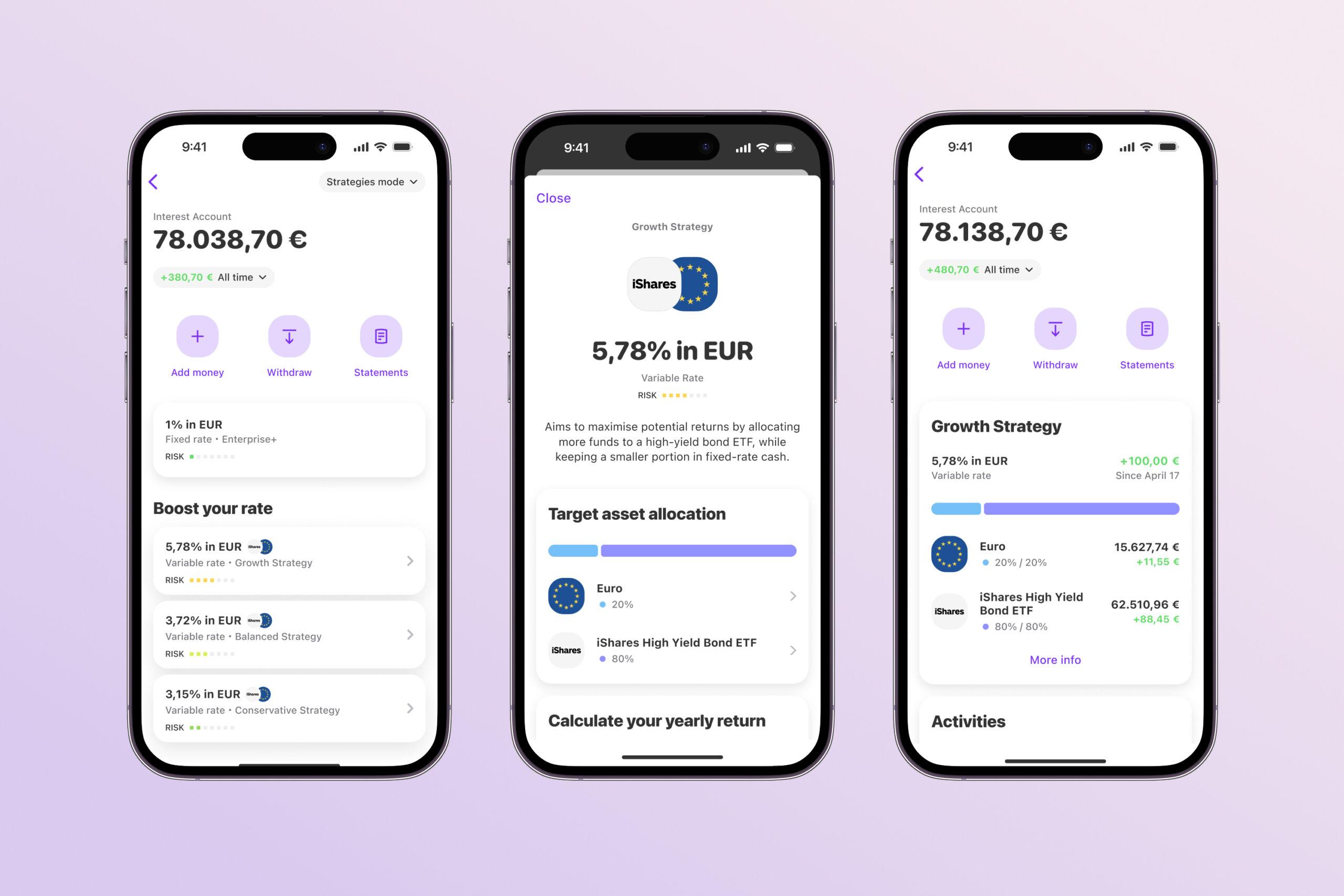

The lemon.markets brokerage-as-a-service platform enables financial service providers and FinTechs to offer securities trading. In a pioneering partnership, the financial education app beatvest was the first company to go live using the white-label solution for its investment offering.

By working with established institutions such as BNP Paribas, Deutsche Bank and Tradegate Exchange, we offer our business partners and their end customers maximum reliability and professionalism.

Max Linden, founder and CEO of lemon.markets

Strong partner network

BNP Paribas Deutschland acts as the custodian bank, processes all transactions and ensures reliable processing thanks to its API connectivity. Deutsche Bank handles payment transactions between lemon.markets and investors and secures deposits of up to EUR 100,000 per customer. Kilian Thalhammer, Global Head of Merchant Solutions at Deutsche Bank, emphasizes the support of innovative business models in the early stages and the provision of seamless payment processing.

Tradegate enables lemon.markets to offer a wide range of financial instruments and particularly long trading hours for investors. As a white-label provider, the platform offers modular solutions for securities processing that enable customer-oriented configuration.

FinTechs such as lemon.markets are fully integrated into our strategy.

Ana Sacadura, Head of Client Services Germany & Austria, Securities Services, BNP Paribas

beatvest is the first partner to use lemon.markets' Brokerage-as-a-Service platform, giving its users easy access to investment products. Beatvest, a financial education app, is thus putting its successful concept for long-term wealth accumulation into practice.

Lemon.markets has ambitious goals for 2024, including onboarding additional partners, scaling teams and processes and continuously expanding the brokerage-as-a-service platform. Renowned international venture capital investors such as Creandum, Lakestar, Lightspeed and System.one have invested 15 million euros in the FinTech as part of the seed financing.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?