Startupnews KW 30 - 2025

Investments

Gixel secures €5 million in seed funding for optical displays for AI and AR glasses

The Karlsruhe-based deep-tech start-up Gixel has closed an oversubscribed seed financing round of €5 million. Investors include Oculus co-founder Brendan Iribe, tech thought leader Ted Schilowitz, the founders of FlixBus, the German Federal Agency for Jump Innovations (SPRIND) and LEA Partners. Gixel develops high-resolution, energy-efficient see-through displays for AI and AR glasses that are characterized by modular scalability, low height and high transparency. The technology is intended to overcome existing bottlenecks in terms of form factor and image quality and is designed for industrial production. Gixel is currently working on functional prototypes and preparing developer kits. A Series A funding round is planned for 2026.

Nuuri secures £275,000 to digitize daycare search in the UK

Edinburgh-based EdTech startup Nuuri has received £275,000 in pre-seed funding to launch the UK's first digital daycare search and enrollment platform. Dubbed "Rightmove for nurseries", the platform allows parents to filter nurseries by zip code, start date and age, take virtual tours, view real-time availability and register directly online. The background to this is a highly fragmented market with 34,000 facilities and long waiting lists: 79% of parents surveyed were put on a waiting list, 43% waited 9-12 months. Nuuri not only wants to relieve parents, but also free daycare centers from administrative work through automated processes. The funding will go towards the further development of AI-based tools, marketing and the expansion of the platform in the UK private sector.

Reshape Systems receives CHF 800,000 for AI-based risk analysis

The Swiss startup Reshape Systems has closed a pre-seed financing round of CHF 800,000. Investors include Backbone Ventures, Heartfelt, GF BRYCK Ventures, N&V Capital and angel investor Kyle Kosic. The company intends to use the fresh capital to further develop its AI-supported models for industrial risk analysis, expand the team and establish its solution in other industries. The aim is to make risk assessments safer, faster and more cost-efficient in the future.

Austrian founder raises $40 million for AI revolution in construction (Trunk Tools)

The US start-up Trunk Tools, founded by Austrian-born civil engineer Dr. Sarah Buchner, has closed a Series B financing round of 40 million US dollars. Led by Insight Partners, Redpoint Ventures, Innovation Endeavors and others are also investing to accelerate the growth of the AI-based platform for digitizing construction processes. Buchner, who began her career as a carpenter in an Austrian village, wants to use Trunk Tools to fundamentally solve the construction industry's multi-billion dollar efficiency problems through specialized AI agents.

Mergers & Acquisitions

Main Capital Partners acquires majority stake in Norwegian software company Xait

Main Capital Partners has acquired a majority stake in Xait, a Norwegian provider of collaborative solutions for the creation of complex business documents and CPQ (Configure, Price, Quote) services. Xait serves over 300 customers, particularly in the energy, capital goods and business services sectors, and generates the majority of its sales outside Scandinavia. The acquisition takes place against the background of growing demand for digital, automated document solutions in a globally growing market. The existing management team will remain on board to work with Main to drive further growth through organic measures and targeted acquisitions.

Cooperations & partnerships

cylib and Syensqo achieve breakthrough in lithium recovery from used batteries

The recycling company cylib and the chemical company Syensqo have successfully recovered high-purity lithium hydroxide from used electric vehicle batteries on a pilot scale - a significant advance in the circular economy for battery materials. For the first time, the efficient recovery of lithium from the so-called "black mass" of various cell chemistries (including NMC and LFP) has been achieved on a single line. The combination of cylib's hydrometallurgical process with Syensqo's solvent technology improves yield and purity and meets the requirements of leading battery manufacturers. The process is scalable, potentially reduces investment costs and supports the EU Battery Regulation targets for lithium recovery by 2031.

Happy Size launches plus-size marketplace with Mirakl

Happy Size, a Popken Fashion Group retailer specializing in plus-size fashion, has launched a new marketplace platform for plus-size customers in the DACH region together with Mirakl. The platform brings together over 30 brands and more than 20,000 products for women and men in sizes L to 10XL. The aim is to create a curated, target group-specific shopping experience that goes beyond mere size selection. The launch in the Netherlands is planned for Q3 2025, with other markets such as Belgium, France and Switzerland to follow in 2026.

Personnel

Kai Langohr becomes Managing Director of Isartal Ventures

In June 2025, Kai Langohr took over the management of Isartal Ventures GmbH & Co. KG, the investment company of the Wort & Bild publishing group for early-stage investments in the digital health sector. In his new role, he is responsible for managing the investment portfolio, initiating new investments and further expanding the network. The 26-year-old entrepreneur brings start-up experience and expertise from venture capital and corporate ventures, most recently as Senior Portfolio Manager at Isartal Ventures. The aim of his work is to strategically promote forward-looking companies and actively drive forward the digital transformation in the healthcare sector and the publishing group.

Christian Reuss becomes Senior Advisor at AQUATY

AQUATY, provider of digital investment solutions for private markets, has appointed Christian Reuss as Senior Advisor. The former CEO of SIX Swiss Exchange brings with him many years of experience in capital markets, regulation and product structuring. He will provide strategic support to AQUATY in expanding the platform and the Securitization as a Service approach. The aim is to make private assets such as private equity or real estate accessible as regulated, tradable securities. Reuss sees digital securities as a key lever for making private capital markets more efficient, scalable and more widely investable.

Other exciting news of the week

AtlasEdge opens new data center in Böblingen

AtlasEdge has opened the STR001 data center in Böblingen, a new, state-of-the-art data center with a planned capacity of up to 20 megawatts and 10,000 m² of space. The data center was built using modular, sustainable construction methods, meets the highest energy efficiency standards (PUE <1.3) and is powered entirely by renewable energy. With this expansion, AtlasEdge now operates eight data centers in Germany and is further expanding its position in the DACH region. STR001 addresses the increasing demand for scalable colocation solutions in a central business location and already meets the requirements of the German Energy Efficiency Act. The opening is part of the European growth strategy of AtlasEdge, which is active in 11 countries and specializes in low-latency, carrier-neutral data center services.

Holcim, E.ON and Orcan Energy launch joint project for industrial waste heat recovery in cement production

In Dotternhausen, Holcim, E.ON and Orcan Energy have launched a major joint project to utilize industrial waste heat in order to make cement production more sustainable. The aim is to efficiently recover previously unused waste heat from the rotary kiln at the Holcim plant and use it for internal processes, potential district heating networks and electricity generation. Orcan Energy's new eP 1000 ORC system, which achieves particularly high levels of efficiency even with a fluctuating heat supply, will be used. E.ON is taking over the project as part of an Energy-as-a-Service model, which means Holcim will benefit from sustainable energy savings and CO₂ reductions without any initial investment. The BMWK-funded project is considered an example of the decarbonization of energy-intensive industries and could be expanded to other locations in the future.

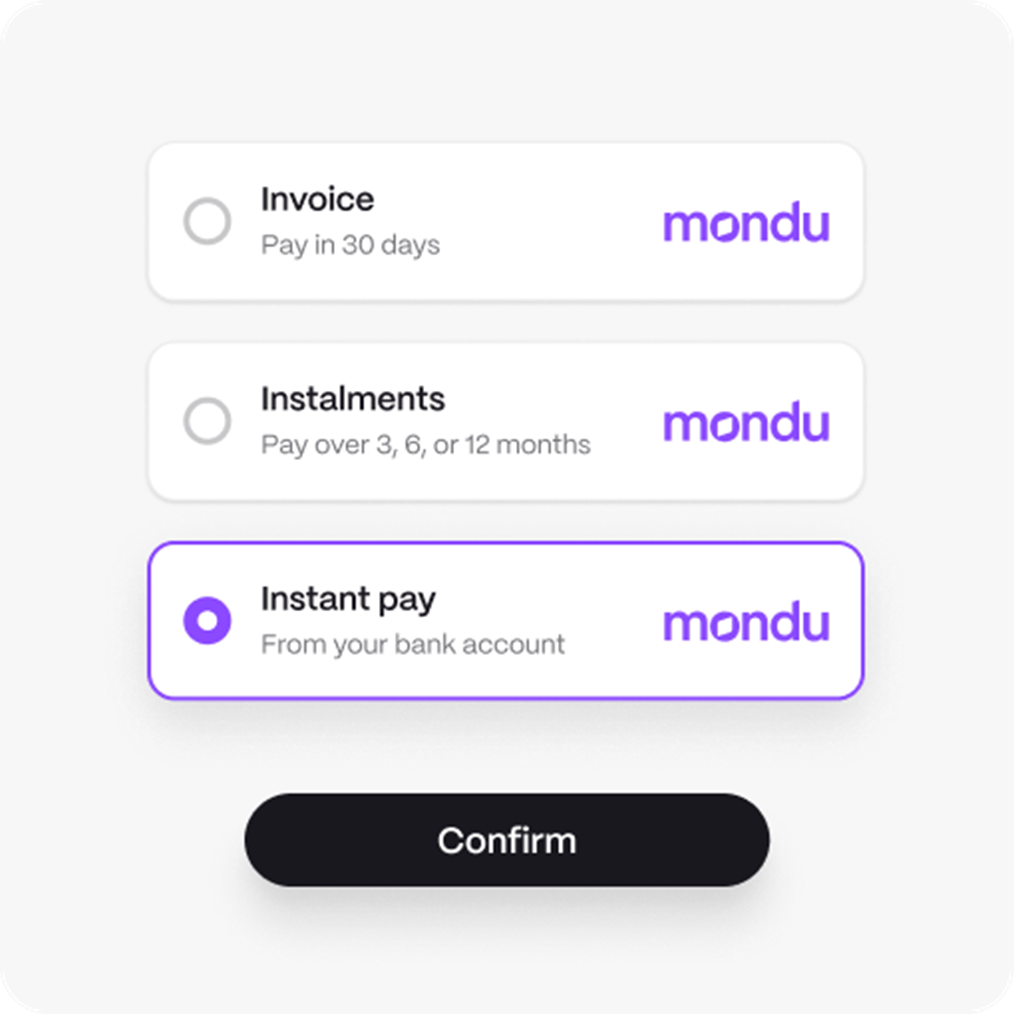

Mondu expands B2B payment solutions with instant payment offering "Pay Now"

Berlin-based B2B fintech Mondu has launched "Pay Now", a new account-to-account instant payment solution for B2B e-commerce. The extension complements Mondu's existing Buy Now, Pay Later (BNPL) product range and enables merchants to offer both instant and deferred payments through a single integration. Pay Now offers a cost-effective alternative to traditional payment methods such as credit cards and is designed to increase conversion rates in online retail. The solution enables real-time transfers directly from shoppers' business accounts and simplifies payment reconciliation, risk and fraud screening and communication.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?