Startupnews KW 50 - 2024

Dr. Achim Plum becomes Managing Director of HTGF. EQS Group acquires ESG software provider Daato. HTGF exit: Cloud Software Group acquires contextual security start-up deviceTRUST. Quantum Systems receives certification as a Bundeswehr training center. J.F. Lehman & Company closes Fund VI with 2.2 billion dollars. 7.3 million US dollars for Prezent AI. Flare secures 30 million US dollars in Series B. Fleet Space Technologies secures AUD 150 million in Series D. Multitude Bank invests €14 million in sustainable agriculture. Ambienta closes €500m continuation fund to promote sustainable water management. Scientifica launches €200 million fund for technological innovation. Archer Aviation secures USD 430 million in capital.

Financing rounds & investments

Fleet Space Technologies secures AUD 150 million in Series D funding

Fleet Space Technologies, Australia's leading space technology company, has closed an A$150 million Series D funding round led by Teachers' Venture Growth (TVG) and backed by investors including Blackbird Ventures and Horizons Ventures. Valued at over AUD 800 million, the funding will be used to further develop the ExoSphere global end-to-end exploration platform. This platform combines satellites, AI and 3D imaging to accelerate the discovery of critical minerals for a clean energy future while minimizing environmental impact. The company is expanding globally and has already won customers such as Rio Tinto and Barrick Gold for its innovative technology.

Flare secures 30 million US dollars in Series B

Canadian cybersecurity company Flare has secured 30 million US dollars in a Series B financing round led by Base10 Partners and backed by Inovia Capital, White Star Capital and Fonds de solidarité FTQ. With triple-digit growth over the past two years, Flare plans to accelerate its expansion in Europe and North America. As a leader in Threat Exposure Management (TEM), Flare is characterized by data collection and the use of generative AI, such as the "Threat Flow" module, which generates highly accurate threat reports. The funding will strengthen Flare's position as a market leader and support the further development of its cybersecurity solutions.

7.3 million US dollars for Prezent AI to scale AI-powered enterprise communications in Europe

True Global Ventures (TGV) has invested 7.3 million US dollars in Prezent AI, a San Francisco Bay Area-based company that develops AI-powered enterprise communications solutions. The investment will help Prezent AI expand into Europe and Asia and further develop business presentation platforms, particularly in regulated industries such as life sciences and finance. TGV emphasizes the importance of Prezent AI as a pioneer in AI-powered productivity and business communication.

Multitude Bank invests 14 million euros in sustainable agriculture

Multitude Bank, a subsidiary of the listed Multitude Group, is entering into a strategic partnership with HeavyFinance, a platform for low-emission loans. Through an exclusive loan agreement, the bank will provide up to EUR 14 million to support small and medium-sized farms in adopting sustainable farming practices. The investment is backed by a €10.5 million portfolio guarantee from the European Investment Fund (EIF) and is expected to support more than 500 farms in Europe. The initiative demonstrates Multitude Bank's commitment to driving sustainable transformation in agriculture while strengthening economically viable models.

Archer Aviation secures USD 430 million in capital

Archer Aviation and Anduril Industries have announced an exclusive partnership to develop a hybrid VTOL military aircraft for the U.S. Department of Defense. Archer brings expertise in advanced aircraft development, while Anduril specializes in artificial intelligence and systems integration. To support the new Archer Defense program and general corporate purposes, Archer has also raised $430 million in capital from strategic partners such as Stellantis and United Airlines, as well as new investors including Wellington Management and Abu Dhabi subsidiary 2PointZero.

Fund

J.F. Lehman & Company closes oversubscribed Fund VI with 2.2 billion dollars

J.F. Lehman & Company (JFLCO) has successfully closed its latest fund, JFL Equity Investors VI, L.P., at $2.23 billion. The fund significantly exceeded its original target of $1.6 billion and marks the largest offering to date in the firm's 33-year history. Fund VI will be deployed across the aerospace, defense, marine, government and environmental sectors, drawing on JFLCO's more than three decades of specialized industry knowledge and operational expertise. The closing brings JFLCO's total assets under management to $7 billion. The placement was supported by UBS Securities LLC, while Davis Polk & Wardwell LLP acted as legal counsel.

Ambienta closes €500 million continuation fund to promote sustainable water management

Ambienta SGR SpA, a European investor in environmental sustainability, has completed the sale of Wateralia, a water pumping platform company, from its Ambienta III fund. Wateralia has been sold to existing and new investors, including the Article 9 continuation fund Ambienta Water Pumps (€500 million) and Ambienta IV. This step marks the second exit of Ambienta III and underlines the importance of sustainable investment in the growing water pumping sector, which is expected to grow to USD 45 billion by 2029. Under Ambienta's leadership, Wateralia has tripled revenues and increased EBITDA six-fold. The company remains a key player in the fight against global water scarcity with an integrated approach to water management and a positive environmental footprint.

Scientifica launches 200 million euro fund for technological innovation

Scientifica Venture Capital has announced Scientifica Fund 1 (SF1), a new €200 million fund to support start-ups and technology projects in the fields of future computing, smart materials, advanced industries and environmental technologies. The fund, which will launch in 2025, aims to accelerate research and development by providing young companies with free access to high-tech labs and resources through an innovative zero-capEx model. With a focus on European and US markets, including a new HUB in Silicon Valley, Scientifica promotes international collaborations and plans further specialized funds such as Quantum Italia to make scientific innovation marketable.

Personnel

Dr. Achim Plum becomes Managing Director of High-Tech Gründerfonds

High-Tech Gründerfonds (HTGF) appoints Dr. Achim Plum as new Managing Director with effect from January 1, 2025. Together with Romy Schnelle and Dr. Alex von Frankenberg, the doctor of genetics will take over the management of the early-stage investor and strengthen the strategic focus in the life sciences sector. Dr. Plum brings more than 20 years of experience in the life sciences sector and has expertise in diagnostics, precision medicine and medical technology. With this reinforcement, HTGF aims to expand its position as a leading seed investor.

Mergers & Acquisitions

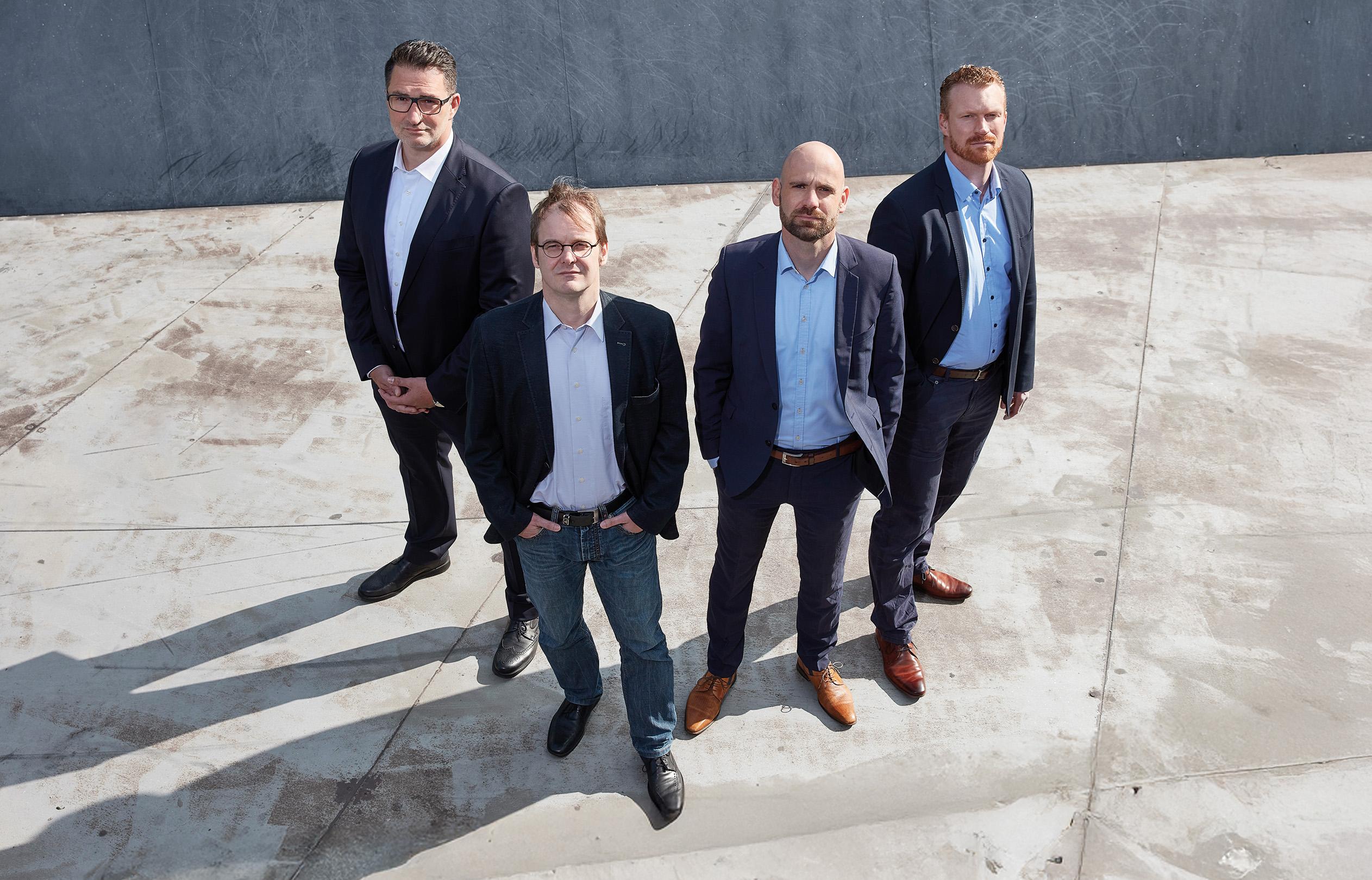

EQS Group acquires ESG software provider Daato

EQS Group has acquired the Berlin-based SaaS company Daato Technologies, which specializes in ESG management and reporting solutions. With this acquisition, EQS Group expands its sustainability reporting offering with a comprehensive all-in-one solution that supports companies in complying with ESG regulations such as the CSRD, the EU Taxonomy and the Supply Chain Act. Daato, founded in 2021, offers solutions for customers ranging from SMEs to large corporations. The acquisition strengthens EQS Group's position as a strategic partner for compliance and sustainability management and is intended to support companies in efficiently meeting regulatory requirements.

Exits

HTGF exit: Cloud Software Group acquires contextual security start-up deviceTRUST

The Cloud Software Group has acquired the start-up deviceTRUST, which specializes in contextual security and was backed by High-Tech Gründerfonds (HTGF), via its Citrix business unit. deviceTRUST was founded in Darmstadt in 2016 and offers solutions to improve end device security and compliance for digital working environments, particularly in the context of modern zero trust strategies. HTGF was the first institutional investor in 2017 and has supported the company ever since. With this acquisition, Citrix strengthens its secure access platforms and underlines the growing importance of IT security in hybrid working environments.

Other news from the start-up world

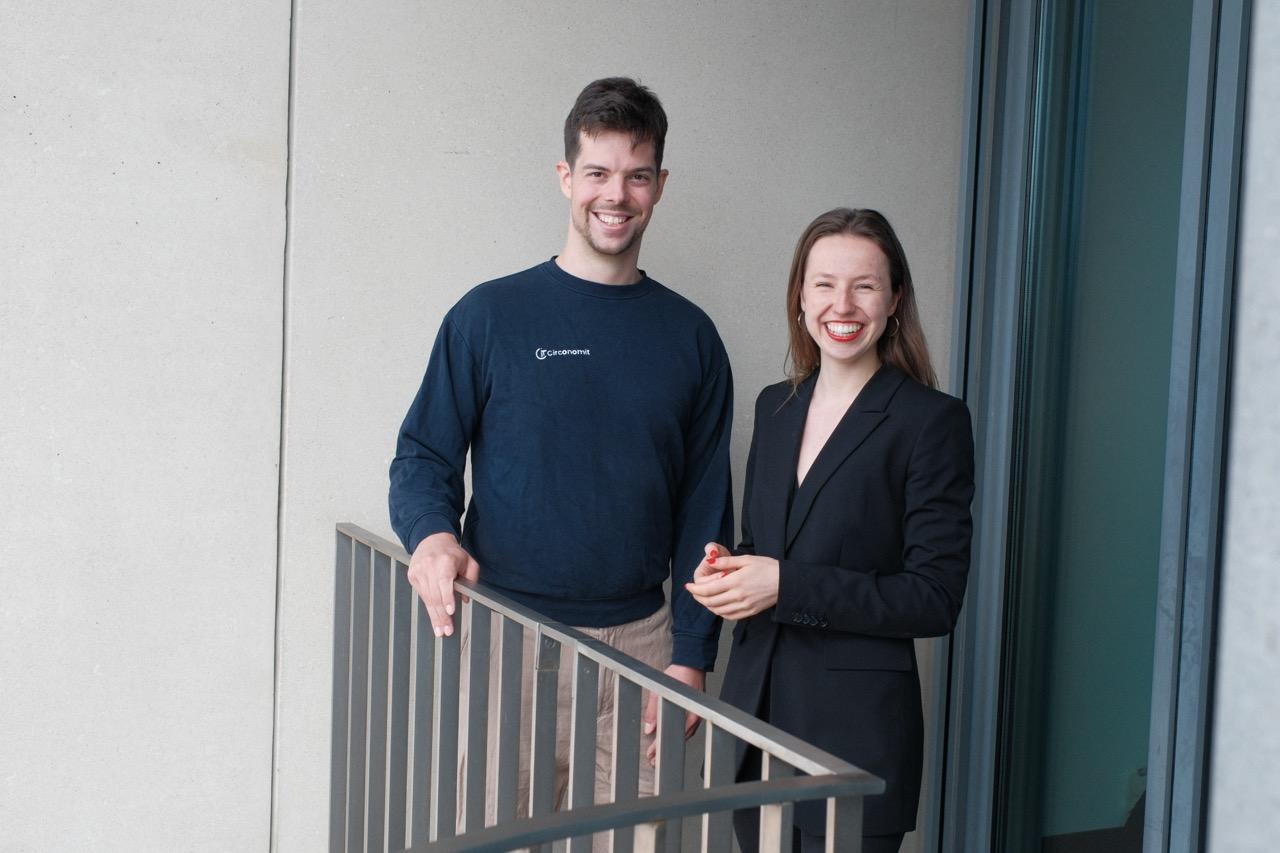

Okka Energy: Innovative solution for greater participation in the energy transition

Okka Energy, a new start-up from EnBW subsidiary Enpulse, addresses the financial hurdles that prevent many households from participating in the Energiewende. With a combination of flexible electricity tariffs and virtual shares in renewable energy plants, Okka provides access to clean energy without high investment costs. Users can use an app to optimize their electricity costs as well as invest small amounts in solar and wind energy. This model not only strengthens sustainable infrastructures, but also offers private households economic benefits and promotes social participation in the energy transition.

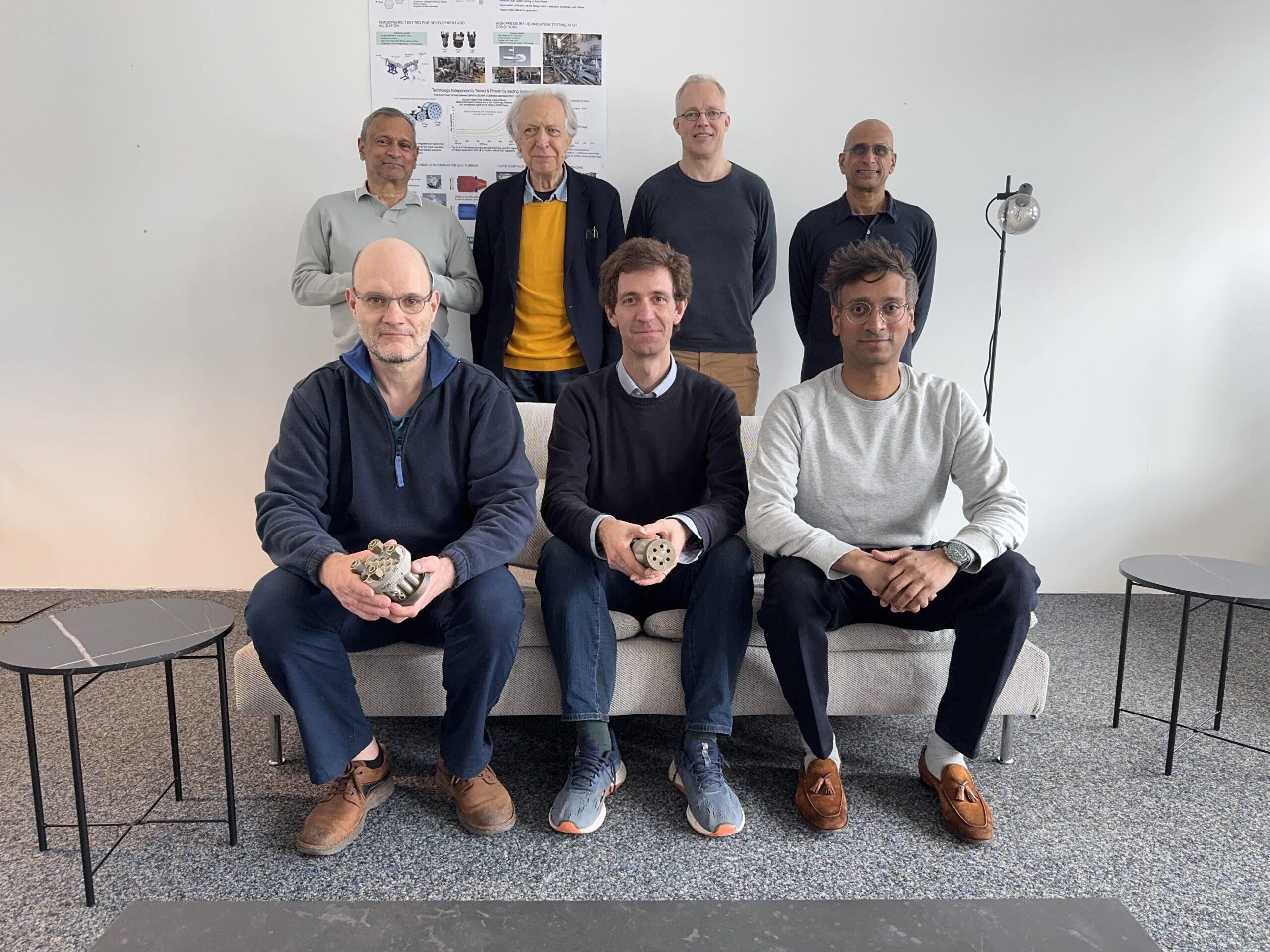

Quantum Systems receives certification as a Bundeswehr training center

Quantum Systems was successfully certified as a training center for unmanned aerial systems by the German Armed Forces Aviation Office (LufABw) on December 10, 2024. The company, a leading innovator in the field of drone technology, is setting new standards in the training of drone pilots and instructors for the German Armed Forces with its simulator training and train-the-trainer program. The training comprises two phases: First, new pilots are trained, followed by the training of experienced pilots as instructors. Another highlight is the integration of simulator training, which significantly reduces the amount of practical training required and could account for a larger proportion of training in the future.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?