Vivid launches bond-based investment offer for business customers

Putting capital to work for companies: Vivid launches new "Interest Strategies" program with professionally managed portfolios and flexible investment options.

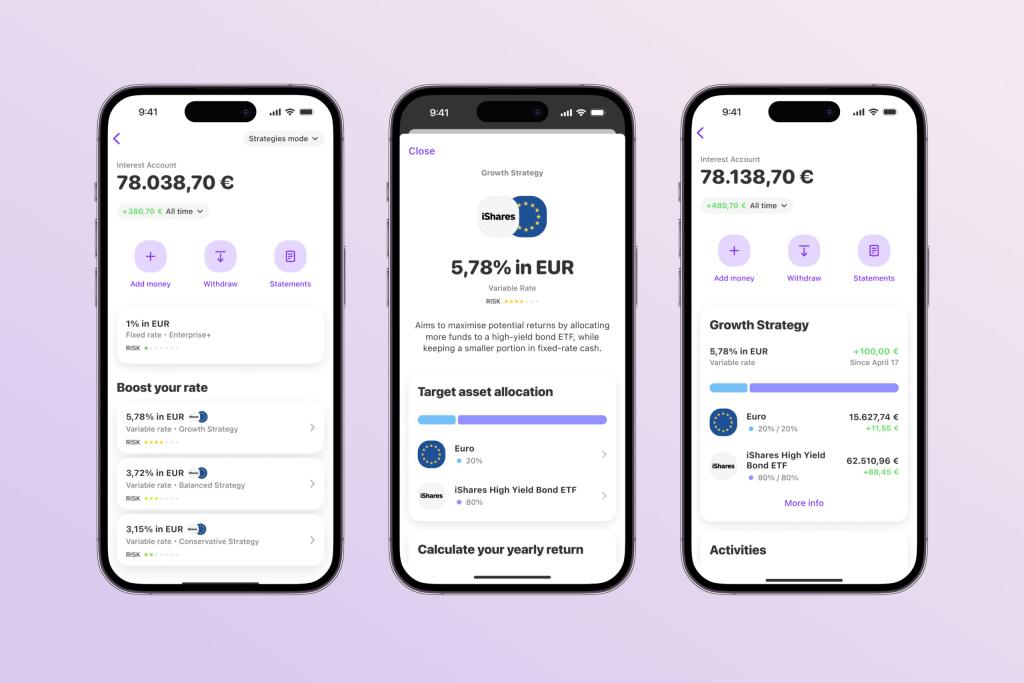

Berlin, April 29, 2025 - The financial platform Vivid is expanding its offering for business customers with a new investment option. With the "Interest Strategies" program, small and medium-sized companies and freelancers will be able to invest capital in bond-based portfolios. According to Vivid, this makes it the first European platform to offer business clients access to investment strategies in this form.

The new offering is aimed at companies that want to use surplus liquidity to generate income. The investment portfolios are managed by BlackRock and offer annual returns of up to 6%, depending on the risk profile.

Responding to the changing interest rate landscape

The launch of "Interest Strategies" takes place against the backdrop of a change in the interest rate policy of the European Central Bank (ECB). After several interest rate cuts since fall 2024, forecasts point to a continued easing of the monetary policy stance. In this environment, forms of investment other than traditional money market products could become more important again.

With the ECB's change of course, now is a good time for companies to start investing.

Alexander Emeshev, co-founder of Vivid

The aim is to offer companies and the self-employed a simple way to utilize unused capital instead of leaving it in an account when interest rates are falling.

Two investment options for business customers

The new investment program complements Vivid's existing interest account. In future, business customers will have two options: a fixed interest mode with a fixed interest rate of 3% per annum for two months (variable thereafter, depending on the tariff) and the new "Interest Strategies" mode. The latter offers three preconfigured portfolios - Conservative, Balanced and Grow - which differ in terms of risk and expected return.

The investments focus primarily on bonds. As a result, the portfolios are intended to offer broader risk diversification than individual investments without having to accept the fluctuations of traditional equity markets. There are no fees for using the portfolios; however, the return remains dependent on the respective market development.

Expansion of the platform offering

With the new investment program, Vivid is pursuing its strategy of positioning itself as a comprehensive financial services provider for business customers. Functions such as savings goals, spending overview and travel expense management are already available.

Note: As with all investments, there are risks involved. The preservation of the invested capital cannot be guaranteed. This article is based on a press release. Startbase has not checked the information for accuracy and completeness. We give no guarantee. This is an informational article only.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?