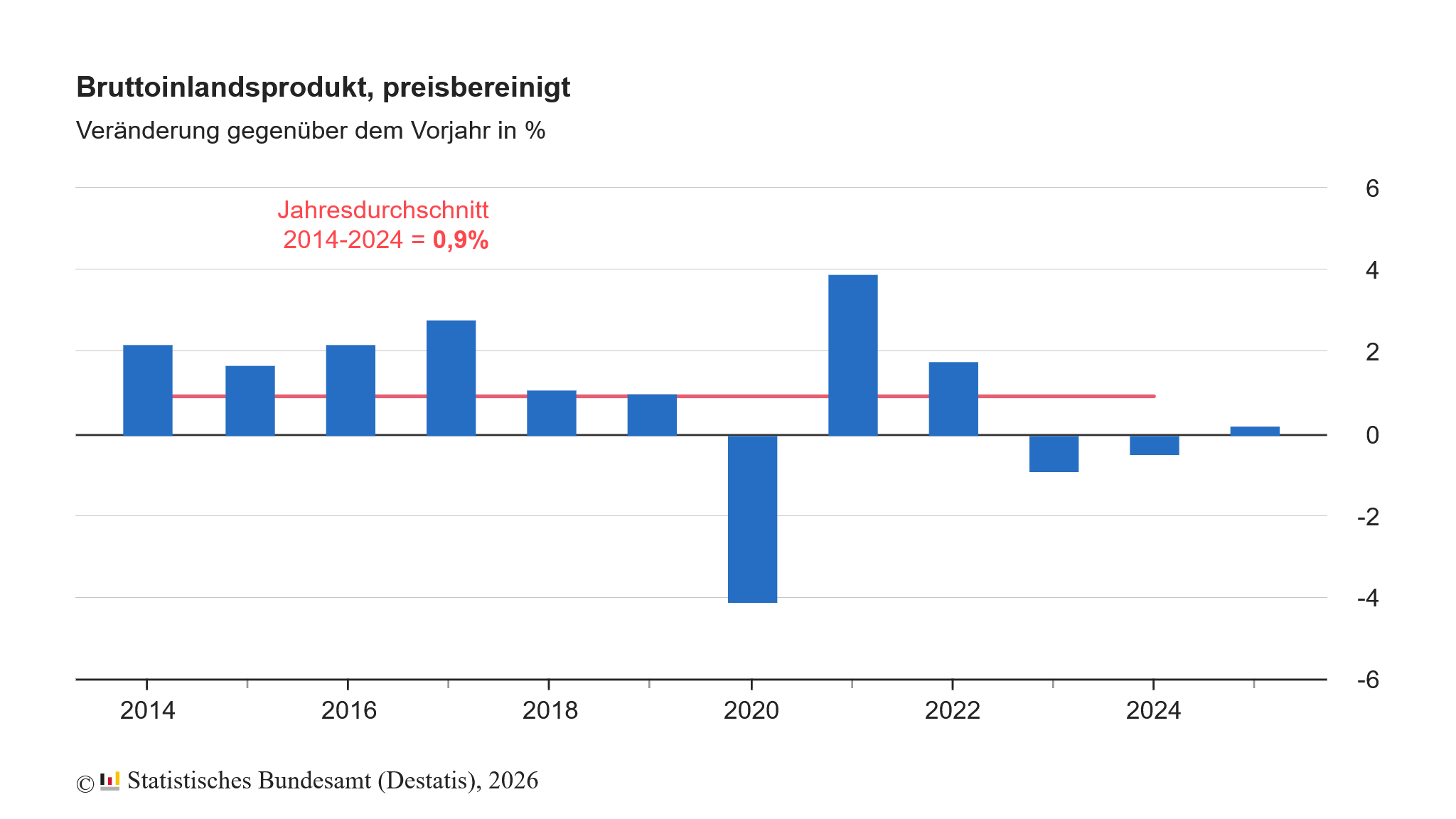

KfW Research on the industrial location: Germany must dare to innovate more

According to a recent study by KfW Research, Germany is facing the challenge of strengthening its industrial location and simultaneously promoting start-up dynamics. A key finding: venture capital (VC) acts as an employment and growth engine for young, innovative companies.

Germany must tap into new sectors of the economy. This is only possible if private investors invest more. Venture capital is important for young, innovative companies in order to accelerate their growth.

Dr. Dirk Schumacher, Chief Economist at KfW, emphasizes:

'Data shows that VC-funded start-ups add an average of 2.5 employees per year, more than twice as many as non-financed start-ups (1.2 employees) and more than four times as many as traditional SMEs (0.6 employees).

However, German investors face hurdles when exiting start-ups. Many successful VC-funded companies move abroad: 57% of takeovers are carried out by foreign buyers, while only 43% of buyers are based in Germany. IPOs also often take place abroad, especially in the USA.

The regulatory and tax framework for start-ups in Germany should be improved so that innovative companies do not move abroad.

Dr. Dirk Schumacher, Chief Economist at KfW, emphasizes:

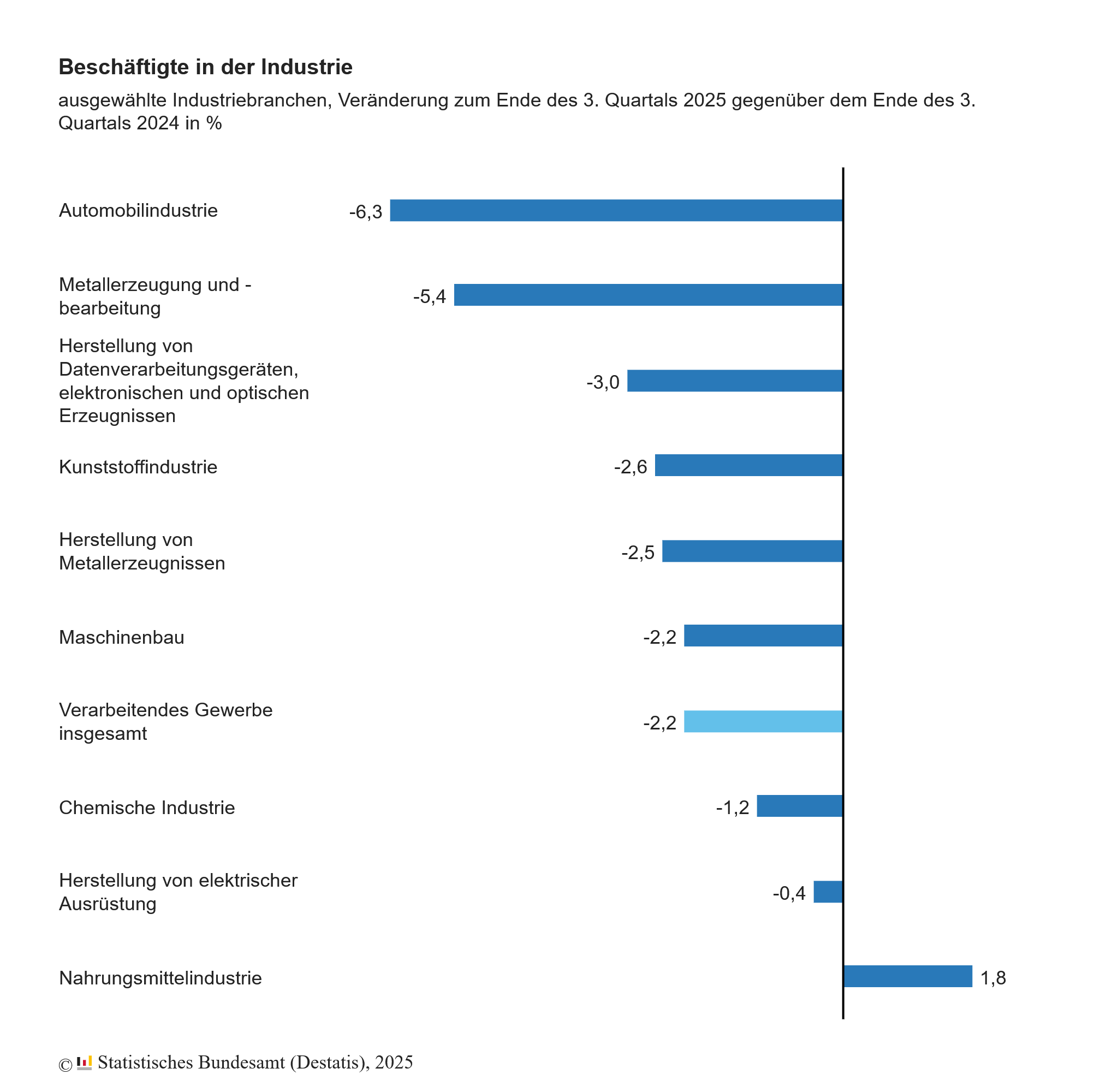

Traditional location factors and geopolitical risks

In addition to the promotion of VC, the KfW study sees a need for further action:

- Breathing space for industry: geopolitical risks, particularly due to mercantilist policies in China and the USA's "America First" policy, are increasing the pressure on German industry. Tariffs should therefore be used as an economic policy instrument to reduce dependencies.

- Improvement of classic location factors: High labor costs, rigid labor markets, bureaucracy and high corporate taxes reduce competitiveness.

- Expand energy infrastructure: An expansion of renewable energies and targeted subsidies could lead to lower energy prices and a more stable supply in the medium term.

VC-financed start-ups: growth and exits

The study shows that VC-financed start-ups contribute disproportionately to employment growth. Particularly successful start-ups realize several rounds of financing, with each round significantly increasing the size of the company:

- 18 employees on average after the first VC round

- Significantly larger after the third round, with the number of employees increasing exponentially in later rounds

The exit strategies of these companies are divided into

- Acquisitions (92%): mostly by other companies, often abroad

- Buyouts (5 %)

- IPOs (4%): small number, but responsible for 51% of employees in startups with a successful exit

The study shows that the majority of exits go into foreign hands, particularly in the USA, which potentially leads to an outflow of value creation and talent. To counteract this, stronger European capital markets and exit opportunities are needed.

Germany must dare more

The KfW research emphasizes that Germany must become active in several areas:

- Mobilizemore private capital for start-ups

- Improvethe regulatory framework for innovative companies

- Adaptenergy and industrial policy to ensure competitiveness

- Strengthenexits and capital markets in Germany and Europe

VC-financed start-ups have shown that they can drive innovation, growth and employment in Germany. The key is to shape the framework conditions in such a way that these companies remain here in the long term and their value creation benefits Germany as a business location.

The short study Start-ups in Germany Growth and exit routes via venture capital can be found under Focus on the Economy at KfW. The detailed study Germany's industry at a crossroads can be viewed directly on KfW Research.

Our assessment

When reading the KfW studies, it is noticeable that the exits are not differentiated according to fire sales or forced sales, which raises the question of the quality of the transactions. There are also no statements on the long-term nature of the jobs created. Venture capital is primarily aimed at rapid growth and the scaling of teams, while the long-term retention of employees is not automatically guaranteed. However one assesses these points, it does not change the fact that the two studies provide fascinating insights into the start-up ecosystem and Germany's economic engine. They impressively show how much dynamism and innovative strength there is in young, VC-financed companies.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?