State in the start-up: doping or downer?

With its new investment fund, the federal government wants to pump more venture capital into the German start-up system. Great hopes are pinned on the new instrument. But how successful it is depends heavily on how it is implemented.

It has now been official for a few days: the federal government's future fund, which is intended to mobilize more venture capital for German start-ups, is coming. The budget politicians of the grand coalition have given their approval, now the Bundestag still has to give its consent.

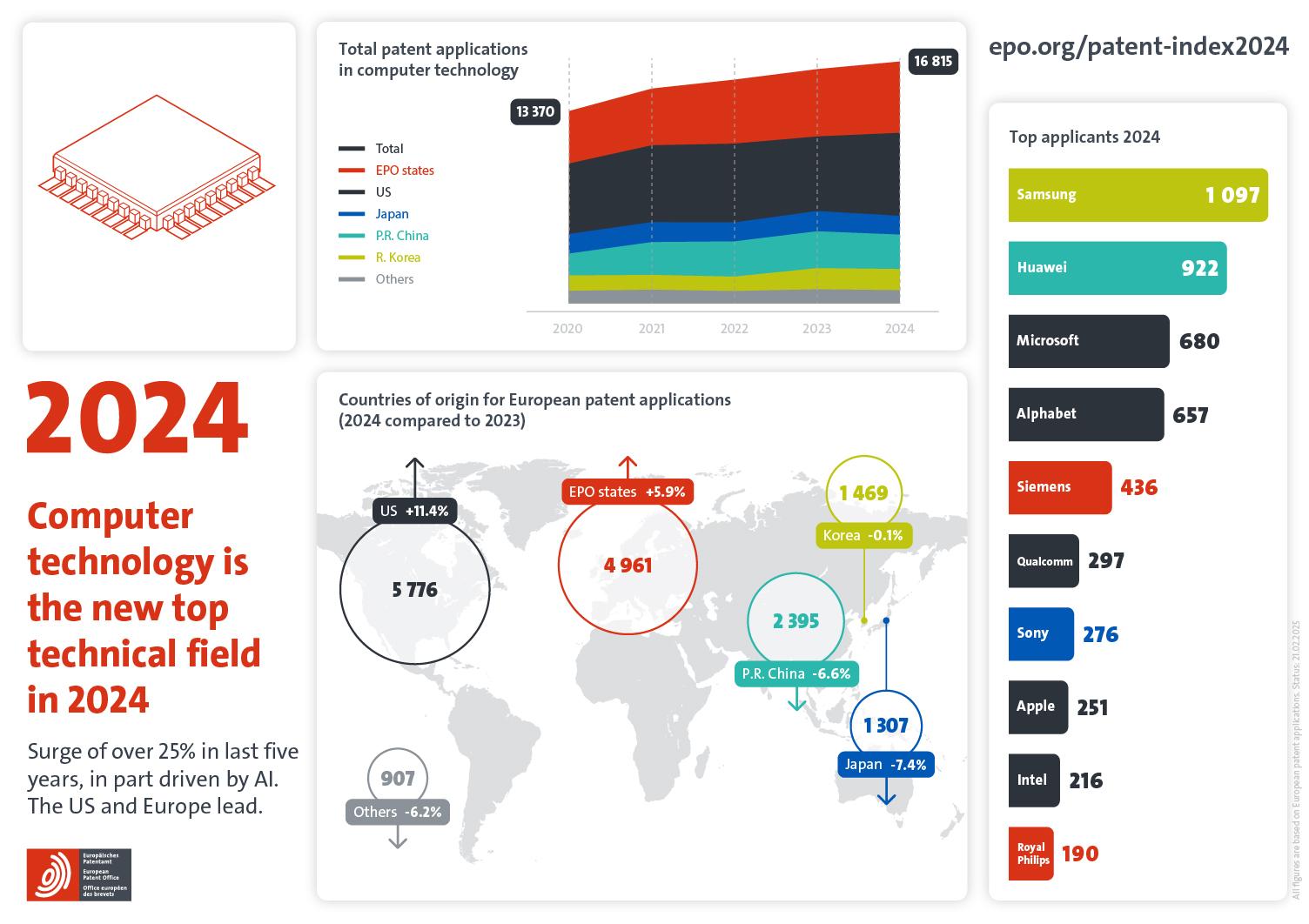

But is there any need for state intervention in a market where there are actually enough private providers? Despite all the complaints about the shortage, venture capital figures in Europe are better than ever, even in the crisis year 2020: according to Pitchbook, 38 billion euros flowed into European start-ups this year. Ideally, the German government's Future Fund will increase this figure in the coming years.

Experts definitely see a need. "Especially when it comes to large financing rounds, we see that investors from the USA, Asia or other parts of the world are often in the majority," says Paul Wolter from the German Start-up Association: "But even European investors of a certain size are becoming rare, and German investors are almost completely absent."

In this way, the state would fill a gap in the venture capital market and not push private competitors out of the way. Until now, these companies have often had to raise money in the USA. One example is the Dresden-based space start-up Morpheus, which manufactures maneuvering thrusters for satellites: In the first round of financing, there were six backers, five of whom came from the USA.

There are many reasons for this. One important reason is that large institutional investors have been comparatively restrained in Germany to date. For example, German life insurers alone had a capital investment portfolio of one trillion euros in 2019. However, little of this flows into venture capital. The default risk is too high for insurers. This is due to the clear guidelines they have for handling policyholders' money. Experts doubt whether a fund alone can remedy the situation.

Politicians are hoping that private investors will step in

Specifically, the investment fund is to be endowed with ten billion euros. It will act as a fund of funds: the money will not go directly to start-ups, but to other programs and smaller venture capital funds. These include the state-owned Kreditanstalt für Wiederaufbau (KfW), the European Investment Fund (which is backed by the European Investment Bank and the EU Commission) and the High-Tech Gründerfonds. In addition, the German government wants to set up two further funds: the KfW Capital fund of funds, which will receive one billion euros, and a deep-tech fund, which is intended to promote "ground-breaking" technologies.

Politicians are also hoping that other investors will also join in and thus significantly increase the capital sum of ten billion euros. The state fund is to act as a fund of funds, meaning that the money invested here will be put into other venture capital funds.

The hope is that the future fund will achieve a similarly good ratio as private funds, i.e. that one successful investment will offset several unsuccessful ones. Companies from the deep-tech sector, whose development cycles are often lengthy and capital-intensive, can particularly benefit from the model if it is implemented correctly. "In the case of programs in which the state invests directly, consideration should be given in particular to those companies that find it difficult to access private venture capital, but are not necessarily less likely to succeed," says Paul Wolter from the Start-up Association.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?