Startups in Germany raised around 7.4 billion euros in 2024

Number of financing rounds increased according to KfW: With 1,407 deals, the venture capital market recorded more transactions than in 2023

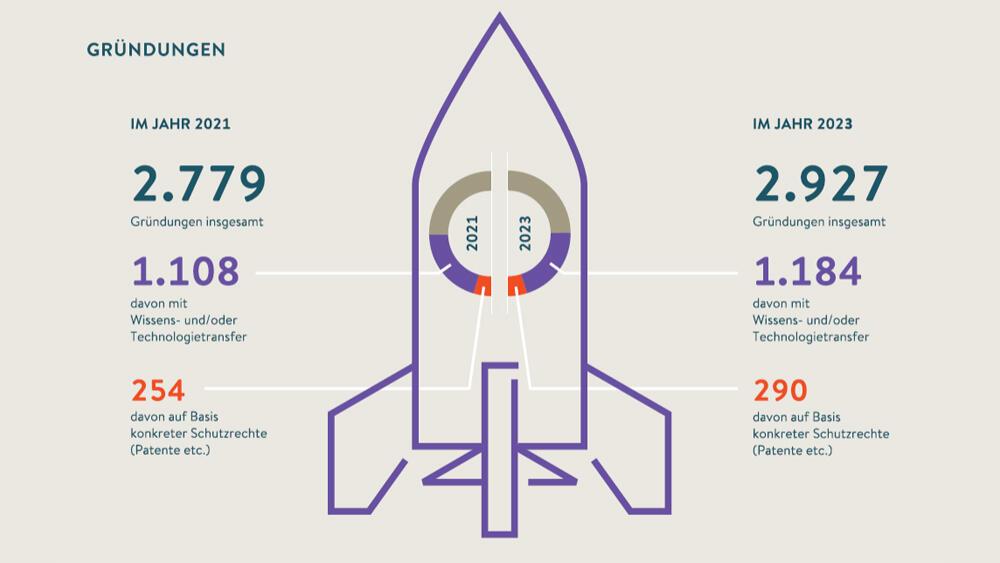

Frankfurt, 13 January 2025 - According to the KfW Venture Capital Dashboard, the German venture capital market stabilized in 2024 and offers reason for cautious optimism. German start-ups raised a total of EUR 7.4 billion in venture capital - an increase of 4% compared to the previous year. The increase in the number of deals was particularly notable: after 1,136 financing rounds in 2023, this figure was significantly exceeded in 2024 with 1,407 rounds.

More deals despite a weak end to the year

While the transaction volume fell to EUR 1.4 billion in the fourth quarter of 2024 (compared to EUR 2.4 billion in the third quarter), the number of deals reached a new high for the year at 484. Overall, only 2021 and 2022 were more successful in terms of the number of financings.

The recovery of the venture capital market shows that the low in sentiment has been overcome

Dr. Steffen Viete from KfW Research

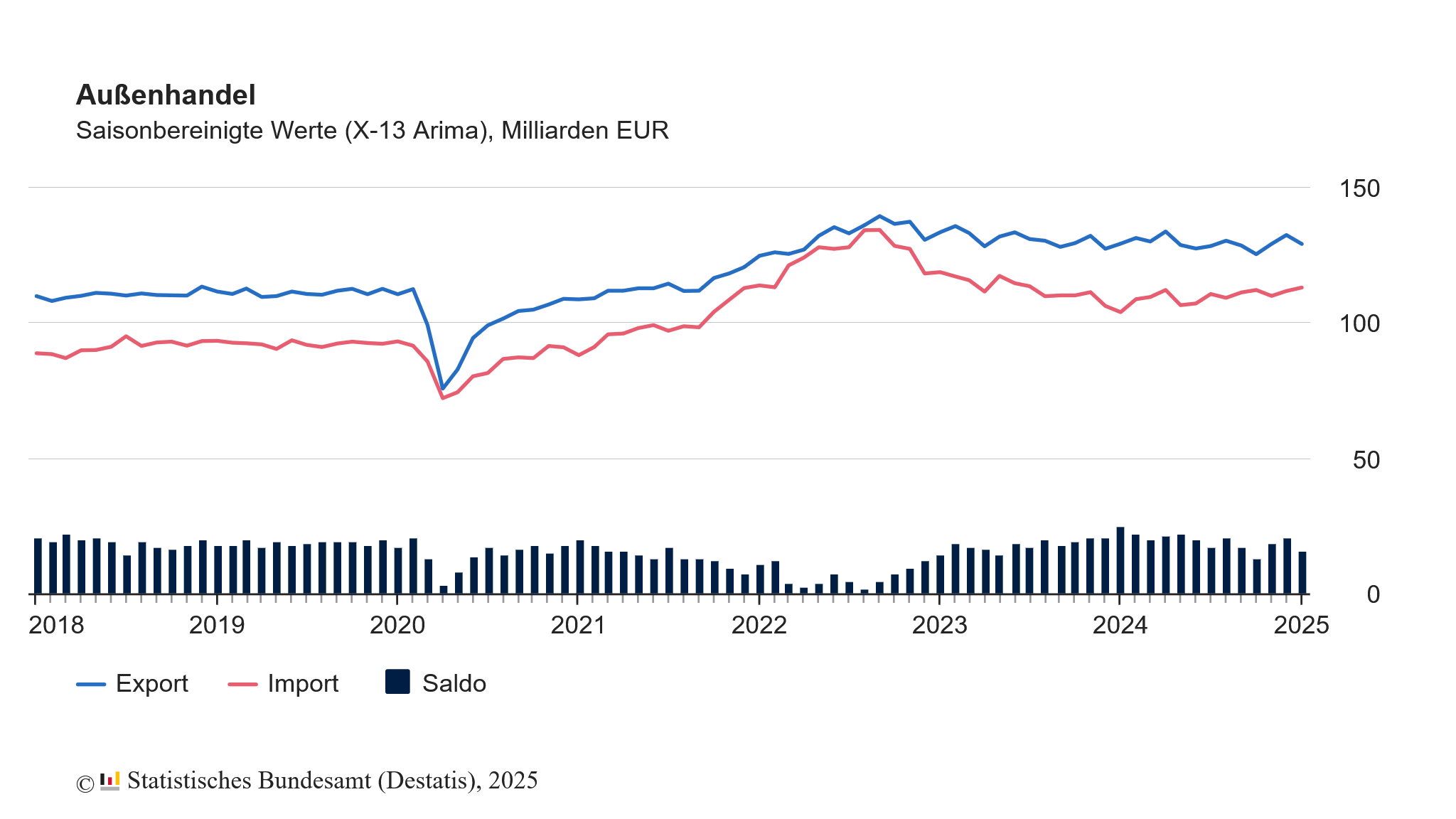

Dr. Steffen Viete from KfW Research attributes the positive development to interest rate cuts by the ECB and Fed, which could also create a more favourable investment climate in 2025.

Energy and healthcare sector dominate

The energy sector attracted the largest capital flow with 1.2 billion euros, followed by the healthcare sector with 1 billion euros. Investments in security technologies such as IT security and defense added up to over 500 million euros. The high level of activity in these fields reflects both geopolitical uncertainties and the pursuit of sustainability.

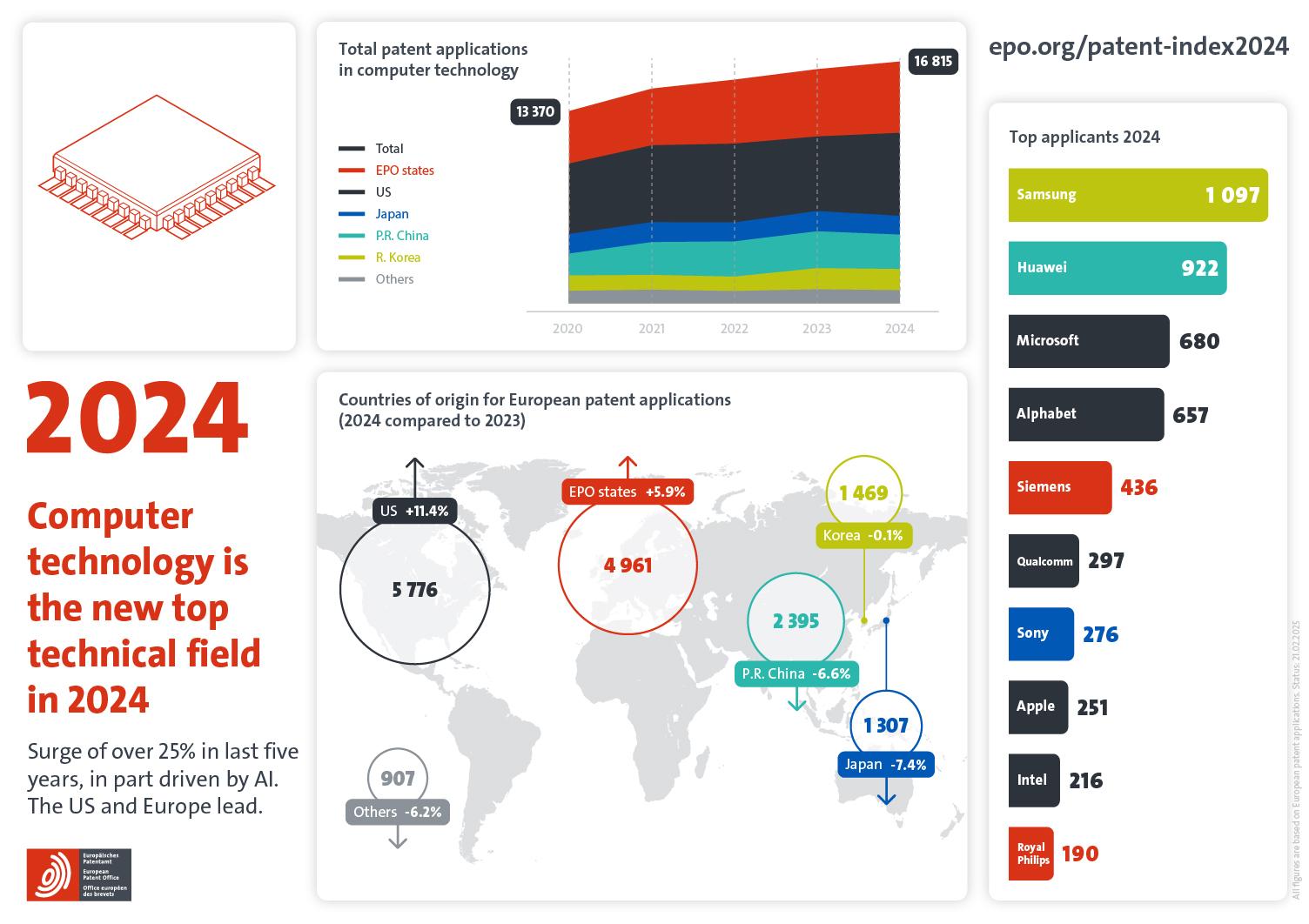

Artificial intelligence: a perennial favorite for investors

With 244 transactions and €1.8 billion, AI was the second strongest category after the record year of 2021. Start-ups in this area are developing solutions for various sectors and benefiting from the growing importance of this cross-sector technology.

International investors, primarily from the USA, provided 30% of the investment volume. German investors followed with a share of 28%, while British investors accounted for 8%.

Exits on the rise

The number of exits rose to 144, with takeovers dominating. Viete noted that exit proceeds were often still below expectations. Successful exits will continue to gain in importance in 2025 in order to strengthen the financing cycle in the venture capital market. The current Venture Capital Dashboard can be viewed on the KfW website.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?