What the EU plans for sustainable finance mean for start-ups

The EU wants to be climate-neutral by 2050 and is turning the world of finance upside down to achieve this. This seems tailor-made for start-ups, but there is often still a lack of creative solutions.

The EU has set itself ambitious targets. It wants to become climate-neutral by 2050. Above all, this requires an economy that completely rethinks production methods and supply chains in some cases - and that requires a lot of money. Back in January 2020, the EU Commission calculated that the "Green Deal" would require investments of 260 billion euros per year. It is also relying on financial service providers for this. In future, there will be many more investment opportunities in sustainable projects to support the economy.

In addition to a restructuring of the economy, a restructuring of the financial world is also on the cards. New ideas are needed. The EU's plans seem to be made for start-ups, but little has happened in the start-up world so far, at least in the area of sustainable finance. The hurdles are still great, but the potential is much greater.

According to the Green Start-up Monitor, which is compiled annually by the Borderstep Institute in collaboration with the Federal Association of German Start-ups, a good 30 percent of all start-ups in Germany can be defined as green last year. In addition to their economic success, they must also make significant contributions to ecological sustainability. Although this is nine percent more than in 2019, the proportion of fintechs in particular is negligible. According to the study, just two percent of all fintechs are green start-ups.

Great opportunities for fintechs?

"Other sectors are still the main focus of sustainability," says Alexander Schabel, Borderstep Institute responsible for Sustainable Business Development, explaining the low proportion. "So far, there have mainly been many green start-ups in areas such as food or mobility." However, Schabel assumes that this could soon change. "When it comes to insurance or investments, consumers - and ultimately also founders - have not yet thought about sustainability," he says. However, as the so-called EU taxonomy will soon define exactly what is green and what is not, the financial world will also have the necessary clarity to offer sustainable products. "This offers a great opportunity for fintechs in particular, who can develop solutions faster than the big banks," estimates Schabel.

Professor Christian Klein, Head of Department at the Institute of Business Administration at the University of Kassel and an expert in sustainable finance, also sees great potential for start-ups in this area. "I'm a little surprised that not many more fintechs are focusing on sustainable finance yet," he says. Because the demand, especially among young people, is already there. "More and more investors want to know what happens to their money or consciously invest it in very specific sustainable projects." Sustainability banks can hardly keep up with the demand. Their problem: "Due to the low-interest phase, they are hardly making any profit with their customers," says Klein.

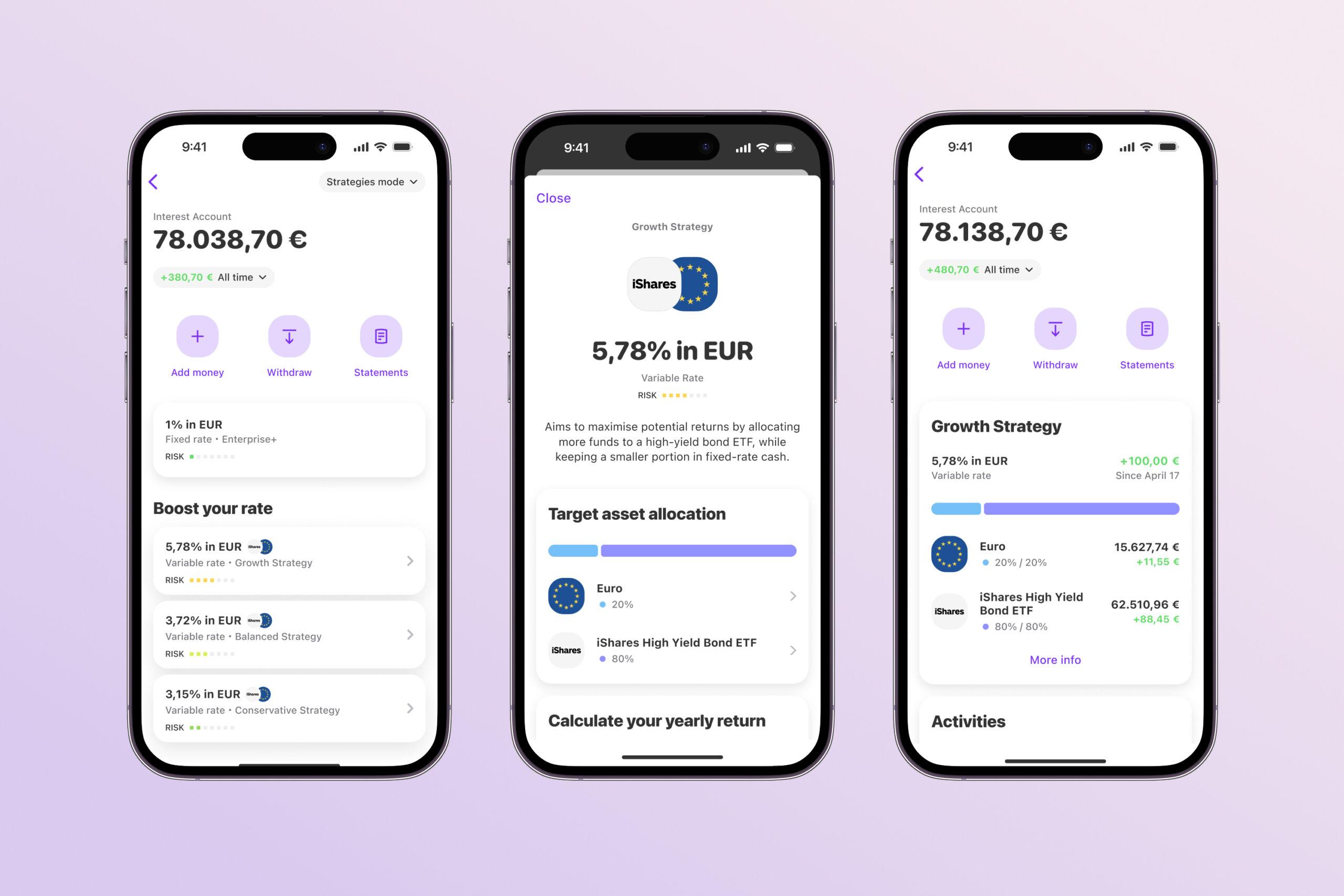

Blockchain technology could prevent greenwashing

This may also deter some fintechs, Klein estimates. They should think in a slightly different direction, says Klein. A sustainable finance robo-advisor, for example, is one such possibility. Customers could click together the criteria and risks they would use to invest money sustainably and the robo would then put together an investment strategy. "We conducted a survey to find out what sustainability means to customers and it turned out that everyone understands it differently," says Klein. "It was impossible for us to identify customer groups from this." Fintechs should therefore create products that allow them to respond as flexibly as possible to their customers' wishes.

Klein also sees great potential for start-ups that want to link blockchain with sustainable investments. "This technology ultimately makes it possible to determine exactly where the money is invested," says the expert. In this way, fintechs can credibly ensure that the money invested through them is actually invested in specific projects. "This would avoid the risk of greenwashing," says Klein.

In addition to the low interest rates that the financial sector is currently suffering from, there is another major hurdle that has apparently caused founders to hesitate in the area of sustainable finance: There is still a lack of seed money for green start-ups. According to the Green Start-up Monitor, every second green start-up has problems raising capital. This also affects founders who want to set up a fintech.

As venture capitalists are apparently too hesitant, half of green start-ups would like to see the creation of a "sustainability" funding line with financing offers tailored to specific target groups, according to the study. "This could be a kind of high-tech start-up fund, for example, only for green start-ups," says Alexander Schabel from the Borderstep Institute.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?