Venture clienting as an opportunity in the crisis

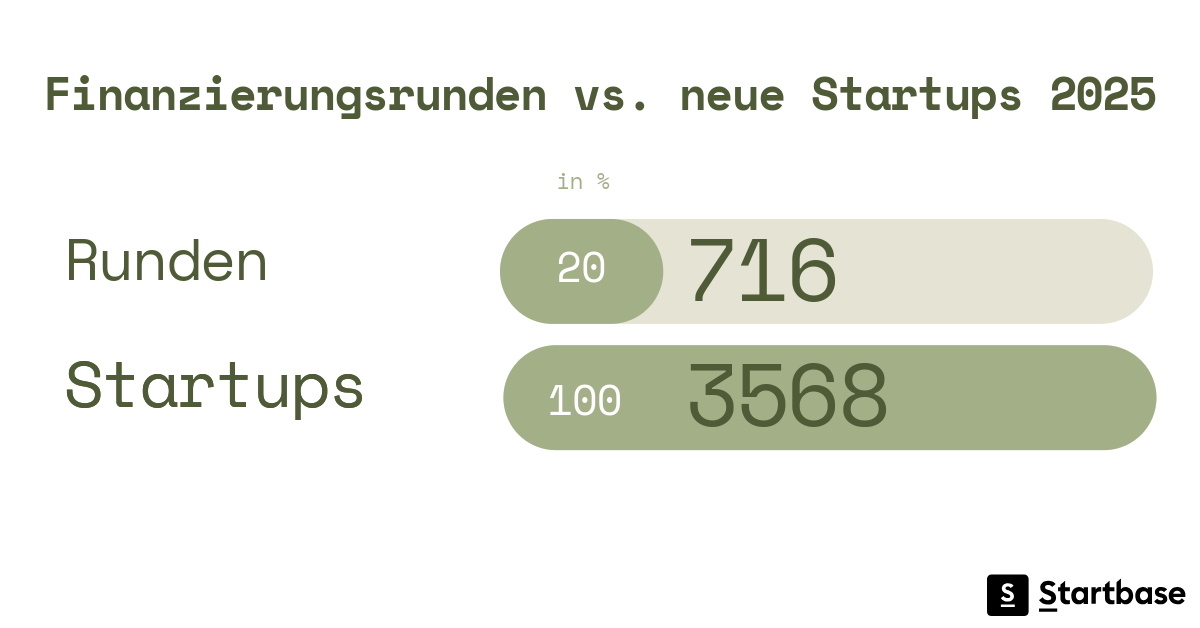

In times of economic uncertainty, falling margins and a reluctance to invest, both large corporations and young start-ups are under pressure. While established companies are looking to increase efficiency, reduce costs and stimulate innovation, start-ups are struggling with scarce liquidity and difficult access to capital. Traditional venture capital financing is often difficult to obtain in times of crisis: Investors become more cautious, valuations fall and financing rounds are delayed.

This is precisely where venture clienting offers a real opportunity. It is an alternative and often overlooked bridge between a hunger for innovation and proximity to the market. A corporate does not act as an investor, but as a customer. It buys the solution from a start-up in order to solve a specific problem in its own company. For example, a process bottleneck, a new technology or a digitalization project.

Venture clienting is therefore not an investment model, but a cooperation model based on mutual benefit. And in a difficult economic situation, this approach can become a real survival strategy for both sides.

For corporations: innovation with less risk

From the perspective of a large company, venture clienting offers a strategic advantage: instead of initiating complex, cost-intensive research projects or long procurement processes, a solution from a start-up can be tested and integrated in a targeted manner.

1. tailor-made solutions for specific problems:

Corporations often have clearly defined challenges, for example in the supply chain, in production or in digital customer service. Through venture clienting, they can purchase a specialized solution for precisely this problem that already exists on the market or in the pilot phase. The startup provides a tailor-made toolbox, so to speak.

2. speed through agility:

Startups act faster, less bureaucratically and often more courageously than large organizations. When a company enters into a venture-client relationship, it benefits directly from this dynamic. Adjustments, test phases and implementations run at a speed that would be almost impossible to achieve within the company's own structure. The startup becomes a catalyst that accelerates innovation processes.

3. calculable economic risk:

Unlike a classic corporate venture investment, the Group does not have to take a stake. The financial risk is limited to the purchase or implementation of the solution. If the technology does not have the desired effect, the loss is manageable.

4. long-term options arise automatically:

If the collaboration is successful, further avenues open up: from expanding the cooperation to licensing models through to investment or takeover. Venture clienting can thus become the door to later strategic partnerships, but only once the solution has proven itself in real use.

For start-ups: stability and focus in turbulent times

On the other hand, venture clienting offers enormous advantages for young companies in particular. Especially when the economic climate is uncertain.

- Predictable income instead of speculative capital: While venture capital becomes scarcer in times of crisis, a major customer can secure stable, recurring income with an order or pilot project. These predictable cash flows can become a decisive survival factor.

- No time lost through fundraising: A financing round takes months of preparation, pitching and negotiations. In the venture client model, the energy flows directly into the product and operational implementation instead. This not only saves time, but also internal resources and nerves.

- Longer runway, less market pressure: In contrast to a financial investor, a corporate partner acts less quickly. Decisions on integration or expansion of the collaboration are carefully examined, which gives start-ups a certain degree of predictability. This deceleration can be an advantage. The runway is extended and the startup can optimize its product at its leisure.

- Direct access to the market and feedback: Hardly any other model enables such targeted piloting. The startup works directly with a customer who knows exactly what they need and thus provides valuable, practical feedback. This results in realistic product development that goes far beyond the abstract requirements of investors.

The downsides: Dependence and loss of control

As convincing as the model is, it also harbors risks for both sides.

For corporations, there is a risk that they will have too little control over the start-up and its intellectual property. The solution can establish itself on the market without the company itself benefiting in the long term. Especially if there is no participation, the startup can later sell its technology to competitors.

Start-ups, on the other hand, face a different risk. They are tied to a single customer, often the first and most important one. If this customer gets into financial difficulties, the entire basis of the business collapses. This is currently particularly evident in the automotive industry. Some start-ups specializing in the digitalization of supply chains or vehicle data are currently losing their venture client partners because OEMs are freezing or postponing projects. These young entrepreneurs are now faced with the challenge of finding new customers for almost market-ready solutions at short notice.

A model for the future, especially in times of crisis

Venture clienting is not a panacea, but it is an intelligent instrument for keeping innovations viable in times of crisis. It combines the agility of start-ups with the stability of corporations without both sides having to take excessive risks.

For companies, it means faster access to market-ready solutions. For start-ups: predictable sales, valuable feedback and real market validation. Especially now, when uncertainty and capital bottlenecks are putting the brakes on many innovation projects, venture clienting can be the bridge that brings together entrepreneurial spirit and corporate strength.

More about this

Venture Clienting

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?