Startup Monitor 2024: New opportunities for venture clienting

The German Startup Monitor 2024 documents the change in the German startup scene: from growth to sustainable profitability. What opportunities does venture clienting open up in this context?

A strong start-up scene means fresh ideas and potential for new partnerships. This is clear to us at LBBW's Innovation Lab. The recently published German Startup Monitor 2024 (DSM) paints a multi-layered picture of the current situation for startups in Germany. The priorities of startups have changed significantly in recent years. In an environment characterized by rising interest rates, financing difficulties and an uncertain global economic situation, we can no longer ignore venture clienting. This model of strategic collaboration between established companies and innovative start-ups can prove to be a key strategy in an increasingly complex start-up landscape.

Profitability is a priority. Almost 74% of start-ups are placing greater emphasis on operating in an economically sustainable manner rather than focusing primarily on rapid growth.

Change in the start-up scene: focus on profitability

For a long time, rapid growth and high capital rounds were seen as indicators of a startup's success. However, the DSM 2024 shows a change in strategy: profitability has priority. Almost 74% of startups are placing greater emphasis on operating in an economically sustainable manner instead of focusing primarily on rapid growth. This has far-reaching consequences for the startup ecosystem. Because with increasing capital requirements, rising market demands and weaker access to financing, it is clear that the days of "hyper-growth" strategies are over for the time being.

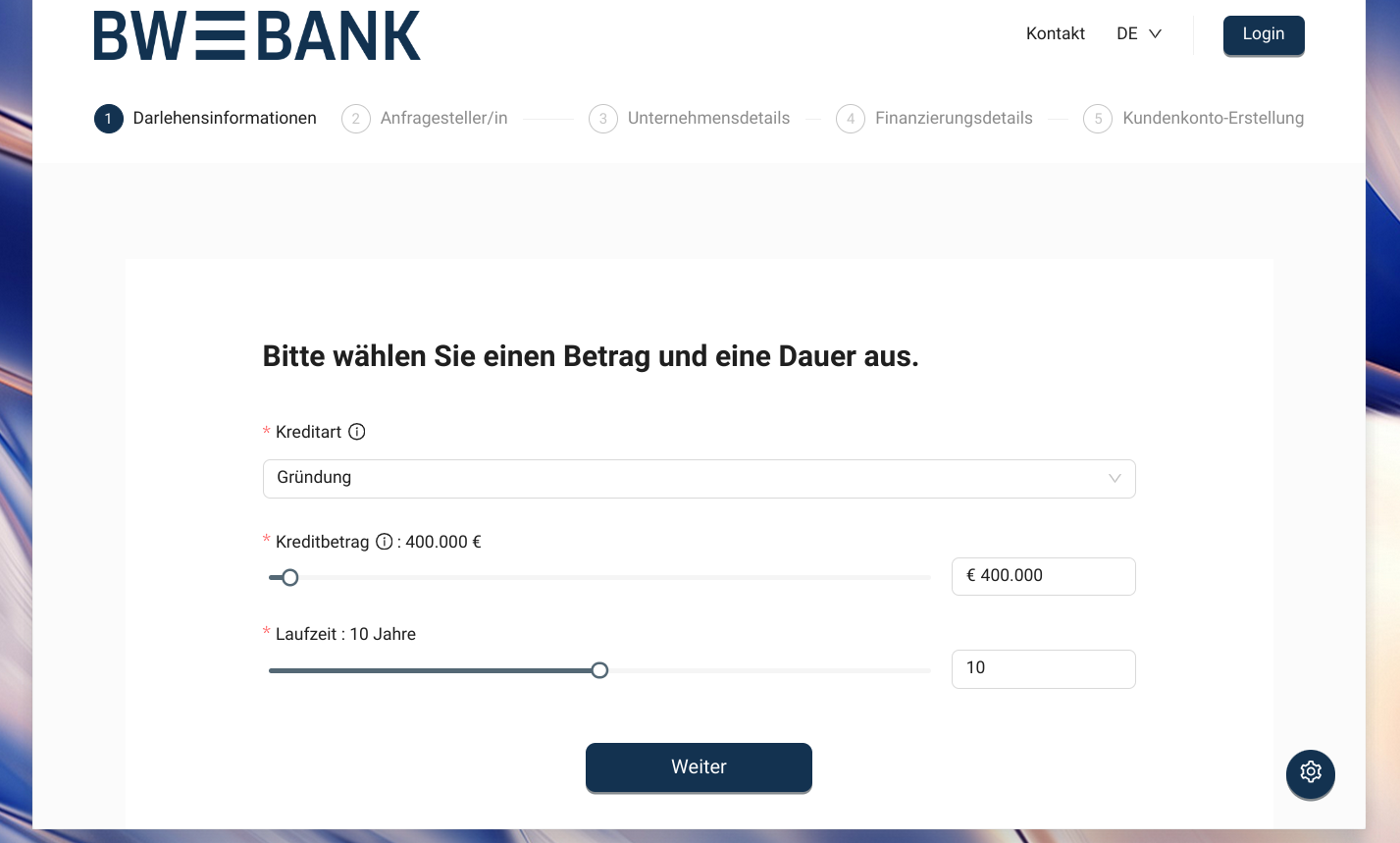

Financing hurdles and the need for alternative approaches

However, capital remains a key issue. 74.1% of the startups surveyed stated that they wanted to raise external capital in the coming months. The need is clearly shifting towards larger sums. While financing is often covered by state subsidies or business angels, particularly in the early stages, venture capital financing remains difficult, especially in later phases. Sure, you need capital - but you also need customers. This is where new partnership models such as venture clienting could offer support.

Venture clienting: a win-win situation

Venture clienting describes a model in which start-ups sell their innovative solutions directly to established companies without having to rely on traditional investments or participations. This model offers both start-ups and companies considerable advantages. For start-ups, it means direct sales, while companies can benefit from the latest technologies and strengthen their innovative power.

According to the DSM 2024, the B2B sector is becoming increasingly important. Almost 75% of startups now generate the majority of their revenue in the B2B sector. This is a clear signal that interest in direct business partnerships with established companies is growing. Venture clienting not only gives start-ups access to important market players, but also the opportunity to test and further develop their solutions directly in practice.

Deep tech and AI: drivers for venture clienting

There is enormous potential for venture clienting, particularly in the area of deep tech and artificial intelligence. The DSM 2024 shows that 11.4% of startups are active in the deep tech sector and almost 22% of startups use AI as the core of their products. These technologies are often complex and require high research and development expenditure. Collaborations with large companies not only provide startups with financial resources, but also access to the technical infrastructure and market knowledge they need for their further development.

Companies need to see venture clienting as an opportunity to integrate innovation directly, rather than simply admiring it from afar.

Established companies that rely on these new technologies can simultaneously accelerate their own innovation cycles and secure competitive advantages. For companies, access to new technologies via venture clienting not only means an opportunity to improve their own efficiency, but also to open up new business areas.

Challenges and potential for the future

Despite these advantages, the DSM 2024 shows that the potential of venture clienting has not yet been fully exploited. The number of start-ups entering into successful collaborations with established companies is falling. This is often due to a lack of understanding on the part of established companies as to how they can benefit from such partnerships and a lack of processes for implementing the cooperation. A rethink is needed here: companies need to see venture clienting as an opportunity to integrate innovation directly, rather than simply admiring it from afar.

Venture clienting as a key strategy

The German Startup Monitor 2024 makes it clear that German startups are in a transition phase. Traditional financing through venture capital has become more challenging and the priorities of founders have shifted. In this context, venture clienting offers an innovative and promising complement to traditional capital procurement. It is a model that not only benefits start-ups, but also offers established companies a sustainable and efficient way to be at the forefront of technological innovation.

For the future of the German economy, this means that innovation will not only be driven by venture capital, but also by targeted collaboration and joint business models. Venture clienting can be the decisive factor that enables this transformation.

More about this

Venture Clienting

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?