Liberalization of financial services through fintechs

While politicians are talking about reducing bureaucracy, fintechs are taking action: with innovative offerings, they are making it easier for founders to access financial services, reducing hurdles and saving time.

Everyone who founds a company, be it a start-up, a holding company or a business, faces a variety of challenges and bureaucratic hurdles. Especially in the initial phase, it is important to find quick and uncomplicated solutions to get the company on the right track quickly. While founders often rely on the support of notaries, lawyers and tax advisors when it comes to legal issues, many initially turn to their bank for financial support. However, it is precisely this sector that is increasingly becoming the focus of fintechs. With innovative services such as the option to open an account without a credit rating, an account in start-up, initial corporate loans or access to international financial systems, they offer exciting alternatives to the traditional banking world.

Opening up the market

Fintechs are still relatively new in the world of financial services. Initially, their main focus was on private customers. In particular, they offered access to the capital market, free current accounts, low-cost custody accounts and simplified payment processing. However, the business customer segment, especially for young companies and start-ups, was neglected for a long time. But this is increasingly changing.

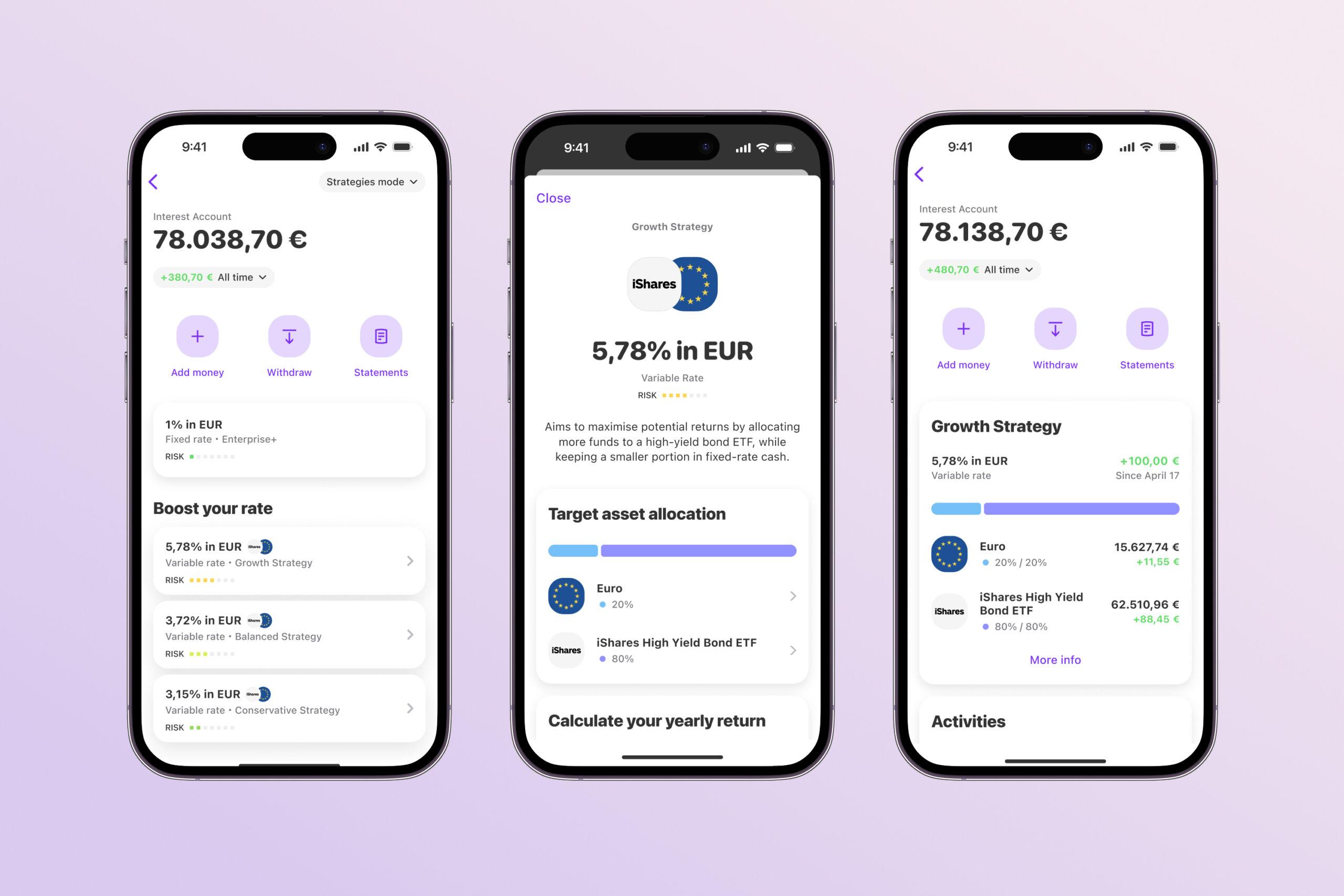

More and more fintechs are recognizing the immense opportunity that lies in the business customer sector and in the life cycle of companies. They offer founders customized solutions that are specifically tailored to their needs.

Political aspiration meets start-up reality

Politicians are constantly talking about reducing bureaucracy and turning Germany back into a country of thinkers, inventors and founders. However, the reality in the financial services sector consists of the LEI, transparency register, commercial register, supply chain law, Bafin and MIFID II. On the one hand, there are calls for digitalization, but at the same time there are hardly any affordable providers for processing transactions over the Internet with international payment transactions.

Several fintechs are filling this gap, offering innovative solutions in the corporate sector and promising a remedy. They are creating innovative offerings that lower the barriers to entry for start-ups and make it easier for them to enter the business world. Of course, they also have to comply with existing regulations, but the spirit of optimism in the market is clearly noticeable.

There is a growing trend among start-ups and young companies: They are increasingly organizing their financial structures via purely digital banks, so-called neobanks. The effort of physically meeting with all shareholders in a bank branch and going through lengthy paper-based processes is becoming less and less attractive. Instead, founders appreciate the flexibility and speed of fintech solutions.

The future of financial services

It remains to be seen whether politicians will actually recognize the urgency of cutting red tape in the coming years and reduce regulatory hurdles. What is certain, however, is that fintechs are already testing the existing limits of what is feasible and liberalizing access to financial products through their services. They facilitate market entry, offer a broader range of services and help to save time and costs. The opening up of the market by fintechs brings many advantages for both start-ups and established companies. The competition they bring to the financial market increases the pressure on traditional banks and promotes the development of efficient and customer-friendly services.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?