Green company names - another kind of greenwashing

Greenwashing or genuine sustainability? Study shows how name changes can affect investor confidence. Research warns of the risks of name changes for companies and investors in the context of sustainability.

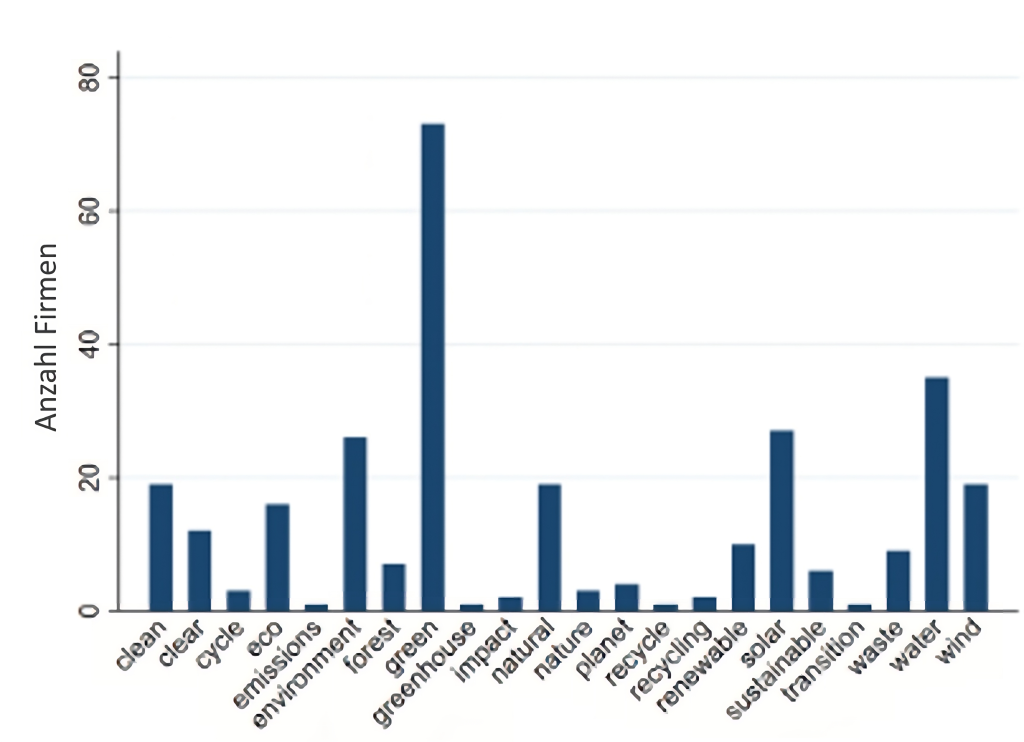

In the wake of growing awareness of climate change and sustainability, companies have started to change their company names to convey a more environmentally friendly image. A study by the Leibniz Institute for Financial Research (SAFE), led by Carmelo Latino, suggests that such name changes could be a form of greenwashing.

Short-term returns of up to 15% through name changes

The study is based on an analysis of sections of text in annual reports that companies file with the US Securities and Exchange Commission (SEC). It found that companies that include "green" terms in their names often receive a positive response from investors. Especially if the company has not previously engaged in environmentally oriented activities, such name changes can lead to abnormal returns of about 15 percent.

However, this positive effect only lasts if the company actually implements sustainable measures. Companies that do not adapt their business model accordingly could suffer negative returns, indicating a loss of investor confidence.

The results of the study suggest that greenwashing does not have a lasting positive effect on share prices.

Loriana Pelizzon, Head of SAFE's Financial Markets Research Department and member of the SAFE Board of Directors

Loriana Pelizzon, Head of SAFE's Financial Markets Research Department, emphasizes that greenwashing can lead to profits in the short term, but can damage a company's trust and credibility in the long term. Investors should therefore be wary of companies announcing name changes related to sustainability, especially if these companies do not have a proven track record on sustainability.

The results of the study suggest that greenwashing does not have a long-term positive effect on share prices and that investors should scrutinize a company's actual sustainability efforts before investing.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectTake care, give care

Did this news inform or entertain you? Then we would be happy if you tell your network about it.

Share on Linkedin Share on Facebook Share on XingFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?