Banxware #FintechPortraits

Miriam Wohlfarth founded her first start-up in the middle of the financial crisis in 2009. Her second start-up followed during the coronavirus crisis. We talk to her about how one of the first female fintech founders got started back then, why she is now entering a completely new market again with banxware and what she advises prospective fintech founders.

Dear Miriam, thank you very much for taking the time. First of all, we would like to know where the idea for your second start-up Banxware came from.

The idea for Banxware came from my first company, Ratepay, which I co-founded. Ratepay is an online payment provider for invoice purchases from online merchants that guarantees merchants that they will receive their money. The idea for Banxware then arose from a customer need around 1.5 years ago.

I was frequently asked whether it would be possible for Ratepay to provide merchants on the marketplaces with additional liquidity - i.e. money paid out much earlier. Small and medium-sized merchants in particular often have the problem that they have short-term liquidity problems due to a lack of a finance department or because they are not yet creditworthy. This has not been easy to solve in Germany to date, as retailers who are less than two years old are not yet granted a loan by the bank itself. And even for established retailers who are creditworthy, it takes around two weeks to get a loan.

So I asked myself how it is possible to support young companies and at the same time speed up the process of obtaining short-term liquidity. There are already solutions for this in the USA, for example. This gave rise to the idea that if you can see a trader's turnover, it is also possible to provide them with money quickly and unbureaucratically.

And that's what you do with Banxware?

Yes exactly, we use Banxware to provide short-term liquidity to merchants from various platforms. To do this, we have a three-stage process that checks a merchant's creditworthiness. This process takes us 15 minutes, which means that a merchant knows in 15 minutes whether they will receive support or not.

And how exactly do you check whether a retailer is creditworthy?

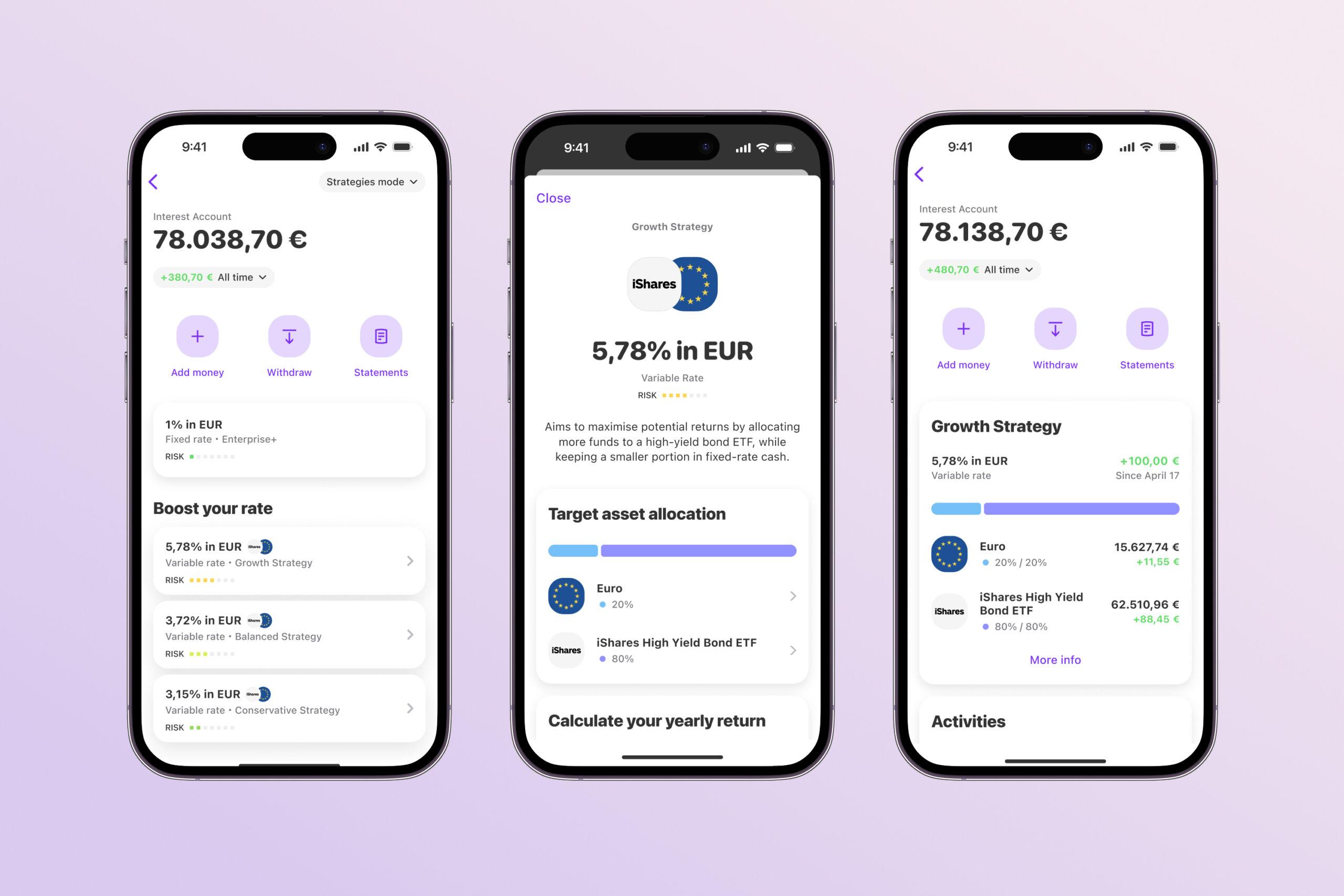

We have various ways of doing this. On the one hand, we use revenue-based financing. In other words, we see the retailers' sales as we cooperate with the platforms and can therefore check how much money they are earning and which offer is right for them. We also have access to the merchants' accounts and can therefore provide a well-founded analysis. We have also built artificial intelligence, which will be used more and more as we gain more customers and data. In this way, we want to ensure even better credit scoring in the future.

So the money that you give to the retailers comes from you?

No, we are cooperating with Volksbank Odenwald, which has provided us with a credit volume of 100 million euros. So after we have done the underwriting and checked whether a retailer is eligible for a loan according to our criteria and the bank's standard regulations, they receive their money on the same day.

Does this also have advantages for the bank?

Yes definitely, the bank is building up a completely new sales channel. And they don't need to build up any technological knowledge for this, they work with us. We are the middleware, so to speak, between the banks and the platforms.

If you think back to your beginnings as a founder. What were the biggest hurdles?

With my first start-up Ratepay, it was definitely the financing. We founded Ratepay back in 2009, which was characterized by the financial crisis. If you spoke to a VC back then and presented them with a financial product, they would say: "Get away from me, nobody wants it at the moment." That was one part of the problem, the other was that we weren't the typical founders. We didn't come from WHU or work in consulting. We weren't that young back then either.

And how did you manage it anyway?

We got an opportunity through a friend. He was a former McKinsey guy and had already founded his own company. He helped us draw up a business plan and told us how to go about it. He was basically like a mentor for us.

Do you think an accelerator could also play such a role?

Yes, definitely. I've never worked with an accelerator myself, but I could very well imagine that it could close some gaps and solve problems. For example, I recently had a conversation with a banker who told me it was actually his dream to start a company. He has really great ideas and would like to start his own business, but it's just hard to do it alone. He told me, for example, that he can't program himself and would need a programmer to do it for him.

I think there are a lot of great ideas in the fintech sector in particular. But the ideas don't work as individual founders. And I think an accelerator could help in this area by simply trying to bring the right people together.

Most founders always think they have to do everything themselves. But I don't believe so much in these individual start-ups, especially not in the technology sector. There are often founders who are very, very clever and do their thing incredibly well, but then they can't get anyone excited about their product, for example. And that's just as much a part of it: You also have to inspire a team, you have to set people on fire for your idea. And I think it's very difficult to combine all these qualities in one person; you're much stronger in a team.

That's why I think an accelerator needs to promote the network, because there are already a lot of people who are toying with the idea of starting their own business but don't really know how to go about it.

What tips would you give prospective fintech founders?

The first tip I would give all fintech founders is to get a lawyer on board right from the start!

If you don't have any legal expertise yourself, it's very difficult. Founders often don't know enough about the regulations. Then you come up with great products, but they can't be implemented because they simply don't work. We also had this problem to some extent with Ratepay. With Banxware, it's much easier now that we have a lawyer on the team. So I can rely on what my co-founder Jens says because he has the necessary know-how to make the right decisions.

Apart from that, I think the most important thing is that you start a company out of passion. I've often seen people fail who have said: "So, these are the 5 hottest topics that work and that's where we're going now". But they often lack the passion to have a product that can improve the world. I think the most successful start-ups are the ones that have products that think from the customer's perspective and fulfill their needs.

In which direction do you think the fintech market is developing?

I think there are two major trends that will play an important role in the coming years. The first is platforms, keyword: embedded financial services, and the second is cryptocurrency.

Consumers today have simply changed, as has the role of the bank as such. Consumers often lack a relationship with banks and it is much easier to be close to customers nowadays thanks to technology. That's why I think embedded financial services offer exactly what the customers of tomorrow will demand. The cooperation between fintechs and banks connects the bank's infrastructure with the fintech's technology. This makes it possible to be closer to customers and meet their needs while at the same time offering all banking-related services. The bank thus maps one part of the value chain and the fintech the other, ultimately integrating the service where the customer is, which is very often on platforms.

The second major trend that is emerging in my opinion is cryptocurrency. So what will come at some point is programmable money. And that, of course, requires cryptocode. If you think about where the future is going:

Appliances are networked, the fridge will have to do the shopping automatically at some point and of course payment will have to be made for that. But if I now have to check a payment from every application, this will eventually become too complex. This is where cryptocurrency comes into play.

Thank you for talking to us. About Miriam Wohlfarth: She started her career in sales at a travel agency, which brought her into contact with the founder of Bibit Global Payment Services and gave her her first insights into the online payment scene. Together with her former company, she helped to build up the online payment industry in Germany. In 2009, she was one of the first women in Germany to found a fintech. 2020 saw the launch of the second.

About our partner fintogether:

The state accelerator "fintogether" is an early-stage startup funding program that provides targeted support for FinTechs from their foundation to market entry. The aim is to build a lively and successful FinTech scene in Baden-Württemberg so that companies, start-ups and investors can benefit from it. Further information via: info@fintogether.de.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?