RISO #FintechPortraits

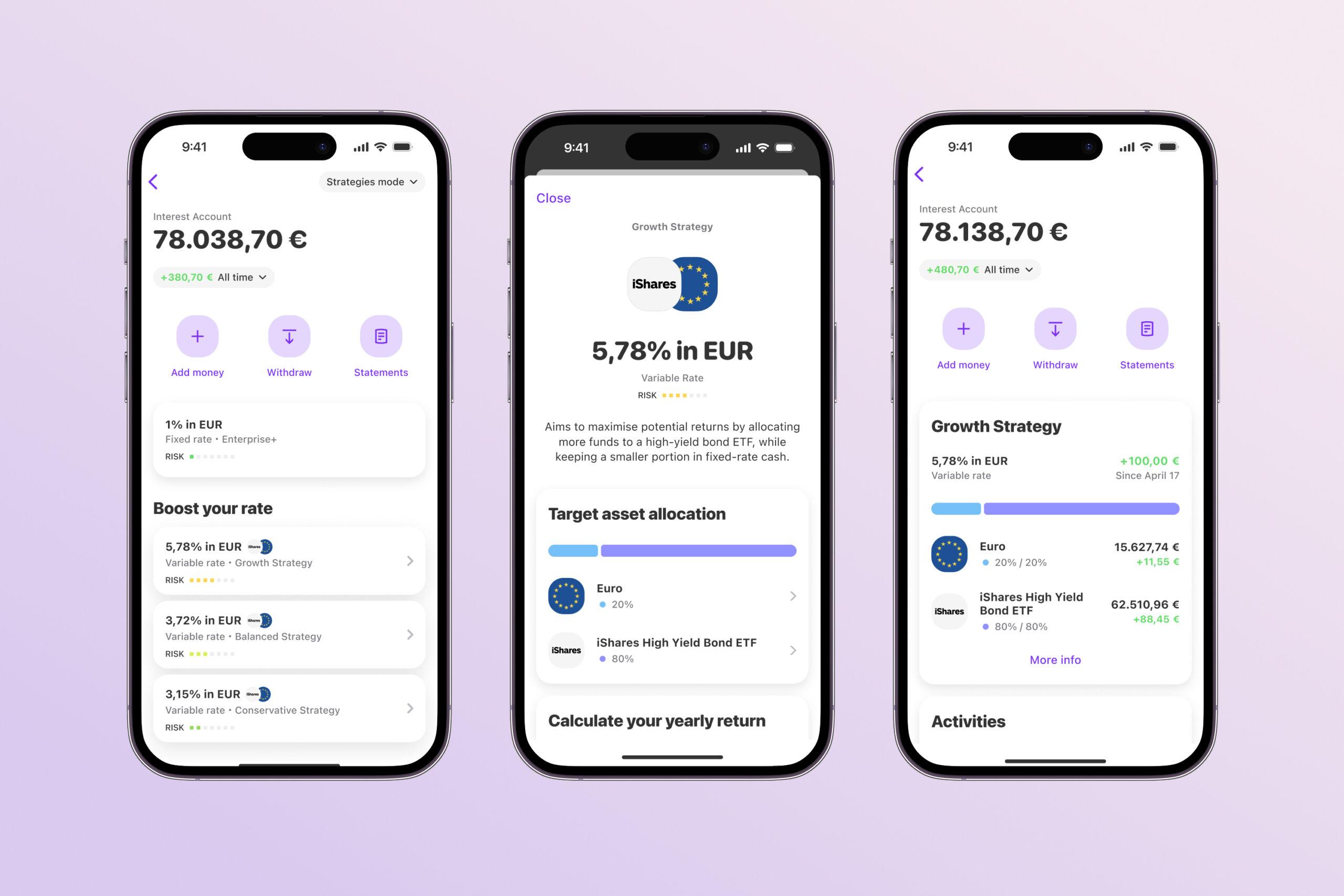

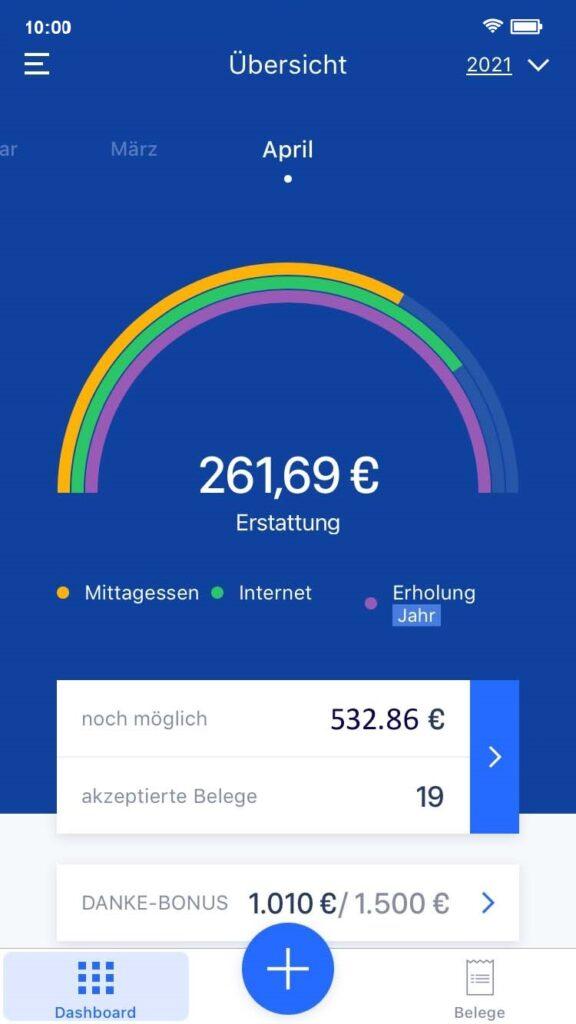

Employee benefits that directly increase net pay. The Baden-Württemberg start-up Riso shows how this works. Receipts for private expenses are scanned in via an app and reimbursed tax-free by the company. Riso wants to create wage benefits for everyone quickly and easily. Founder Philipp Maier explains exactly how this works, why an accelerator has helped the young start-up to grow and how to assert oneself against competitors in the fintech market.

How did you come up with the idea of founding your start-up?

I was working in financial consulting at the time and heard about the tax-optimized possibilities in the area of wages. At first I was very surprised that these options were not widely used. But then I realized that it was difficult to implement in practice because of the complicated laws for SMEs: the big players put entire teams of tax advisors to work on the topic and take advantage of the millions in subsidies. This brings financial benefits and strengthens their market position. In order for SMEs to catch up here, they also need consultants who specialize in them and, above all, one thing: a simple system that is suitable for everyday use. We have created this with the Riso app.

What is special about Riso's business model, what do you do differently?

We are consistently digital. All our benefits are processed digitally and in the cloud. This clearly sets us apart from traditional providers who rely on paper and cards. We are also aimed at German SMEs: we have no minimum quantities or minimum company sizes and make benefits possible from the very first employee.

Last but not least, we combine various tax-free salary components and benefits and can therefore deliver everything you need directly to the payroll department from a single source.

What were the biggest hurdles you had to overcome at the beginning?

Perhaps quite trivially, the fact that there are only 24 hours in a day: in other words, a lack of resources. In the beginning, I did too many things myself and only gradually found partners. Even today, we still regularly take on more as a team than we can achieve. But this is now happening at a healthier level and we see it as an incentive to keep moving forward in seven-league boots every day.

What support or help would you have liked to have received when founding the company?

Both founders and supporters must be prepared to break new ground, consciously take risks and accept the possibility of failure. This type of supporter is not easy to find, especially when it comes to taxes and finances, people like to rely on the established methods of the last century. We have experienced a lot of resistance from advisors regarding our digital approach, but also disbelief at the potential administrative efficiency. It could have been easier. On the other hand, resistance makes you stronger and allows you to grow and develop.

A circular from the Federal Ministry of Finance, which expressly endorsed our approach, then surprisingly helped us from the official side. But of course we also received support from individuals who went down this path with us. And when founding a company, you don't always need the masses, but the broad backing of a few, but all the more involved supporters.

Did you work with an accelerator?

Yes, I took part in Up2B. It was a great program.

How did that help you? What else did you miss?

For me, the exchange, feedback and expert input were particularly important. We did some extra lessons in the evening. I am still in contact with many of the participants and lecturers today. The spirit of wanting to improve, change or drive something forward unites us.

How do you feel about the current funding opportunities for fintechs in Germany?

There is currently a very wide range of digitalization funding. We are also supported and benefit from it. Nevertheless, it is still difficult for start-ups to survive. There are many initiatives, but not everyone understands at a political level what a start-up really needs on a day-to-day basis. And that is definitely more than money, e.g. the supporters, visionaries, development partners, inventors, live testers and, of course, paying initial customers mentioned above.

And what is the situation in Baden-Württemberg? How do you feel about the funding opportunities for FinTechs here?

I'm not sure about fintechs in particular. However, with Pre-Seed BW (and then Protect), the state has created great early-stage support. As far as I know, this is unique in Germany. It's good that Baden-Württemberg has taken its cue from other countries here: If you are best-in-class in your league, you have to change leagues and look for new role models.

There are currently around 900 fintechs in Germany. How do you succeed in such a booming market?

As a young company, it's good to specialize and position yourself clearly. You could always build more app features, implement a 17th special request or get lost in product development: Simplification and focus are essential for survival, and not just for us.

We'd rather try to do one thing right than a dozen halfway. Incidentally, we can take this literally in the case of Riso: There are a good dozen tax-optimized salary modules; we are currently only doing four of them. That's good, because we cover enough tax-free wages for our first customers. At the same time, we still have great development potential: A tripling is possible and we can already show these options.

And what direction do you think the fintech market will take?

The transformation has already begun - modern insurance solutions, digital banks, countless services ... - but the real impact is yet to come. The traditional banks still dominate the market and generate the lion's share of sales. However, many fintechs are now switching to the growth and scaling track and this development will lead to some market upheavals in the next 3-5 years.

Personal details: After completing his studies in International Management, Philipp Maier founded several companies and focused on the topic of wage optimization. This was followed in 2018 by the founding of his start-up Riso, with which he aims to make tax-optimized salary benefits accessible to smaller companies.

About our partner fintogether:

The state accelerator "fintogether" is an early-stage startup funding program that provides targeted support for FinTechs from their foundation to market entry. The aim is to build a lively and successful FinTech scene in Baden-Württemberg so that companies, start-ups and investors can benefit from it. Further information via: info@fintogether.de.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?