The role of venture clienting in corporate venturing

Venture clienting is designed to bring start-up innovation into companies quickly. Frederic Pampus explains how the approach unfolds its full potential when combined with other corporate venturing strategies.

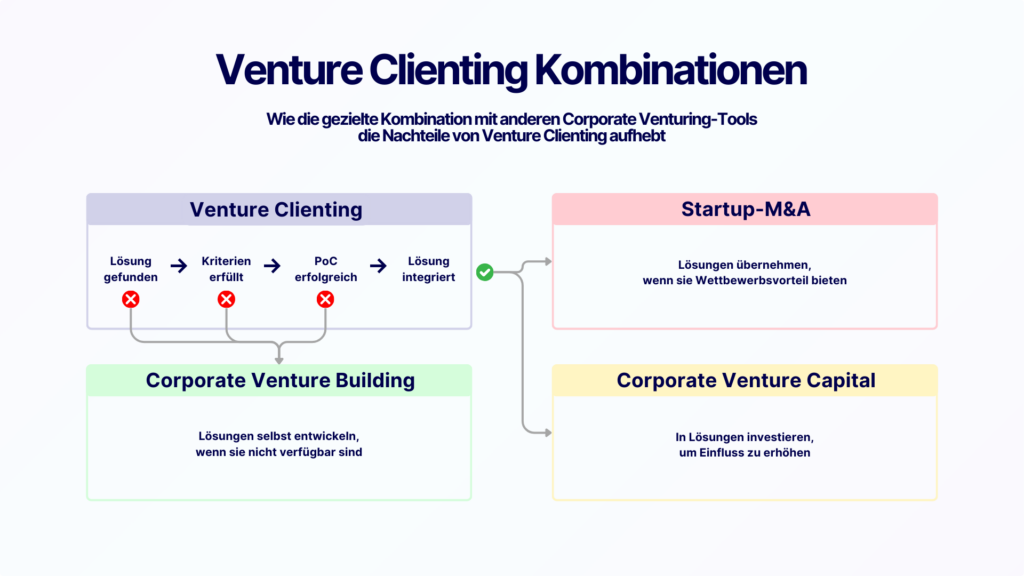

Corporate venturing describes the range of strategic approaches that companies use to drive innovation. These approaches can be divided into four categories: Build (corporate venture building), Buy (startup M&A), Partner (venture clienting) and Invest (corporate venture capital, or CVC for short). Each of these strategies not only has its raison d'être, but also its own strengths and limitations.

Venture clienting stands out as a particularly lean method for integrating innovations quickly and efficiently into existing business models. Companies become "clients" of start-ups and use their market-ready solutions to solve specific problems in their core business.

However, an approach focused purely on venture clienting can quickly reach its limits: What if no suitable startup is found? Or what if the startup's solution does not fit in with the long-term corporate strategy? What if a proof of concept (PoC) fails or does not deliver the desired results? How can companies react flexibly and act strategically in such cases?

To answer these questions, it makes sense to place venture clienting in a broader context.

In the following, we will briefly look at the advantages and limitations of venture clienting and then analyze three strategies that enable companies not only to benefit from the advantages of this corporate venturing tool, but also to overcome the challenges.

1. the advantages of venture clienting

Let's start with the strengths: Venture clienting offers numerous advantages that focus on speed and efficiency.

No other corporate venturing tool offers companies the opportunity to find, test and, if successful, integrate innovative solutions so quickly, at low risk, close to the core business and with a low budget:

- Instead of investing their own resources in the development of new technologies, companies benefit directly from the innovations of agile start-ups.

- The initial investments are manageable, especially in comparison to CVC or startup M&A.

- PoCs (proof of concepts) make it possible to quickly test whether a solution is suitable before major commitments are made.

- If a PoC fails, the company has little risk and can move straight on to the next option.

In short, venture clienting allows companies to test innovations with comparatively low risk and is the quickest way to benefit from external innovations without making a long-term commitment.

This might give the impression that an innovation tool has finally been found that can be used as a panacea for all problems and opportunities for existing companies - and with a low budget and low risk. But it is worth taking a look at the flip side, the limits and challenges of venture clienting.

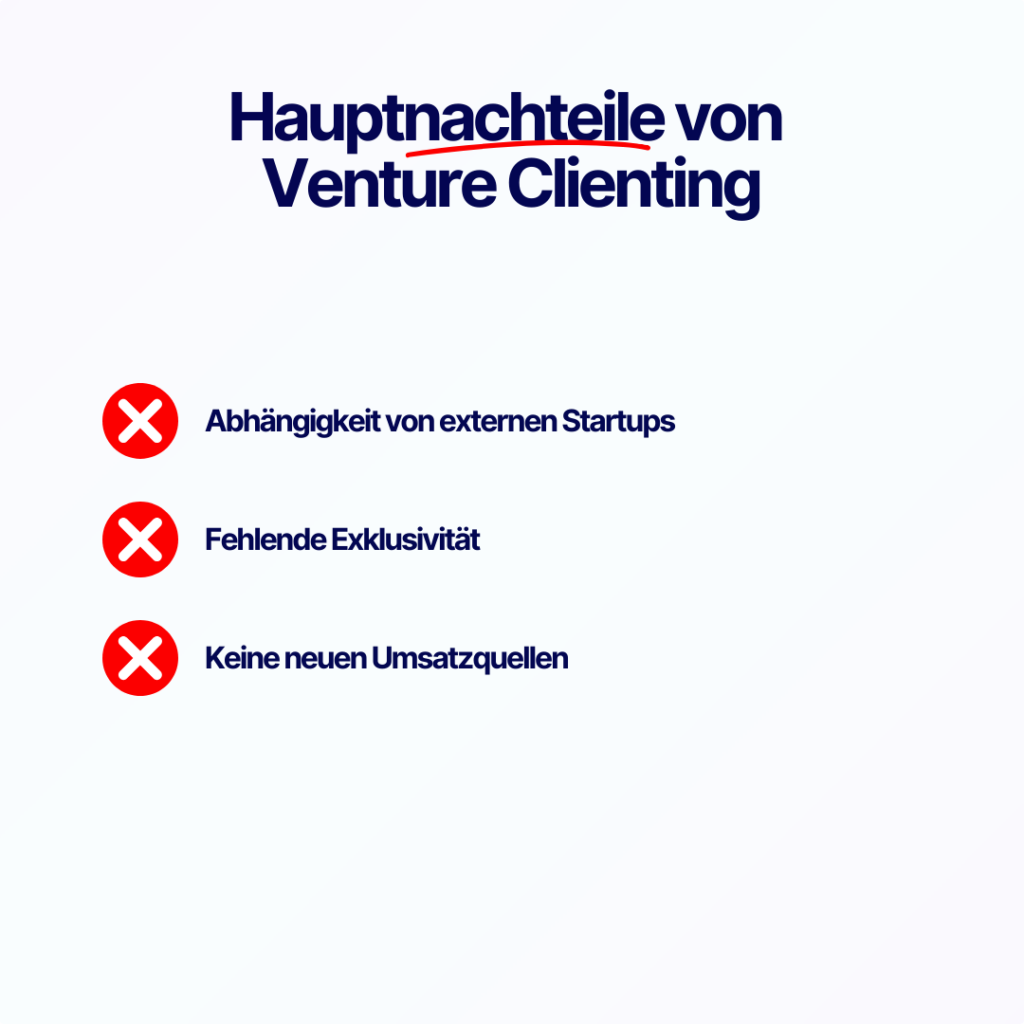

2 The limitations and challenges of venture clienting

After looking at the advantages of venture clienting, the question arises: What are the weaknesses of this strategy and how can companies specifically address them? We will find the answer to this by taking a closer look at some of the key challenges.

Dependence on external start-ups

One of the biggest challenges is the dependence on external start-ups, as companies have little control over the further development of solutions. What happens if a startup suddenly takes its technology in a different direction?

Integration into existing structures

Added to this is integration into existing structures. New solutions do not always fit smoothly into existing systems. Large companies in particular can face technical, organizational and cultural hurdles.

The cultural aspect is particularly important here. While other corporate venturing tools such as corporate venture building and CVC can often apply agile working methods "undisturbed" in separate units, to a certain extent detached from the processes and structures of the core business, it is inherent in venture clienting that employees from the core business (the so-called "problem owners") are involved in the process.

Here, the Venture Clienting unit plays an important role as a mediator, translator and moderator of the process. However, it can only build cultural bridges between high risk and speed on the part of solution providers and risk aversion and mostly adverse incentives on the part of the company to a limited extent.

Short-termism and a lack of new sources of revenue

Another challenge is the often short-term mindset that venture clienting entails. The method is primarily geared towards solving problems quickly and rarely contributes to tapping into new sources of revenue. Instead of creating new business areas or sustainable revenue models in the long term, the focus often remains on optimizing existing processes.

Lack of exclusivity

Another disadvantage is the lack of exclusivity of the solutions used. As companies in venture clienting do not acquire exclusive rights to the technologies or products, there is a risk that direct competitors will use the same solutions. This can significantly limit potential competitive advantages and the innovations used lose their strategic uniqueness.

In summary, although venture clienting offers a fast and low-risk way to deploy innovative solutions, it has clear limitations. From the dependence on start-ups and cultural and structural hurdles to the frequent failure to generate new revenue streams or exclusive competitive advantages: The method alone is not enough to build a sustainable innovation strategy.

In the next section, we will therefore look at how these challenges can be overcome through the targeted combination of venture clienting with other corporate venturing tools.

3. combining venture clienting with other corporate venturing strategies

The good news first: many of the weaknesses of venture clienting can be compensated for by combining it with other corporate venturing strategies. This is precisely the key to sustainable success.

Combination 1: Develop solutions yourself if they are not available

What do you do if no suitable startup is found, the PoC is not successful or adaptation is not possible?

Often, no suitable solutions are found at all, a supposedly suitable solution has not passed the PoC or adoption ultimately fails, e.g. due to price expectations or because the solution provider decides against a long-term collaboration.

The real problem becomes clear when we remember the original reason for starting the venture clienting process: A significant problem has been identified in the core business that the organization cannot solve itself.

Its existence does not change if the process was not complete. In other words, companies that rely solely on venture clienting will not solve the problem without taking further steps.

This dilemma can be solved by combining it with corporate venture building.

In the classic venture building process (ideation, validation, MVP development, scaling), the validation and thus the assessment of desirability (benefits for people), feasibility (technology) and viability (economic aspects) can be started directly.

There are two possible outcomes:

- The problem is also relevant for other companies and an independent and profitable business model can be established: With an independent corporate venture, not only can the company's own problem now be tackled, but additional sales channels can be opened up.

- But does this mean that it is only an internal problem? Product building and subsequent integration into the specialist area provides an efficient solution option.

The positive side effects of this are full control over the technology and the creation of a solution that is precisely tailored to your own needs.

Combination 2: Adopt solutions if they offer a competitive advantage

What to do if the venture clienting process is successful?

Actually perfect: a significant problem has been identified in the core business, a suitable startup has been found, the PoC was positive and the adaptation of the solution works. In short, the normal venture clienting process has been successfully completed.

However, if it ends here, important options remain unconsidered. Competitors can still use the same solution. This is particularly problematic if it represents a real competitive advantage.

This is where the combination with startup M&A comes into play. Companies should set up processes and structures to be able to act quickly in such a case and thus secure exclusive access to the technology and create sustainable competitive advantages.

Combination 3: Invest in solutions to increase influence

What to do when strategic security and long-term influence are important?

When it comes to start-ups, few things are as certain as constant strategic realignment. Without constant experimentation, innovations and above-average growth rates rarely emerge. However, this also regularly leads to "pivots", a radical change of focus on target customers, regions, products offered and entire business models from the perspective of established companies.

To put it mildly, this is impractical if a solution has become part of the company's core processes once it has been adopted.

To mitigate this risk, there are basically two possible solutions.

- The focus on late-stage start-ups ("scale-ups") for the solution of success-critical core processes, as the intensity of the pivots decreases with increasing maturity and the risk of these can be assessed and, if necessary, contractually secured.

- Our third combination and thus the link between the venture clienting process and CVC: by taking a financial stake in the providers of the solutions that are adopted in core processes, companies can secure themselves and exert a longer-term influence on strategic decisions. In addition, this increases the knowledge and network in an important solution path for the company, not only through shareholder reporting, but also through active participation, for example through a supervisory board mandate.

These combinations show how important it is to think beyond individual strategies. Innovation is not a linear process. The real strength lies in the intelligent dovetailing of corporate venturing tools.

The result is a flexible venture clienting strategy that solves short-term problems as well as opening up new revenue opportunities and offering profound added value.

4. use combinations wisely

As useful and valuable as the combinations are, they need to be applied with a sure instinct. Venture clienting is also designed to position the company as an attractive partner for start-ups. This can be seen, for example, in the fact that the venture clienting units of many companies have their own branding and marketing. "Dear start-ups, we are an attractive major client for you" is the tenor here. One of the strategic reasons for this is that it increases the probability of success and speed in startup sourcing.

So what happens if a company regularly starts venture clienting processes, but ends up buying the solution, building it itself or acting as a strategic investor?

That's right, the strategically sensible and valuable combinations are viewed as a Trojan horse by the market and startup sourcing becomes difficult, even to the point of adverse selection: only suboptimal solutions reach PoC and adoption.

Fortunately, the solution is not very complex. Clear and open communication from the first meeting, coupled with transparent criteria for decision-making and examples of success show an objective and professional partner who is interested in the best possible way of working together.

5 Conclusion: Venture clienting as part of a comprehensive corporate venturing approach

Venture clienting has a clear raison d'être. It is the only corporate venturing tool that can bring innovations into the company so quickly, with such low risk, close to the core, with a small budget and usually through existing internal employees.

However, like any other corporate venturing tool, it has its limits and challenges. To overcome these, companies need to combine the various building blocks of corporate venturing in a targeted manner.

- Adopt solutions if they offer a competitive advantage

- Develop solutions yourself if they are not available

- Invest in solutions to increase influence

This holistic approach ensures that venture clienting not only solves problems, but also creates long-term competitive advantages. This is how individual tools become what innovation in companies is all about. A holistic strategy that offers options.

More about this

Venture Clienting

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?