DACH VC market reaches new equilibrium after decline in financing

The latest analysis from NGP Capital offers exciting insights into the DACH VC market. Find out how AI and deep tech are driving investment despite an overall decline and which cities are emerging as new start-up hubs.

NGP Capital's latest analysis shows that Generative AI and Deep Tech are driving investment in the DACH region despite an overall decline in funding. In the last 12 months, start-ups in Germany, Austria, Switzerland and Liechtenstein raised a total of 11 billion dollars. The high per capita investment in Switzerland is particularly striking.

Results of the "DACH Startups Decoded" report

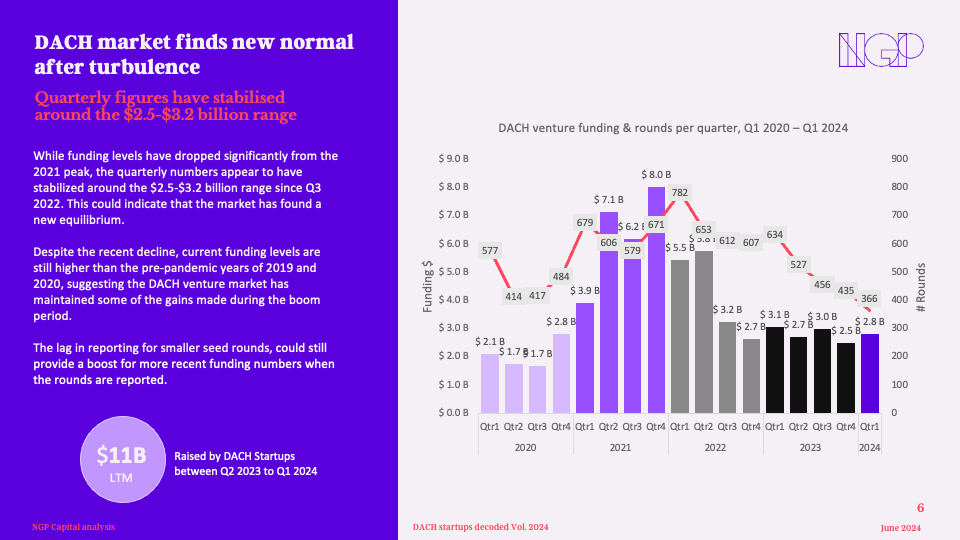

NGP Capital, a global venture capital fund, has presented the results of its second annual survey of the DACH startup ecosystem. The "DACH Startups Decoded" report analyzes data from over 1676 venture-backed startups and 1748 funding rounds from April 2023 to March 2024. Despite a significant decline in funding levels since the peak in 2021, quarterly figures have stabilized since the third quarter of 2022 and are now in the range of 2.5 to 3.2 billion dollars. These figures are higher than in the pre-pandemic years of 2019 and 2020, indicating that the ecosystem has retained some of the gains made during the boom phase.

Germany dominates, Switzerland leads per capita

Germany remains the driving force in the region, accounting for 75.2% of total venture funding in the DACH region. However, Switzerland leads per capita with 247 dollars, almost on a par with the United Kingdom, which has 305 dollars.

The study by NGP Capital also reveals some important trends:

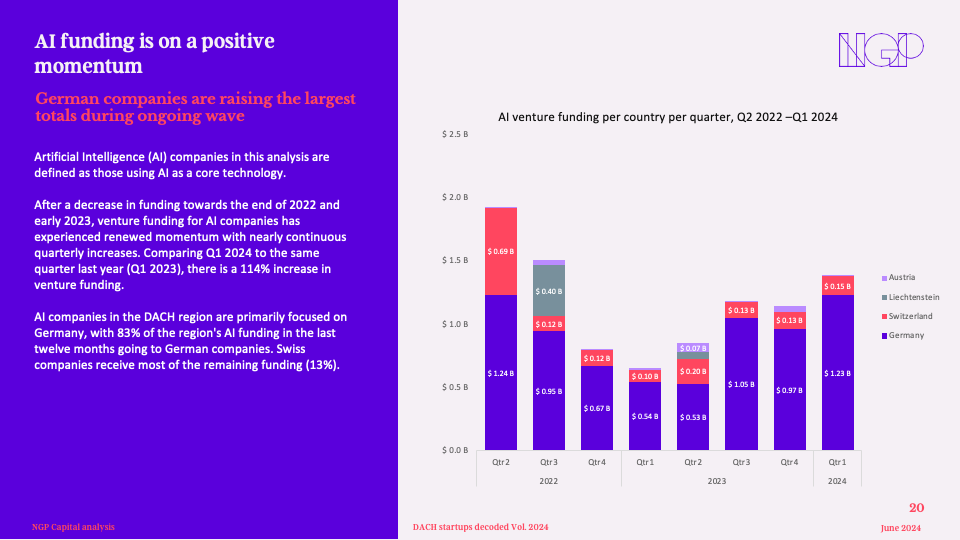

- AI start-ups are driving the current boom: in the first quarter of 2024, investments increased by 114% compared to the previous year to 1.38 billion dollars.

- Deep tech is also booming: 2.23 billion dollars were invested in the areas of industrial technology, advanced manufacturing, robotics and computer vision in particular.

- Shift to B2B: Since the second quarter of 2022, investments in B2B start-ups have significantly exceeded those in B2C companies.

- New start-up hubs: cities such as Hamburg, Dresden and Frankfurt are experiencing significant growth

- Expansion into the USA: 25% of vacancies at DACH start-ups are in the USA.

- Local VCs continue to dominate: Growth start-ups mainly rely on local investors, while international investors focus on seed start-ups.

The DACH market is experiencing an upswing, particularly in AI and industrial technology. This growth trend extends beyond traditional centers, with new thriving startup ecosystems. However, challenges remain, such as bureaucracy, securing growth capital and attracting top talent."

Christian Noske, Partner at NGP Capital

NGP Capital remains active in investing and supports start-ups like Daedalus that embody the region's strengths. The VC, with 1.6 billion dollars under management, has been investing in early-stage companies in Europe, the US and China since 2005.

DACH Startups Decoded Download

The "DACH Startups Decoded" report is based on data from NGP's own analysis platform "Q" and offers detailed insights into the dynamics of start-up investments in the DACH region. Interested readers can download the full report here.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?