Which market gaps camping start-ups can exploit

Supply chain problems and the desire for more individual tourism have meant that waiting times for motorhomes are often almost a year. The perfect opportunity for rental and sharing start-ups?

A pair of underpants and a toothbrush, that's pretty much it. That's all your customers need to pack if they want to spend a few weeks camping in the wilderness. That is the promise of Bastian Gembler, who founded the camping start-up Vantopia together with his girlfriend Larissa Peters at the end of 2018.

Gembler and Peters rent out camper vans, which they partially convert and equip themselves beforehand. According to Gembler, they store more than 100 items of equipment in the camping vehicles. In addition to the standard equipment, which includes cooking pots and spices, customers can also book more unusual extras, such as a coffee set with special espresso beans or an inflatable kayak.

Camping without much preparation - and without a problem that many motorhome owners know only too well: Where to put the vehicle when it's not being used for a vacation? Traveling on wheels is often portrayed as spontaneous and uncomplicated, but the truth is often different: The motorhome is used for four weeks and the remaining 48 weeks of the year the neighbors are annoyed because a huge vehicle is narrowing the way through their street.

Camping is becoming increasingly popular

A space problem that is increasing rather than decreasing: Because camping is becoming increasingly popular in Germany. According to figures from the Caravanning Industry Association (CIVD), more than 81,000 new motorhomes were registered in 2021 alone. Between 2018 and 2021, motorhome registrations more than doubled. The camping hype also attracted many start-ups who saw a new business opportunity in the sector.

Vantopia was no exception - although the idea came about more by chance, according to founder Bastian Gembler. He and his girlfriend and business partner Larissa Peters had met while working at British American Tobacco. They had both worked in marketing there. However, they no longer saw their future in the tobacco company and both resigned in 2016.

"After that, we traveled around the world," says Gembler. First with the VW bus through Europe, then backpacking through Asia and finally to North America. "That's where we really caught the camping bug," says the founder. Unlike in Europe, the camping culture in North America tends to be characterized by active holidaymakers who not only want to enjoy a beer at the barbecue, but also go hiking. "We wanted to establish this camping idea in Germany too," says Gembler.

Vantopia would now be in its third proper financial year. In the two previous years, they had not yet made a profit, says Gembler. Now he hopes to be in the black. The motorhome rental business is capital-intensive, after all, they buy new vehicles every two years and sell the used ones. In addition, there are now supply chain problems.

China's tough coronavirus lockdown and the Russian war of aggression in Ukraine have led to vehicle manufacturers running out of important materials, such as aluminum and chips. As a result, motorhome manufacturers are waiting for vehicle chassis. Materials such as wood and adhesives are also in short supply.

It is difficult to estimate how long this supply chain crisis will last. Christian Günther, Managing Director of the Federal Association of the Camping Industry (BVCD), agrees. The industry is only just recovering from the effects of the coronavirus lockdowns. "The camping industry has often been described in the media as a corona winner, but to be honest: there is definitely no one in tourism who has benefited from corona," emphasizes Günther. Campsites also had to close for months, and in 2020, income fell by five percent compared to 2019. In 2021, it was even down eight percent compared to the year before the crisis.

Waiting times of up to one year

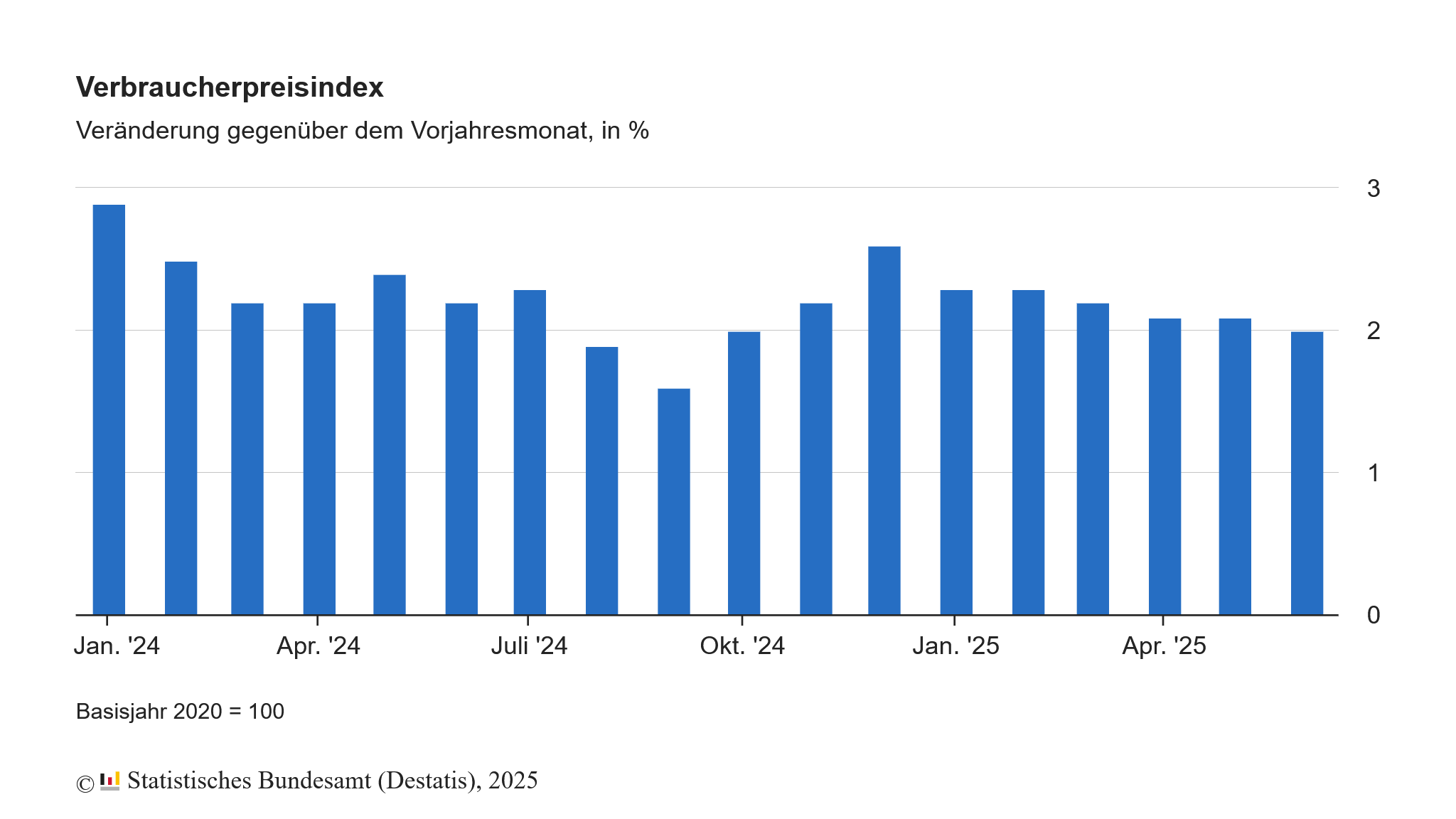

Interest in individual travel on wheels increased, as booking flights and hotels was more of a gamble during the pandemic. However, anyone interested in a motorhome often has to wait between nine and twelve months for the vehicle to be delivered - it's not an impulse buy. And now there is also inflation, which is causing price-sensitive potential buyers in particular to reconsider their purchase decisions.

Experts see this as a risk. For example, Peter Greischel, Professor of Tourism Management at Munich University of Applied Sciences. "The alarming rise in inflation is causing some prospective motorhome buyers to put their purchase decision on hold for the time being." At present, he would advise entrepreneurs who rely on rental or sharing models to familiarize themselves even more than usual with the special features of this market. "Many market participants are seeing saturation trends in the market," he says. Although the sharing sector is an interesting business area for several providers, newscomers should be aware of the growing risks if they want to capture market share. And recreational vehicle rental companies have to contend with high expenses - the business model has to be well thought out and sophisticated.

These start-ups for camping exist

In fact, there are several rental and sharing start-ups in Germany that have managed to conquer the market within just a few years. For example, the sharing company Paulcamper or the motorhome rental company Freewaycamper, which recently raised 30 million euros in a financing round. Its competitor Roadsurfer, Europe's largest campervan rental company, is now venturing to expand into the USA.

And foreign competitors are not sleeping either. The French sharing start-up Yescapa took over its German competitor Shareacamper at the beginning of last year. Since the beginning of this year, Dutch provider Goboony has also been looking to conquer the German market. The start-up is a kind of Airbnb for campers: motorhome owners can advertise their vehicle there and rent it out to travelers.

Unlike tourism management professor Greischel, Goboony co-founder Mark de Vos is convinced that the sharing trend will continue to grow. On average, a motorhome stands idle for eleven months a year. "I noticed that myself when I enthusiastically bought a motorhome after my first camper vacation." So he lent it out and that's how the idea for Goboony came about.

Many "taster campers"

According to de Vos, only one percent of motorhomes in Germany are currently shared. So there is a lot of potential. In addition, the company is not affected by supply chain problems, as motorhomes that are already on the market are shared via Goboony. Gobooby has also benefited greatly from the pandemic, as many customers have become "trial campers" - in other words, they didn't want to buy the vehicle straight away. Platform revenue increased by 200 percent in 2020 and 2021.

The start-up Campspace, which took over its German competitor Pop-up Camps in April, also comes from the Netherlands. Campspace relies on a completely different business model: a booking platform that allows private individuals to rent space to campers. "Anyone who has a nice piece of land, a mini campsite, a tree house or a yurt is welcome to register as a host with Campspace," says Campspace boss Hugo van Donselaar. His aim is for Campspace to become the largest booking platform for outdoor accommodation in Europe.

To get a free pitch in an attractive region during this time, it is increasingly advisable to arrive at the nearest campsite in the morning."

Peter Greischel, Professor of Tourism Management at Munich University of Applied Sciences

An idea that tourism management professor Greischel sees potential in. "Pitches are currently in short supply," he says. "To get a free pitch in an attractive region during this time, it is increasingly advisable to arrive at the nearest campsite in the morning."

Spontaneous, individual travel looks different. But this is exactly what many younger travelers want, inspired by the "vanlife" trend on Instagram. Countless millennials upload pictures of their campervans there, always perfectly exposed, beach and sunset included.

"Camping has received a lot of media attention in recent years, especially during the pandemic," says BVCD Managing Director Günther. Urbanization has also increased the desire to spend more leisure time in nature.

'Our target group has a great need for individualism and freedom'

Vantopia co-founder Bastian Gembler

Vantopia is also particularly aimed at customers who want to relax in nature. "Our target group has a great need for individualism and freedom," says Gembler. Vantopia wants to move away from the cliché of garden gnomes on a permanent pitch - and therefore develop a second business area in the medium term: its own campsite operation.

But first, the founding couple is looking forward to their summer vacation. "We are our own customers, of course," says Gembler. They travel to Slovenia and Albania in one of the converted motorhomes.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?