rubarb

The new start-up from Olaf Scholz's nephews offers investments in ETF portfolios for everyone. Fabian Scholz, co-founder and CEO of rubarb, explains to us how this works and why they named their start-up after the rhubarb plant.

Your app was launched in November 2020, can you tell us a bit more about it? Why did you found your start-up, what problem are you addressing and how are you solving it?

With rubarb, we want to completely rethink the topic of "savings accounts". It is still only a fraction of the population that is willing to invest their money in financial market products. The majority still rely on traditional savings products, despite the fact that these hardly generate any profits in the face of low interest rates and inflation. We have therefore asked ourselves the question: Do saving and investing even necessarily have to be mutually exclusive? We think: no! If the hurdles for investment newcomers are lowered, many more people may be willing to try out the capital market.

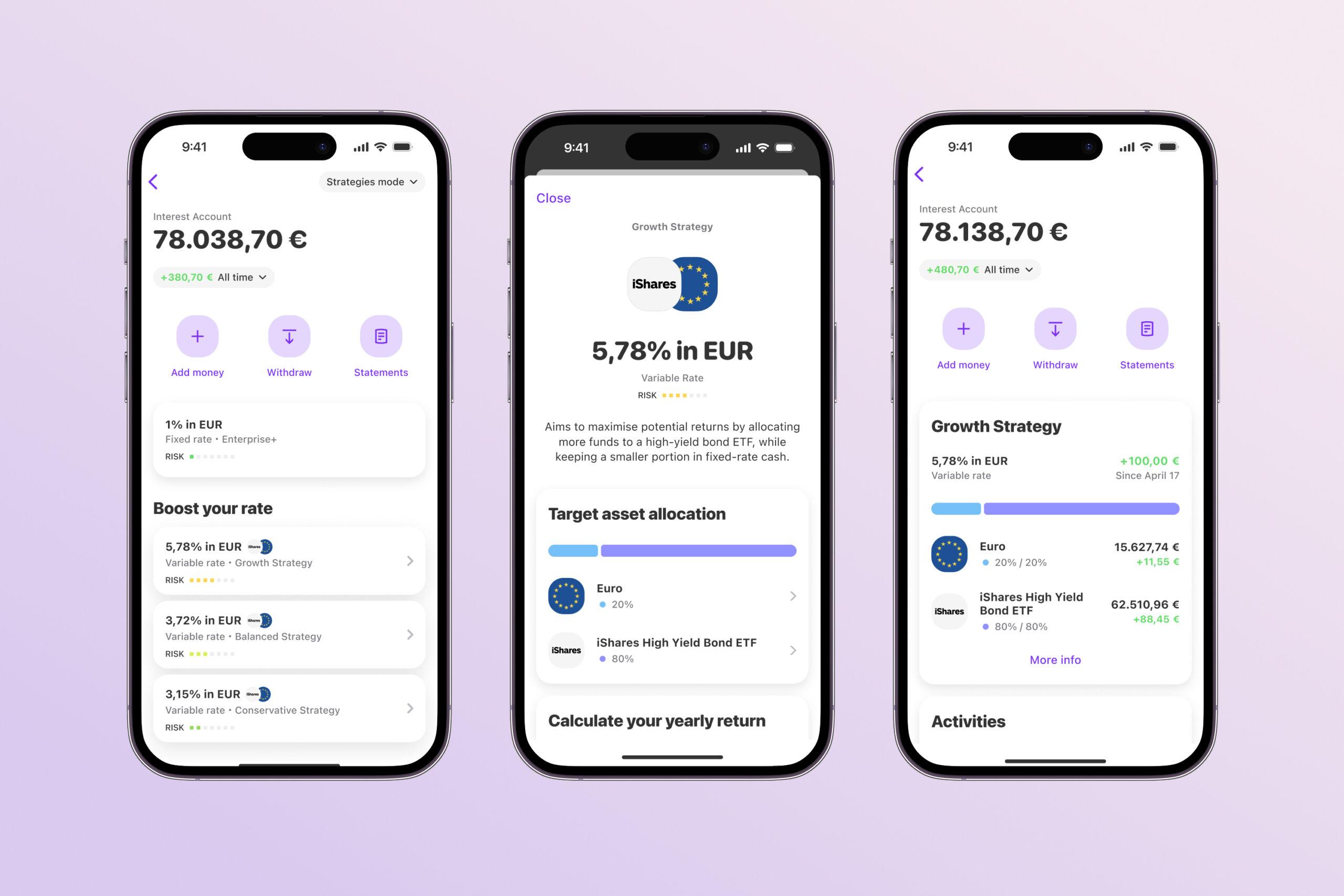

And this is exactly where we came in and developed rubarb, an app that allows users to invest without much effort. The principle behind it is called 'rounding up'. This means that every user can link either their current account, credit card or PayPal account to the app. Every amount of money spent is then rounded up to the next full euro; the difference collected in this way is then invested once a week in one of a total of three globally diversified ETF portfolios.

Your target group is, as you say, the general public. You want to make finance and investments accessible to everyone. What special features does this entail, what should people look out for?

Exactly - our app is aimed at the 85% of the population who have not yet used any financial market products. They either don't have the confidence to invest or are afraid of doing something wrong and losing all their money in the end. We want to alleviate these concerns by making our app as clear and easy to understand as possible, making the underlying processes transparent and, above all, enabling users to access their invested money at any time. With our app, there is no minimum term or minimum investment amount, but we create the lowest possible threshold for accessing the investment market.

What were the biggest challenges you had to overcome at the beginning?

We founded rubarb in the midst of one of the biggest economic crises in history - and took a full risk. In hindsight, there would certainly have been a more relaxed time to found the company. At the same time, however, we also see the crisis as an opportunity, as it shows us every day how important the idea behind our business model is: if you want to be protected in times of crisis, you are well advised to put money aside early on. Of course, this seems to be difficult for many people at the moment. This is where our app comes in and fills a glaring gap in the market.

What was the most valuable piece of advice someone gave you during the start-up phase?

"Hire experienced people for the most important core functions and expect that the majority will not share your enthusiasm for the idea at first" - both pieces of advice came from good friends and both proved to be true. Especially at the beginning, we looked at different ways to find the balance between experience, speed of implementation and costs. Freelancers, agencies and others often have a great pitch and make big promises. Ultimately, however, the personal commitment of each individual when a team is working on a product without distraction is simply unique. In the short term, an experienced colleague is of course somewhat more expensive. Twelve months after the company was founded, however, it pays off many times over to have built an extremely stable and high-quality product that can be scaled and for which the necessary knowledge is available within the company.

And on the second point: in Germany, everyone is doubly critical at first anyway - it's simply in the genes of many people here. But even when taking on risk capital, you have to bring a lot of composure with you, especially at the beginning. In the end, if it was so obvious and easy, someone would have already done it. So every new idea is always one that many people don't understand at first. Fortunately, it has now become very clear that we have brought an incredibly useful product onto the market.

Your app is called rubarb (German for rhubarb); at first glance, one would assume that it is a food start-up. But what does rhubarb have to do with finance and how did you come up with the name?

That's an exciting question. Initially, we took a very analytical approach to finding a name and didn't make it easy for ourselves. We wanted a name that we could also use internationally, so that it wouldn't have negative connotations in other languages. Ultimately, we see a parallel between the English term rhubarb and the topic of saving: Money is like rhubarb - no one really dares to eat the raw vegetable, but everyone loves what you make from it.

One of your product promises is "financial wellness", how do you create this for your customers?

We want our users to create a solid financial foundation so that they can look to the future with peace of mind. To do this, they have to put money aside regularly over a longer period of time - just like with a savings account or call money. Rounding up purchases involves small sums that are not really missing from the account at the end of the month. However, the total amount is still worth investing. Our experience so far has shown that the average user saves around 30 euros per month. Depending on their risk affinity, the money is then invested in one of our three ETF portfolios and yields a corresponding return. The associated effort for our users is extremely low, but the effect is still great! Incidentally, we also offer a savings plan on a daily, weekly or monthly basis - and of course one-off deposits are also possible at any time!

You are initially offering rubarb free of charge, but let's be honest: how do you earn your money (or rather your rhubarb) with it?

The app is completely free to use; anything else would contradict our conviction that we really want to offer investments to everyone. In the medium to long term, however, we want to further expand our offering. For example, some premium functions will soon be offered in the app, which our users can book for a fee if they are interested. The idea is to gradually develop rubarb into a personal finance app that helps our customers to identify potential savings in their spending habits. At the moment, of course, we are most interested in what our users actually want. That's why we regularly gather feedback, exchange ideas and develop new ones.

Where do you see your start-up in three years' time?

We want to establish rubarb as a trustworthy investment partner for the vast majority of the population. We are also planning to make our business model known beyond national borders. This year, for example, we want to launch the rubarb app in at least one more EU country - after three years, we are aiming for a substantial six-figure user base in several EU member states. We are very much looking forward to this journey ahead of us.

Do you have a role model and if so, who is it?

For me personally, it's actually many of my friends and people from my extended circle of acquaintances. However, my brother Jakob has a clear favorite: Jeff Bezos. On the one hand, of course, because of his rigorous product focus, which Jakob also exemplifies on a daily basis and which has made Amazon what it is today. But more importantly, because he would probably never have founded the company without him.

I already have a few more years of experience in the start-up scene and have talked Jakob into it a lot. But in the end, he saw an interview with Jeff Bezos, who made the decision to give up his well-paid hedge fund job and found Amazon instead. He asked himself the question: When I'm 80 and look back on my life, will I regret not having made the move? For him, the decision was then clear - he could live with failing in case of doubt. But he couldn't live with not having tried. That's when the penny finally dropped for Jakob too: In the end, everyone cooks with water. The question is, what motivates you, what stories do you want to be able to tell the next generation? We think we're currently on the right track here.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?