This is how Upvest wants to reach one million end customers

Fintech Upvest wants to expand its existing business model and tap into a new market. Founder Martin Kassing wants to occupy a very specific niche.

Ride with cab competitor Uber and get a few ETF shares in your account as a small kickback or buy a coffee from the Starbucks café chain and receive the cashback in cryptocurrencies: This may sound rather far-fetched at first glance - but it fits in with the vision of a young Berlin fintech.

Upvest, as founder Martin Kassing called the company in 2017, wants to be a company that offers "Investment as a Service" or "Custody as a Service". This means that fintechs, banks and other companies will be able to offer securities trading in their apps in future without having to worry about the technical and regulatory background.

The end customer, for example Max Müller, sees the design of their own bank in the foreground, while Upvest handles the trading and safekeeping of securities in the background. The fintech is thus entering a niche that does not yet exist in this form, believes founder Kassing, who has led the start-up from a one-man operation to one with 35 employees. "Our approach is to offer a simplified API that companies can use to offer their customers the storage and brokerage of investment products," says Kassing. In this context, the technical term API means programming interface.

Upvest started in the crypto sector in 2017. At the time, founder Kassing, who had previously worked in the private equity sector, was employed by the Berlin start-up Finleap. He was so fascinated by the hype surrounding cryptocurrencies such as Bitcoin that he quickly set up his own company, Upvest. "I had always hoped that people would manage to build up their own wealth. I wanted to contribute to this," says the founder looking back. The start-up initially started out as a custodian for Ethereum stocks of smaller companies, later joined by larger start-ups such as Bitwala. Kassing did not want to reveal whether and how much profit the start-up has made so far.

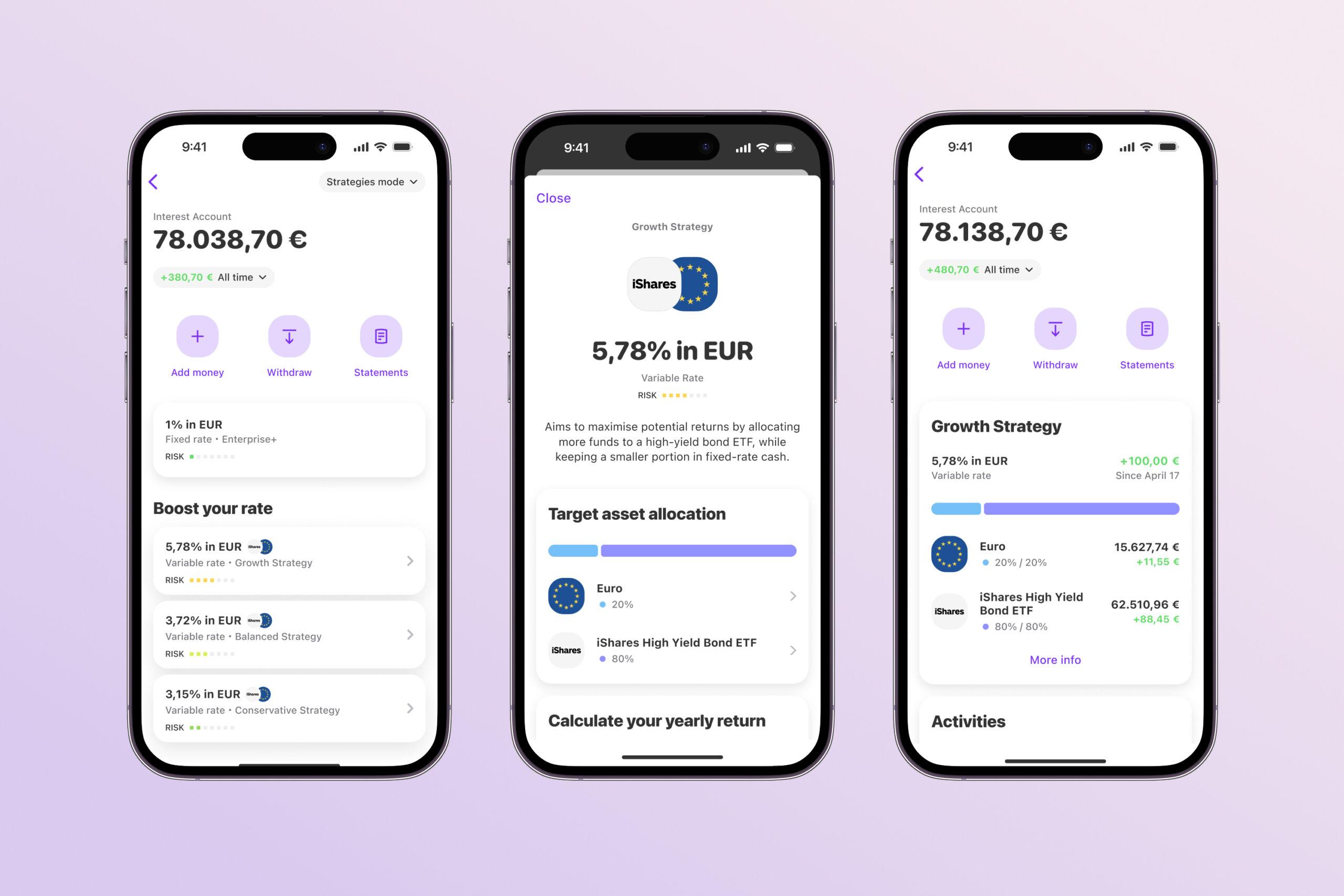

In future, Upvest also wants to offer the option of storing and brokering traditional securities such as shares, bonds or ETFs. The start-up has applied to the financial supervisory authority Bafin for the remaining three of four licenses and expects to receive approval in the coming weeks. "In future, we will be a digital securities trading bank that stores and brokers both traditional securities and modern assets such as cryptocurrencies or tokenized securities," explains Kassing.

The fact that Upvest is also moving in this direction is not unusual. People are buying more shares and bonds again and investing their savings in exchange-traded funds, or ETFs. The sector in Europe is now said to be worth a trillion euros, and demand for securities is also high in Germany. Since January, customers have had to put up with long waiting times to open an account with companies such as the neobroker Trade Republic. According to the Berlin-based fintech, there is simply a lack of video agents who can wave so many people through so quickly, even though they already have a solution that will soon be introduced.

Upvest has already been able to convince investors with its plans and initially raised seven million euros from investors such as N26 founder Maximilian Tayenthal; later, venture capitalist Earlybird , among others, also invested and, together with existing investors, drove the sum raised to twelve million euros. IDNow founder Felix Haas, who also provided money, justified the investment with two main points. Firstly, the sector is interesting and founder Kassing understands it well. "Secondly, he is agile, which means he is someone who doesn't blindly follow a thesis, but adjusts to the left and right," says Haas. "Upvest's model is different from the original one - and that's great," says the investor.

By expanding its portfolio, the start-up now wants to scale its product further and needs new customers to do so. Kassing's initial focus is on neobanks, which in turn want to offer their customers their own investment products, followed by banks and finally apps or companies that do not come from the world of finance. Kassing wants to connect one million end customers via the interface by 2023, and one day he even dreams of significantly more. "I believe the topic of investment as a service has the potential to reach 100 million end customers or more," he says.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?