Stuttgart Accelerator Program: fintogether

The Stuttgart start-up accelerator fintogether is starting and we are there live: every week, we provide an insight into the start-up stories, the workshops and the program processes. You can find all the information about the first batch, which start-ups are taking part and what fintogether has to offer them in our article about the start of the program.

After exciting and intensive months with workshops, mentoring and the intensive further development of their business models, the start-ups are approaching the end of the program and thus the imminent conclusion of their (pre-)seed round. The last few weeks are all about preparing for the big demo day. This is where the teams will present their current status to investors and the public. The start-ups use this time to optimize their pitch deck and financial plans, start actively searching for business angels and prepare their first MVP for market testing.

Week 8

Start-up evaluation workshop, Achim Dümpelmann from EY

In this workshop, the start-ups learned which criteria are used to evaluate young companies and how a potential purchase price can be derived from this. How do you approach investors? What are the special features that play a role in the valuation of a fintech? These are just a few of the relevant questions that were dealt with in this workshop.

The Startup Evaluation workshop helped us a lot to understand the perspective of an investor and which key figures are important to get a positive valuation.

Tobias Prinz, Pinsl

Week 7

Workshop Business Angels & Funding with Dr. Gesa Miczaika from Auxxo Capital

Gesa Miczaika summarizes for us what business angels are and what is important to them: "There are many different types of investors. These include business angels, who typically get involved in the very early stages of a start-up. Angels have a variety of motivations for investing in the start-up sector. Examples include high potential returns, access to the startup world or staying on top of current trends and technologies. Angels are often individuals or organized in groups and also underwrite convertible loans. In principle, all types of companies are potential investment candidates for business angels. The focus is often on high risk and high potential (>10x returns as a target) and disruptive technologies as well as large, growing markets. The due diligence of angel investors can vary greatly. As these are typically early-stage investments, investments are often made before a product or service is marketable. In addition to many other factors, the founding team, the market, the timing and the product-market fit are examined as part of the due diligence process. Governance rights are also relevant. These include, for example, the possibility of taking a board seat, the right to participate in future financing rounds and liquidation preferences. Particular attention is paid to the cap table. The founders must still hold sufficient shares in their company. When starting out as an angel investor, it is advisable to make the first 1-2 investments with experienced angels or to form syndicates. Active networking is particularly important in order to obtain as much information as possible as well as access to potential investments.

"As an angel investment commits you to the start-up for several years, the personal fit between founders and investors is particularly important."

Gesa Miczaika

Financial planning for start-ups: Dr. Julius Tennert, Startbase

For an idea to become a real start-up, it is important that founders deal with the topic of finance at an early stage. Only capital makes it possible to win customers, manufacture products and provide services professionally. Banks, business angels and venture capital investors therefore always ask how much it costs to turn an idea into reality. However, first-time founders in particular find it difficult to give a concrete answer to this key question. Why is that? "It's actually quite simple: if you know what you have to do, you also know how much money you need. However, many first-time founders find this difficult due to their lack of experience, especially if they are coming straight out of university," says Fintogether coach Dr. Julius Tennert, who offers a workshop on financial planning to founders in the Accelerator program.

Financial planning is not about Excel or accounting skills, but about project management. That's why founders need to work on their project management skills in particular.

Julius Tennert

His tip for founders: Create a to-do list, describe each to-do in as much detail as possible and then think carefully about how long it will take you, what still needs to be purchased and where you need outside help. In the planning process, hours become employees, purchases become investments and help becomes consulting costs.

Week 6

Data privacy: Mona Pirouz, EY

The topic of data privacy affects all of us, including start-ups. In the "Data Privacy" workshop with lawyer Mona Pirouz, the start-ups will learn the basics of data protection, legal regulations and what they need to pay particular attention to as start-ups.

Data protection should not slow down new technologies, but rather ensure that users' data is protected and therefore secure.

Mona Pirouz, EY

Week 5

Founders Lounge with the founder Max Willert, HYRE

Max talked about his journey with Hyre Talent, the most important milestones and, above all, what he has learned along the way that may also be relevant for other founders. There were many questions and answers, especially on the topic of financing rounds with crowd funding, first business angels from approach to negotiations and a VC round, as well as on the topic of finding and hiring employees.

Regulatory Foundations for Start-ups: Kristian Borkert, JURIBO

In the workshop with Kristian Borkert, lawyer at Juribo, the start-ups learned about the most important regulations for start-ups and where they can affect them. As a fintech start-up in particular, there are an incredible number of regulations that need to be observed. This is shown by the sheer number of bodies that monitor all of this. These include banks and financial service providers (EBA, Bafin, IHK), but also payment service providers (EBA, Bafin) and insurance service providers (EIOPA, Bafin, IHK). Many fintech start-ups require a banking license for their business model. However, obtaining one is not as easy as it seems at first glance.

If the business model can be implemented without a banking license, that's great. If not, you should think about how you can structure the conditions to avoid having your own license.

Kristina Borkert, JURIBO

In order to obtain such a banking license, you have to meet several requirements, such as several years of professional experience, high free capital, dealing with the issues of money laundering, compliance and the Bafin. An alternative way to start your own business quickly is "banking as a service" or as an IT consultant. Service providers such as Solarisbank provide support here and offer companies the opportunity to run their business under their license. In the beginning, it is always easier to build on an existing license instead of applying for your own. If you are in this field, read up on it and get advice so that you can successfully enter the business world with your start-up.

Week 4

SAP TechDay, Tino Albrecht and Jan Gutknecht, SAP

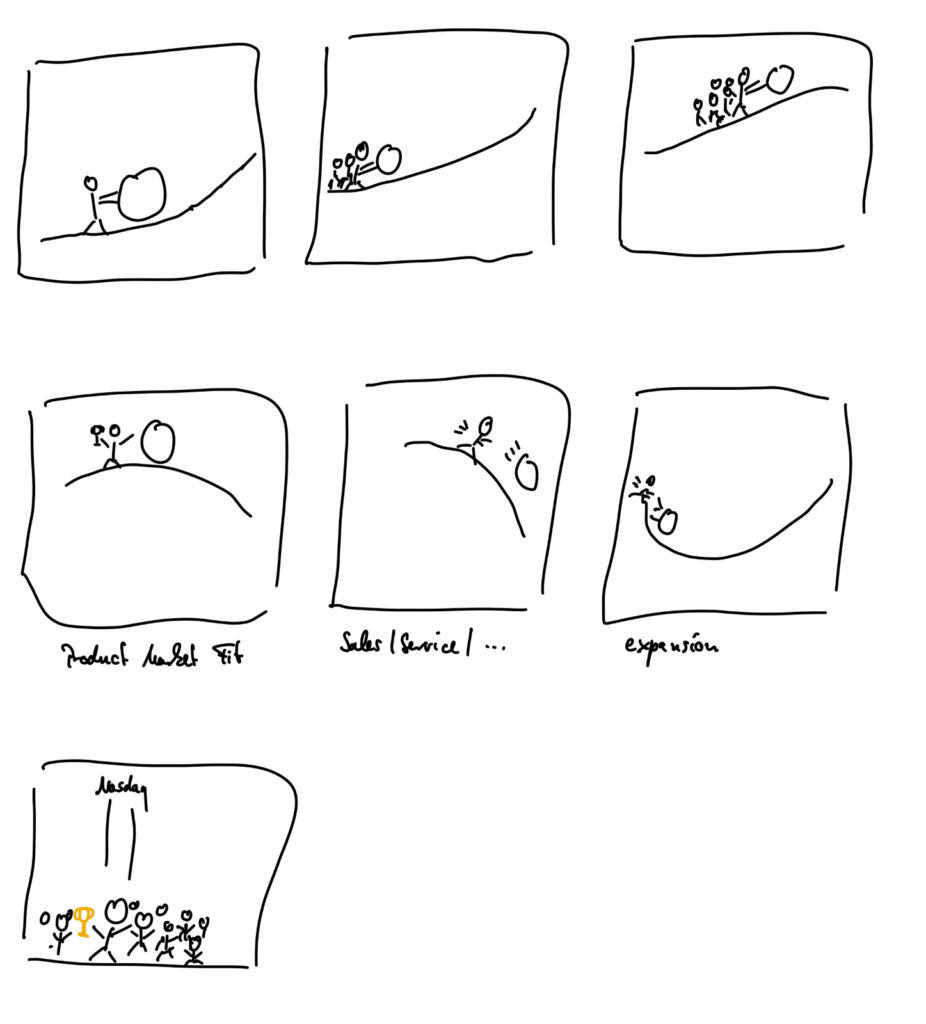

After a brief introduction to the SAP startup programs by Tino Albrecht and Jan Gutknecht, we went straight into the topic of the day: Building blocks of successful startups. From their experience with customer engagements and the exchange with investors and accelerators, Tino and Jan realized that the success of a company depends on the one hand on the service/product developed, but on the other hand the successful scaling also depends on a functioning and stable organizational and operational structure.

It is important for the long-term success of a start-up to invest in the development of structures and processes as early as possible. Otherwise, from product-market fit onwards, you are running behind your own success and not scaling.

Jan Gutknecht, SAP

Founders often focus on the product and service. It is equally important not to miss the point of equipping the company with the right structures, skills and business processes. To put it metaphorically: While you have been rolling a heavy stone ball up the hill for a long time (symbolizing the build-up of the product/service), you are running after it when you are over the crest of the product market fit and sales, service, accounting, etc. are suddenly confronted with completely different volumes of orders.

A timely focus on scalable business processes, a well-structured organizational structure and the selection of the right partners can counteract this. At the same time, setting up a solid IT architecture at an early stage reduces technical debts and the company's own infrastructure does not stand in the way of scaling. In the afternoon, individual sessions were held with each fintogether Batch One start-up. Topics such as the presentation of the product/service, discussion of the business model and networking were dealt with here. Finally, there was a feedback round with a cold beer.

Week 3

Business plan development: Eric Heintze, Institute for Entrepreneurship and Innovation Research, University of Stuttgart

A business plan is essential for every newly founded company. At best, it should answer the key questions: What products and services will be offered? What strategy is the company pursuing in the market? What are the opportunities and risks? What are the prospects for economic success? The business plan should then be used to convince investors. Expert Eric Heintze gave the fintogether participants some basic tips for their own business plan, such as focusing on early adopters at the market launch. The founders also went through their own pitch decks with the entrepreneurship expert and looked for potential for improvement.

Foundation for agile working: Mandy Gardemin and Christina Korber, Lime & Paper

"Foundations for agile working" was the title of one of this week's workshops. Agile working describes the way of working that enables companies and teams to adapt to rapid changes, react quickly and therefore work successfully. In essence, it means greater flexibility, the ability to act more quickly and the willingness to think and work innovatively instead of sticking to outdated processes. To achieve this, bureaucratic hurdles must be removed to make room for more dynamism. But what are the basics, how do you create a foundation for agile working to work? In this workshop, the start-ups developed their purpose, vision and mission, as well as their values and a strategy. The purpose they developed should help them to get up at 6 a.m. every Monday morning and continue working towards their goals. The strategy directs the focus to the essentials, on which you should concentrate in order not to lose the thread.

Brand positioning and brand building: bilekjaeger

During the "Brand positioning and brand development" workshop with our partner bilekjaeger, the start-ups analyzed their logos and the visual language in their presentation. They looked at whether the target groups were correctly formulated and classified and how to be flexible despite changes in the market. The start-ups' websites, presentations and pitches were also scrutinized with regard to the choice of words and a more comprehensible presentation of the business model.

Week 2

Online marketing: Jan Hendrik Reichenbacher, Startbase

A good KPI depends as little as possible on external parameters or coincidences. Instead, it should encourage the team to take responsibility and make them hungry for success.

Jan Hendrik Reichenbacher

The start of the second week was all about marketing. In a workshop, founder and marketing expert Jan-Hendrik Reichenbacher introduced the teams to the basics of online marketing. In a direct exchange with the expert, the teams were able to scrutinize their own marketing concept and adapt the strategy if necessary, for example to address the right target group. In a short space of time, the founders were able to identify and rectify typical mistakes, such as faulty code that prevents a start-up from being found on Google.

Elevator pitch training: Dirk Lehmann

The best pitch is already inside you!

Dirk Lehmann

How can you prepare your pitch even faster and achieve better results at the same time? Is it possible to do this in just one day? In his intensive workshop, pitch trainer Dirk Lehmann teaches you how to inform your audience, but also how to get your target group to take action and get the support you need. The teams learned how to present properly and thus generate enthusiasm among the audience. For example, how do you introduce your start-up in one sentence? According to Lehmann's tip, being clear about such things helps to define your own target group more clearly.

Week 1

Business modeling: Dr. Franceso Pisani, EY

The business modeling canvas and the value proposition model are among the basic analysis tools for every young company. Of course, our founders know this too. But even with such approaches, getting it right is not that easy. Which is why Dr. Francesco Pisani from EY came to the Accelerator right at the start of the program to give a workshop on the topic. In discussions with Pisani and the other start-ups, the participants once again worked out the fundamentals of their business models. The aim was to quickly incorporate many different perspectives and feedback loops in order to derive concrete recommendations for action at the end.

The opening of the workshop series with the topic of business modeling was a great start to the Accelerator program. We fundamentally re-examined both our value proposition and our business model.

Simon, founder of @AktienStudieren

Low code, no code: Sarah and Marco Berger, Die Biberei

Software development poses major challenges for many organizations: It takes a relatively long time, it is often cost-intensive and there is often a lack of necessary development capacity. Wouldn't it be nice if there was a way to develop software faster, more efficiently and, if necessary, without - or at least without extensive - programming knowledge? One answer to this wish is low-code development. Low code does not refer to the quality of the code, but to the code creation. In low-code development, the majority of code is generated through configuration with the help of a low-code platform. The proportion of manual code development is low compared to the configured code quantity, i.e. "low". The promise of no-code development, on the other hand, is that all code is configured and manual code creation becomes unnecessary. In the "Low Code, No Code" workshop with Sarah and Marco Berger from Die Biberei, start-ups learn how to implement projects cost-effectively without extensive IT knowledge.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?