Why Evergreen is taking over the customers of Rubarb and Vantik

The Leipzig-based start-up is certain that its business model will be more successful than its former competitors.

This month, things went from strength to strength for digital asset manager Evergreen. First, the Leipzig-based company took over the customers of the insolvent savings ETF service provider Rubarb at the beginning of August - just two weeks later, it concluded a similar deal with the equally insolvent fintech Vantik. Within a short space of time, Evergreen gained around 60,000 potential new customers, 40,000 from Rubarb and 20,000 from Vantik. Of course, not all of them will actually switch to Evergreen. "We expect a conversion rate of ten to 20 percent for existing portfolios," says Evergreen CEO Iven Kurz. The company is currently in the middle of this range and is therefore very satisfied.

It is a paradoxical situation: several fintechs have filed for insolvency in recent months, including the crypto administrator Nuri. Financing rounds and start-ups are on the decline and the climate seems to be getting gloomier. And Evergreen? Is buying up strongly. But how sensible is the Leipzig-based company's strategy of acquiring the customers of failed competitors? And how does this affect Evergreen's business model?

Iven Kurz is an atypical fintech founder. Unlike many others, he has been in the financial business for 20 years and has worked as an investment advisor for private banks Metzler and Lampe, among others. He also drew inspiration for his business model from this time. "We see ourselves primarily as a sustainable asset manager," he says. "The digital offerings such as our Robo Advisor are channels through which we bring customers to this offering." He is now opening up another channel with the customer acquisition of Rubarb and Vantik.

Unfortunately, a cooperation did not work out

Kurz does not want to be seen as the beneficiary of other entrepreneurs' misfortune. "We initially approached the founders and the insolvency administrators with an open mind and offered our help," he says. Insolvency does not necessarily lead to the dissolution of the company. "We could also have imagined cooperating with them." However, this was not an option. This is how the customer takeovers came about this month. "That was also in the interests of the founders, as it was important to them that their customers didn't suffer from the insolvency."

Evergreen promises customers who switch providers the same conditions as before. The fact that the fintech works together with DAB-Depotbank, just like Rubarb and Vantik, means that the customer transfer should also work relatively smoothly. "In the end, only the intermediary changes," says Kurz. But how sensible is it to take over conditions from a company that had to file for bankruptcy?

"At Vantik, there was no match between the classic savings plans and the savings card," says Kurz. And there was simply no monetization at Rubarb. "Rubarb covered the custody account costs and offered ETFs. Unfortunately, there are usually no kickbacks for these," he says.

How Evergreen earns money

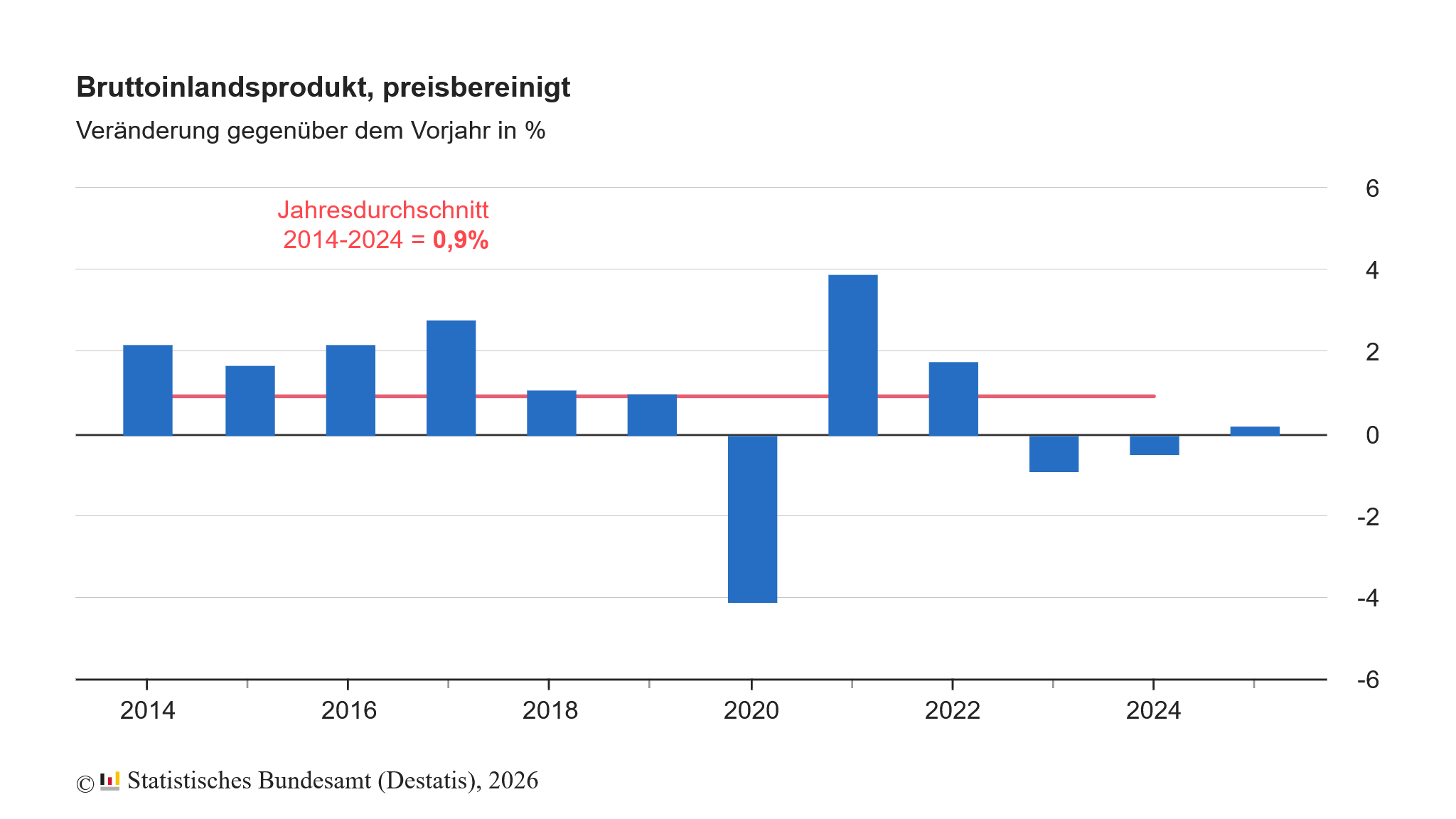

Added to this is the generally difficult situation in the investment market. "For me, it's currently déjà vu, I'm thinking of the time of the Neuer Markt," says Kurz. Back then, many people quickly turned away from shares in the face of the crisis. But he also hopes for a kind of cleansing. "Much of what has gone under the heading of "equity culture" in recent years has had more to do with a casino than wealth accumulation," he says. It's more of a boring business. But one in which Evergreen could make good money.

After all, the Saxons are pursuing a fundamentally different approach. The Vantik card business was not taken over, it went to Vivid Money. And the monetization problems with Rubarb? "We don't have any with our products," says Kurz confidently. Evergreen sells its own funds, for which the fintech retains a fee. This is higher than the custody account fees charged by DAB Bank, which Evergreen pays just like Vantik and Rubarb. "Thanks to this spread, we earn money from every customer," explains Kurz.

This is a good thing, as it is becoming increasingly apparent that scaling is not that easy, especially with robo-advisor offerings. In the US, Wealthfront and Personal Capital had two exits at the beginning of the year that fell short of expectations. One of the main reasons for this is that robo advisors find it difficult to become profitable with the help of pure fees. They cannot charge rates that are too high, and some strategies that simply combine various ETFs are too simple. However, it is difficult to become profitable on the basis of fees of 25 basis points; a large customer base is required. Few providers manage this balancing act. Also because it is relatively easy for established names to steal customers away from them. The major bank JP Morgan Chase, for example, now manages 55 billion US dollars with its You Invest platform. According to the CEO, this was achieved more or less without any marketing.

Evergreen's plan to earn money through fund management rather than fees could be a good way out of the robo-dilemma. Especially because the market environment could become more uncomfortable in the coming months and years.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?