A department store within a department store

Just a few months after it was founded, the Stryze Group was able to raise 100 million US dollars. And it did so with a very simple business model.

It is not easy for a start-up to raise 100 million US dollars. Especially not one that has only been around for a few months. But the Berlin-based Stryze Group managed to do just that at the end of 2020.

The money came from VC Upper90 and Alstin Capital, a VC fund from Carsten Maschmeyer's corporate universe. Both investors are heavyweights in the scene. They are investing so much money even though Stryze's business model is not actually new. So what exactly does the company do that enables it to collect such sums of money?

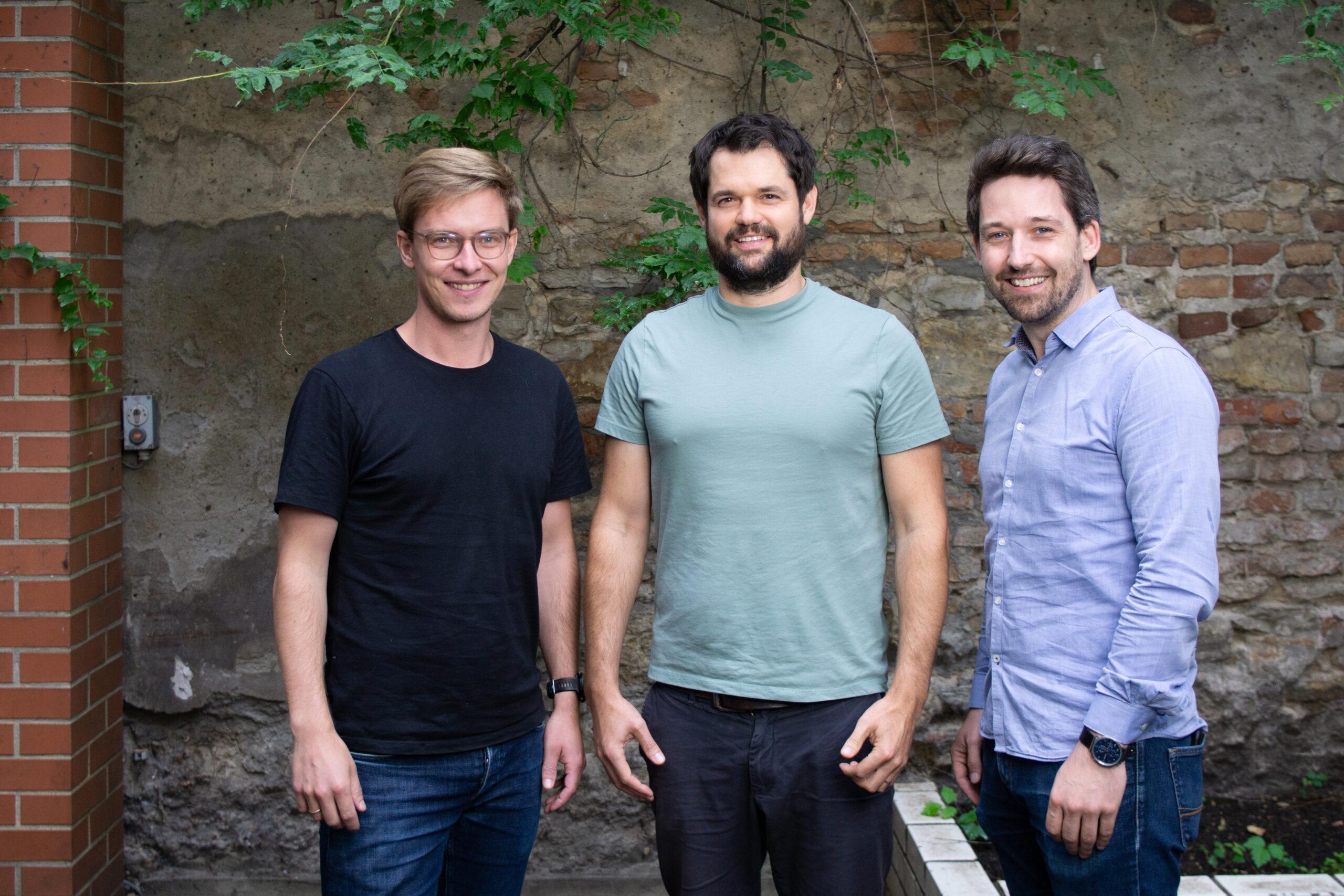

Sebastian Funke can explain. The 40-year-old is CEO of the Stryze Group and a veteran of the German start-up scene. He founded the gaming start-up Smyt back in 2006 and has been active as a company builder in the retail sector for around ten years. In 2017, he founded Manuco, a company that sells private labels on Amazon and is something like the nucleus of the Stryze Group. "We already took over smaller Amazon retailers with Manuco two years ago," explains Funke. With the Stryze Group, he now wants to take this business to a new level.

The company's approach is simple: Funke and his team analyze which retailers have achieved a good listing on Amazon. The Stryze Group focuses primarily on sellers of everyday items, such as coffee capsules, yoga mats and scissors. "However, we stay away from hyped topics, and fashion and electronics are not of interest to us either," Funke qualifies. Stryze also builds brands itself, such as the coffee capsule brand Gourmesso, the first brand that Funke and his colleagues launched, as he explains. But sometimes it is easier to take over a successful company. "You can't achieve the listings that these companies have built up yourself in the short term," he says. Something like that would take 18-24 months. The Stryze Group therefore approaches retailers, offering manpower, capital and expertise. "We can help with the internationalization of the business, for example," says Funke.

Stryze is not necessarily focused on Amazon, but the American online retail giant's marketplace is the most important channel. 200 billion US dollars were generated by third-party retailers via Amazon in 2019, which represents huge potential. However, Facebook and Instagram are also becoming more relevant as shopping platforms, although a different approach is required there, according to Sebastian Funke: "With Amazon, you can work with pull marketing, while social networks are all about push marketing." There is a simple idea behind the terms: anyone searching for something on Amazon - coffee capsules, for example - wants to buy it, so they no longer decide for or against the purchase in principle, but only for a brand. Those who are well positioned on Amazon benefit. On Facebook, Instagram and the like, on the other hand, users are not necessarily on a shopping spree, so anyone who appeals to them with their products cannot necessarily expect a purchase, no matter how well positioned they are. They have to push consumers first. Marketing experts speak of low "conversion rates".

Stryze's business model is not new; US competitors have been using it for some time. However, it did not take off in Germany for a long time, partly due to a lack of capital. "With Manuco, we had to finance all of our acquisitions from cash flow," recalls Funke. Banks and other investors held back, perhaps simply not understanding the business model. Recently, however, venture capitalists have become aware of the trend. "This is one of the reasons why we founded the Stryze Group, to address these VCs and debt capital providers," says Funke.

With the money it has now raised, Stryze is fully focused on growth. By the end of the year, the current 25 brands under the umbrella of the group are to become over 100, and the number of employees is to increase from 60 to 120. "We will also need more capital for this in the medium term," says Funke. He is optimistic that further investors will come on board. "We have always been profitable, we don't burn money," he says.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?