"N26 is overrated for me"

Excessively high valuations, poor sentiment on the stock markets, burst IPOs: according to Fabian J. Fischer, the rosy times are over for start-ups for the time being. In an interview, the VC investor explains why continuation funds could now be a solution.

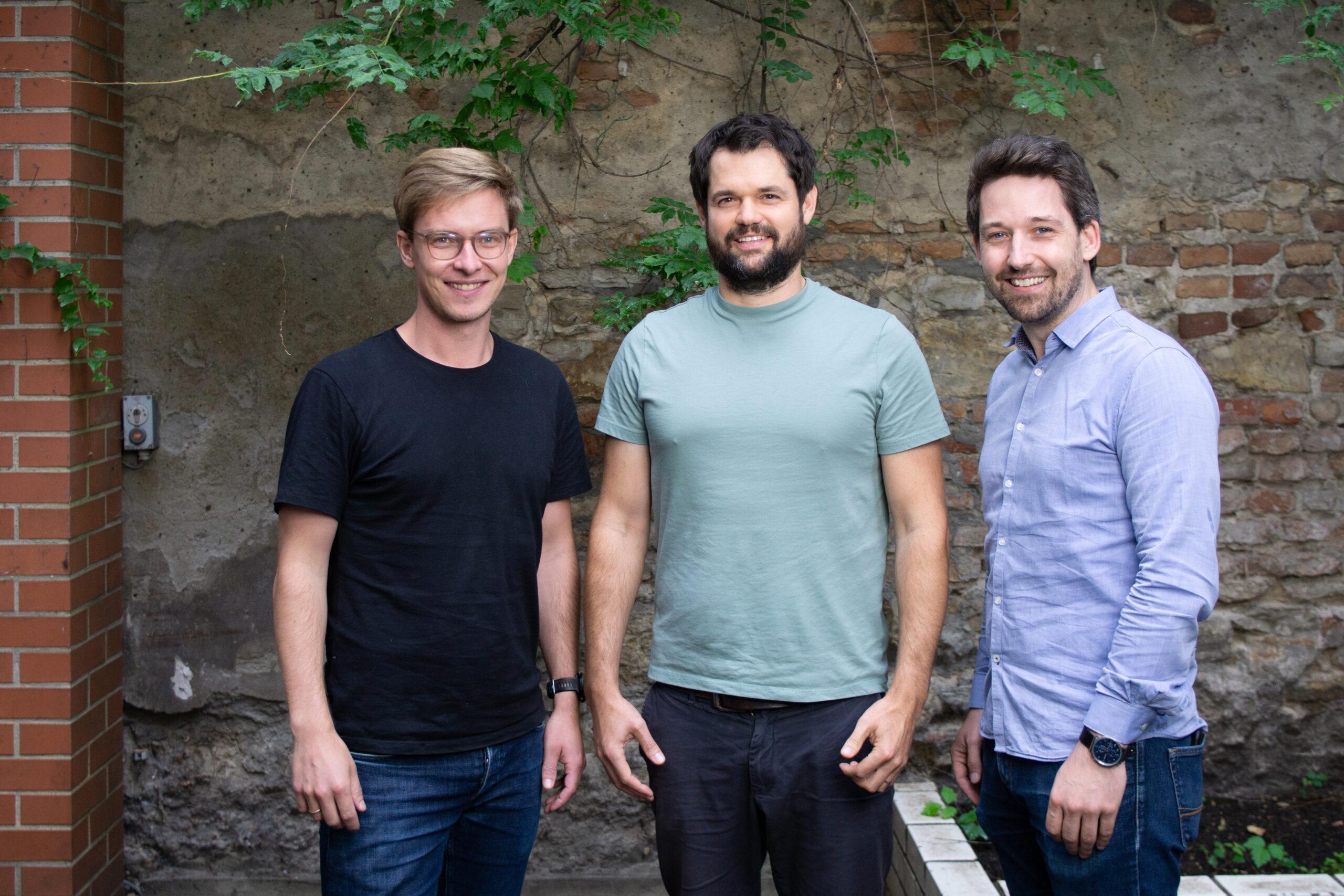

Fabian J. Fischer is a little stressed. He has 30 minutes until the cab arrives. In addition to his time as an investor via Picea Capital, a venture capital company that he co-founded himself, he is also CEO of digital consultancy Etribes. But when it comes to realistic and unrealistic valuations of start-ups, burst or postponed IPOs and the current market sentiment, Fischer has a lot to talk about. Because the next three years at least will be tough for the start-up world, he says.

Mr. Fischer, you see a disparity between excessively high start-up valuations and the chances of a good IPO. What do you mean by that?

We have now had a long period on the stock market in which tech stocks have only ever gone up. For investors, the potential of companies was sometimes more important than hard key figures. This phase is now finally over. In the current tense phase on the markets, investors are more cautious on the stock exchanges. The expectations that many VCs have of start-ups are therefore currently not being met.

Can you give us an example?

I think N26 is currently overvalued. It was a different story in October 2021. After a financing round, it was even said that N26 was worth more than Commerzbank. This valuation may have been appropriate at the time due to the interplay of supply and demand. However, with the best will in the world, I can no longer imagine that happening.

Why do you think such valuations are currently untenable?

We are currently seeing liquidity being pulled out of the market. This is happening somewhat more slowly in the VC sector, where people always think in terms of financing rounds. On the stock market, however, it is happening very quickly. Both start-up shareholders and potential new investors are currently holding back. Investors who currently hold shares in very highly valued companies are trying to sell them on and this is currently only possible with considerable losses. To compensate for the current gloomy mood on the stock market, more and more VCs are now launching a continuation fund.

What is this all about?

Continuation funds come from the private equity sector. If an asset has to be sold because the private equity company has to pay its investors, but it assumes that its investment in a company will be even more valuable in the foreseeable future, then it transfers this asset to a continuation fund. To a certain extent, this fund takes over the investments in the companies from the old fund. Shareholders or new investors can then participate in this fund. This gives investors another opportunity to benefit from the growth of a company.

A lot of stupid money will disappear from the market

Fabian J. Fischer, CEO of Etribes

That sounds a lot like the threat of a Ponzi scheme.

It depends on how transparent this whole process is. If a new vehicle is only ever built to hold shares and pay out investors without there really being a chance of a good exit, then you could be talking about a Ponzi scheme. I think continuation funds are good if the value of the company is realistically assessed and professional investors can decide again whether they want to invest or not. Of course, this is nothing for private investors.

Isn't there a danger that continuation funds will become nothing more than a ramp for start-ups?

Continuation funds must clearly be made for winners. Start-ups are also reassessed. Young companies with a high burn rate, low growth prospects and no realistic scenario for an IPO will find it difficult to get into a continuation fund. Such funds should be used for selection and not to carry out life-prolonging measures on start-ups.

You stated earlier that N26 would probably not get as high a valuation on the stock market as many VCs had estimated last year. Would the start-up end up in a continuation fund?

I think everyone at N26 has to be prepared for valuation corrections. With these corrections, it could definitely end up in a continuation fund. If I were a fund investor now, I would only participate if there was a fair valuation round.

How do you think the financial opportunities for start-ups will develop in view of the current situation?

We will see a whole series of continuation funds so that VCs and start-ups can survive this phase. This will probably last for at least three years. Founders are well advised to keep as much liquidity together as possible and reduce costs. They cannot currently hope for large financing rounds or IPOs. A lot of stupid money will disappear from the market as hard figures become more important again. This also has a positive side: the selection that takes place as a result will lead to more quality.

Personal details: Fabian J. Fischer is a Hamburg-based entrepreneur and investor. As CEO of digital consultancy Etribes, he is responsible for the strategic development of the company, which supports medium-sized companies and DAX-listed corporations with the challenges of digitalization. Fischer is also co-founder of Picea Capital, a venture capital company that invests in early-stage technology companies via an evergreen VC fund.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?