"Impact is the greatest economic opportunity of our century"

As part of Better Ventures, Tina Dreimann has been investing in impact start-ups as a business angel for several years. In this interview, she talks about companies that actually have an impact and those that only pretend to.

There was a time when Tina Dreimann looked after turtles in Costa Rica during her studies. Then she joined the management consultancy Bain & Company. Only then did she enter the start-up world. Today, she is an investor and focuses on impact start-ups. In hindsight, all of her previous positions have prepared her for this role as a business angel, she says.

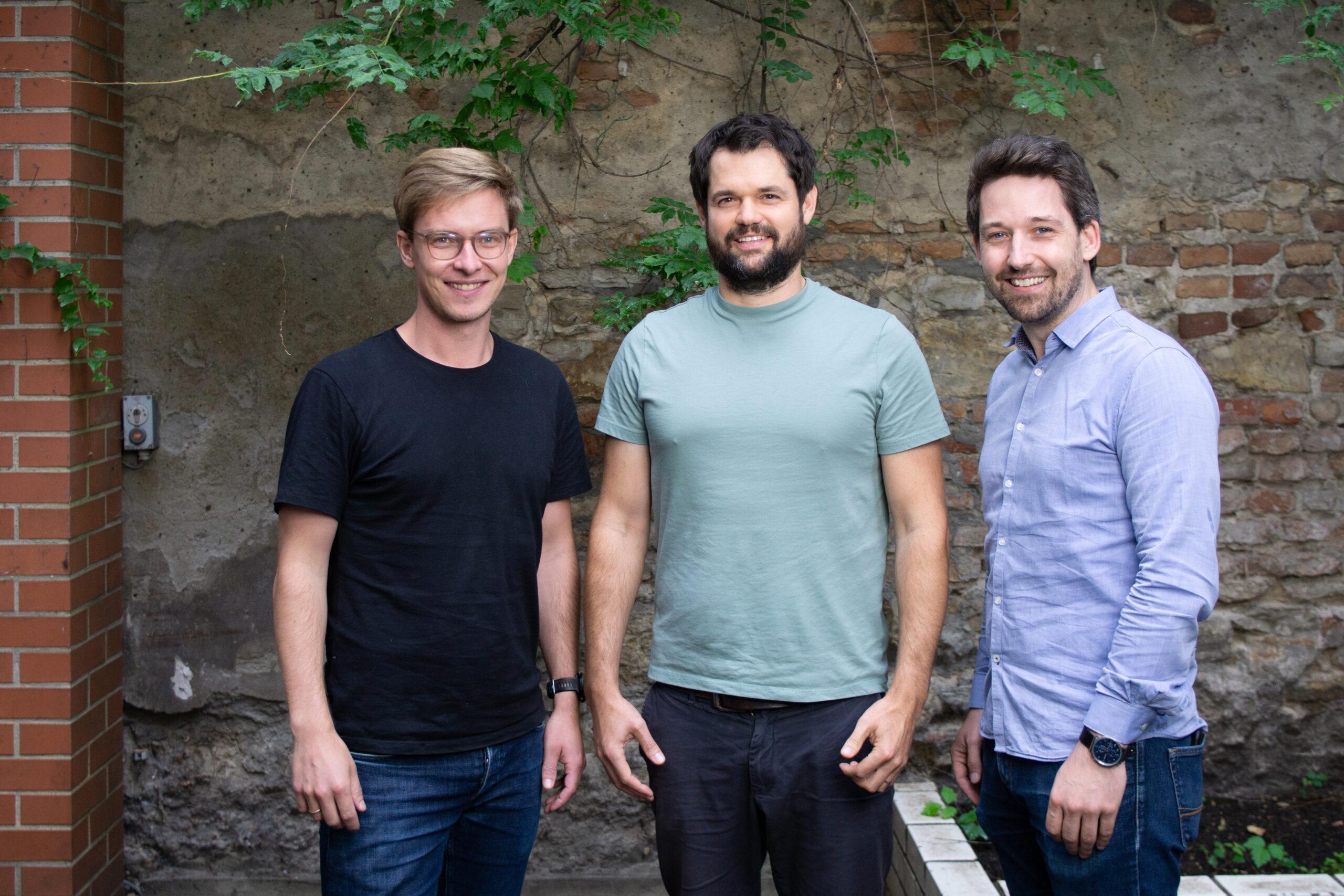

Ms Dreimann, you founded the angel network Better Ventures together with Christoph Behn and Cedric Duvinage in 2019. How did this come about?

We were already working together before the company was founded. I knew Christoph from my time at Bain and then ended up at his scale-up, Kartenmacherei - where I was the first part-time manager. That's also where I met Cedric, our third co-founder. What all three of us have in common is that we have long been interested in the topic of impact, i.e. business models that are not only profit-driven but also have a positive influence.

Better Ventures now has almost 50 investors. How do you decide which of you invests in which start-up?

The nice thing about our Impact Angel Club is that it is always an individual decision. It is also important on the investor side that you support the topics you are passionate about. Only then can you become a good angel. We currently receive over 100 start-up applications per month. We make the pre-selection and then share one or two, sometimes a little more, investment opportunities in our community. The angels who are then interested are included in the investment call.

What sums do you usually invest?

We are early-stage investors, so we are usually active in the first or second round. We have raised everything from 250,000 to almost a million euros from the club itself. The average is probably between 350,000 and 500,000 euros.

You focus on "Impact Only", as it says on your website. So you want to earn money by improving the world, why this focus?

That is my most important message. I am convinced that impact is the greatest economic and business opportunity of our century. With our current investments, we have already proven that it is possible to combine impact and making money. We are not philanthropists. We want to make money and that is the only way we will be able to live in this world in the long term: If we can reconcile profitability and sustainability.

That still sounds rather unattractive to an investor who is out to make a profit, doesn't it?

The start-ups we invest in don't want to forgo profit. The mistake in this assumption is when you imagine investments in a coordinate system in such a way that the possibility of improving the world is shown on one axis and the probability of generating a return on investment on the other. This is precisely not the case: the two belong together.

Please give us an example of such a start-up.

We have invested in Everdrop, for example. The start-up develops sustainable household products. All products are completely free of disposable plastic and unnecessary chemicals. Everdrop only launched in 2019, but already has a turnover in the double-digit millions of euros. The start-up is therefore helping to ensure that less plastic waste ends up in the world's oceans and fewer chemicals endanger the environment.

Basically, many founders are convinced that they have the next big thing, that they will improve the world or at least their industry. How do you differentiate when it comes to impact?

Business models have an impact if they have a direct positive effect on our society or our world. This means that any increase in turnover must automatically result in a measurable increase in this positive added value. What would therefore not be an impact start-up for us is a SaaS start-up that only records CO2 emissions for other companies. That is certainly a successful long-term business model. But at the end of the day, it only helps companies to buy their way out with CO2 certificates and show a better balance sheet.

But the start-ups help companies to find the causes in the first place.

Yes, the first step is transparency. But it must not stop there: In our view, a company only delivers impact if it also provides levers on how companies can reduce their CO2 emissions.

Everyone probably has their own ideas about impact. Flixbus can ensure that fewer people drive cars or fly and thus perhaps also produce less CO2. Does this make Flixbus an impact start-up for you that also has returns in mind?

If Flixbus one day ensures that A. only buses that don't emit CO2 are used and B. fewer people drive themselves, the company will solve many problems at once: it's good for the environment and it's good for our mental health because people will be less lonely and will travel by bus together. And then Flixbus would be an impact startup, yes.

Thank you very much for the interview.

Personal details: Tina Dreimann worked at the management consultancy Bain & Company for five years before moving into the start-up world. She first went to Friendscout24. She later joined Kartenmacherei as a business and agile coach. In 2019, she co-founded the business angel network Better Ventures.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?