InsurTech hepster expands notebooksbilliger's insurance offering

InsurTech hepster expands the insurance offering of notebooksbilliger.de with "NBB Care Plus". Customers can now protect notebooks, tablets and wearables with monthly insurance without a deductible.

Electronics platform notebooksbilliger.de (NBB) has announced a new partnership with InsurTech company hepster. From 01 August 2023, NBB will offer its customers matching insurance for selected products. Hepster is expanding NBB's existing insurance offering with the specially developed product "NBB Care Plus". This insurance is available specifically for notebooks, tablets and wearables such as smartwatches and sports watches.

Customers' buying behavior and needs have changed significantly in recent years. They no longer just want to buy their new laptop, or a camera. They also want the corresponding accessories to go directly with it

Hanna Bachmann, CRO and Co-Founder of hepster

With the new additional service, customers get more flexibility and security. The insurances can be added to the monthly subscription without a deductible or waiting period and offer worldwide protection for drop, breakage, battery damage, damage due to weather conditions, theft and robbery.

Buying the insurance is easy: with one click, it is added to the respective NBB product and thus becomes part of the shopping cart. The monthly insurance rate is based on the price of the device. The first insurance installment is paid via NBB, after which the insurance is activated at hepster and also processed there. In the event of a claim, settlement is also made directly through hepster.

We attach great importance to offering our customers a thoroughly flexible and customized buying experience. This also includes a comprehensive range of services.

Fabian Nösing, Director Marketing at NBB

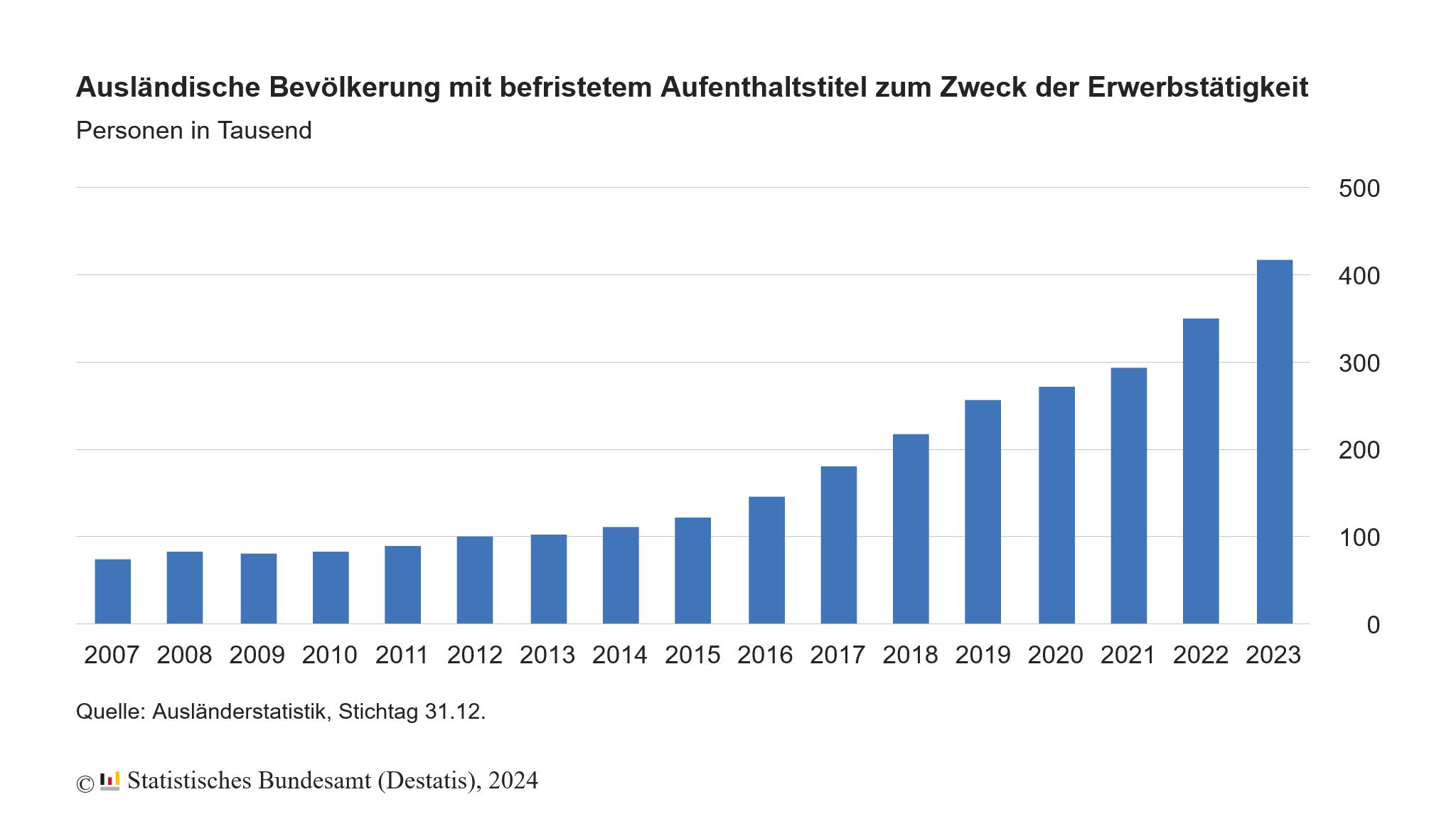

The market for integrated insurance is booming, according to a recent survey of 1,792 participants commissioned by hepster:

- 53 percent of participants have already taken out supplementary insurance. Particularly in demand are insurances for smartphones/cell phones, which one in five takes out directly at the time of purchase, followed by laptop/notebook insurances, which 15 percent have opted for.

- For a purchase price of 500 euros, insurance is important for just under 55 percent of participants, while a further 41 percent consider this from a price of 1,000 euros.

The cooperation between hepster and notebooksbilliger.de enables customers to protect their electronic devices with suitable insurance. Just last month, we reported on Startbase about a successful financing round at hepster for 10 million euros. The trio of founders around Hanna Bachmann, Alexander Hornung and Christian Range seems to be on course for further success with this news.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectTake care, give care

Did this news inform or entertain you? Then we would be happy if you tell your network about it.

Share on Linkedin Share on Facebook Share on XingRelated companies

Startup

2016

Rostock

hepster

Digital and online insurance solutions for private persons and companies.

Startup

2016

Rostock

hepster

Digital and online insurance solutions for private persons and companies.

FYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?