Turning point for start-ups: what is needed now in the crisis

The motto for the start-up scene must be: don't panic. With the right qualities, founders can also build rock star companies now. There are opportunities for start-ups in the B2B sector in particular.

Not long ago, start-ups were inundated with capital, with one record-breaking round following the next (see also "This is why the flood of cash is hurting German start-ups"). Now everything is suddenly different: reports of mass redundancies have replaced news of the next unicorn. Having just been hyped for their IPO, previously successful newcomers are now experiencing public pressure for the first time when their share price spectacularly collapses. How the turnaround from boom to impending recession is affecting the start-up market in concrete terms - and why now is the big opportunity for "hidden champions".

Still in the middle of a boom, but the party mood is gone

Rising interest rates and energy prices, the after-effects of the pandemic, war and globally disrupted supply chains are the macro causes of the general change in sentiment. Long predicted by industry veterans but previously dismissed as superfluous scaremongering by newcomers, concerns about the downturn are now also visible in the micro-cosmos of the start-up scene.

The exuberant mood in the venture capital market had already cooled noticeably in recent months. The FOMO (fear-of-missing-out) often cited by acronym aficionados has given way to the fear of paying inflated company valuations. For founders in fundraising, this can already be felt in concrete terms. Even start-ups for which investors were just queuing up now have to fight much harder for the right follow-up financing.

Investors have put the brakes on hype topics

Momentum seemed to be the only investment criterion, especially in recent years. For start-ups, this meant "growth at any cost", regardless of the risk and burn rate - i.e. the speed at which they burn through their liquid assets. No problem with an abundance of capital, but if funding falters, this means at best: cutting costs in marketing, at worst: redundancies in the team.

The hardest hit by this turnaround are the hype topics in which a lot of venture capital has so far seeped away. Investors have literally slammed on the brakes for Quick Commerce, e-scooters and the like. Even the established fintech sector is weakening. It remains to be seen what impact an impending recession will have here.

Time for the "hidden champions"

Having grown up with the boom, the suddenness of the change in mood has taken young founders in particular by surprise. Nevertheless, there is no reason to panic about a new dotcom disaster. The ecosystem in Germany and Europe has grown up considerably since then. While the Silicon Valley mentality in the USA rewards increased risk-taking among founders, the focus on efficiency and long-term value creation has always been much more deeply rooted in the start-up and investor DNA in Germany. The majority of start-ups are also solidly financed, have resisted the temptations of the cash flood of recent years and have scaled without major overheads.

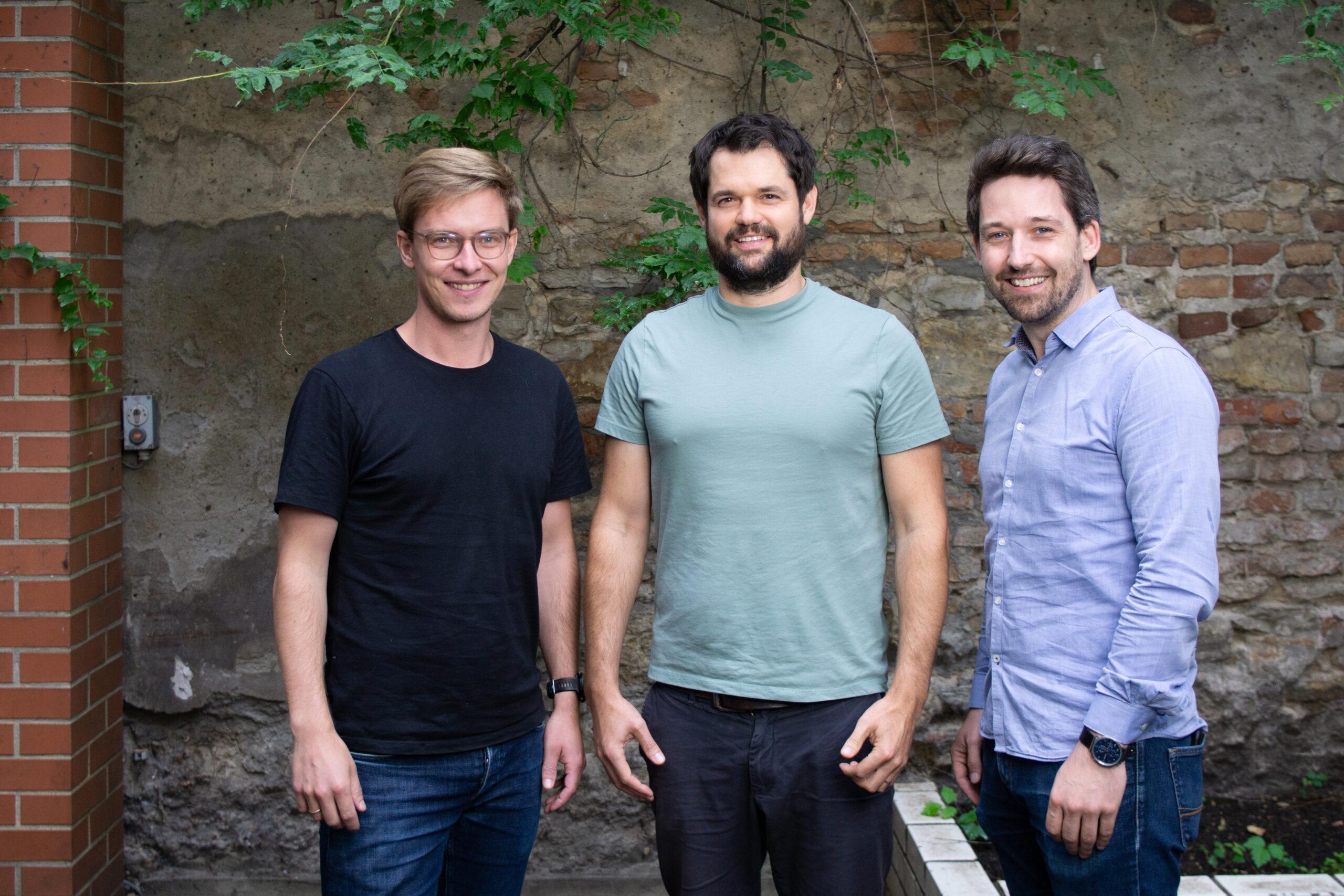

Instead of the greatest possible momentum, what counts now is specialization, efficiency in dealing with the available funds and a clear strategy towards profitability. This is the great opportunity for the "hidden champions", such as the Plantura team, which has built up a literally flourishing company and a loyal customer base without much media hype and with only low marketing costs.

Great opportunities for B2B newcomers in particular

While B2B start-ups are usually the underdogs of the industry in terms of structure, they could now come up trumps. On the one hand, they are much more cost-conscious when it comes to marketing expenditure and, on the other, the pressure on companies to optimize in the face of an impending recession is opening up new opportunities for innovative business models. When digital solutions for transparent supply chains and efficient logistics are in demand, for example, specialized newcomers such as Metalshub from Düsseldorf, which enables price transparency in the raw metal trade, or the digital warehouse-as-a-service solution from Munich-based company Everstox are benefiting. How to build real rock star companies in the supposedly unsexy B2B sector has been demonstrated by the (now-no-longer-quite-so) hidden champions Celonis and Mambu.

Conclusion: Whether B2C or B2B, don't panic about the crisis! With a clear focus on profitability, a certain sense of proportion when it comes to growth and problem-solving skills, founders can build real rock star companies even now.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?