Broken String Biosciences closes $15 million Series A financing round

Broken String Biosciences receives $15 million to further develop its INDUCE-seq technology, which makes genome editing safer. Investors including Illumina Ventures and Mérieux Equity Partners are backing the company.

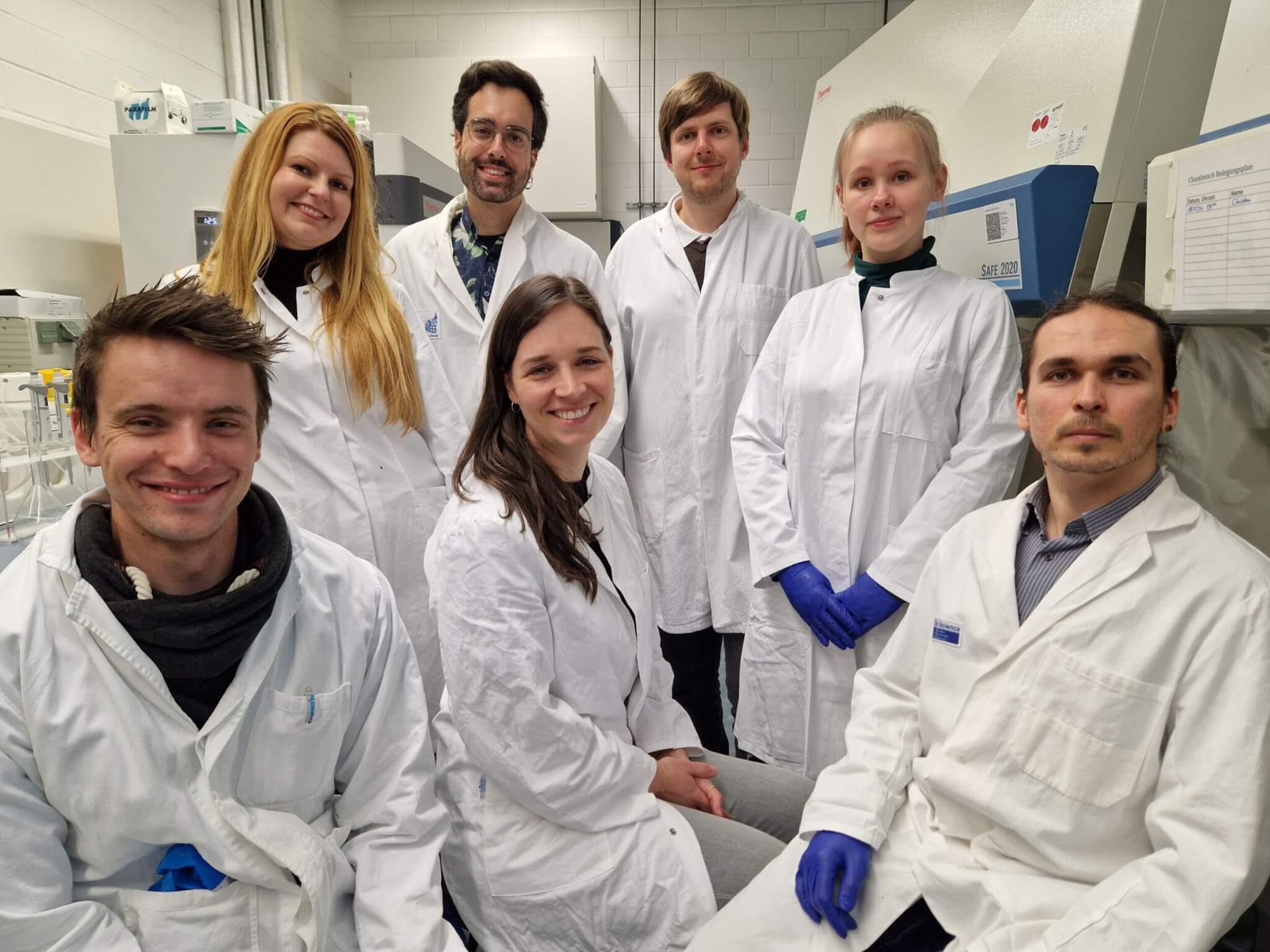

Cambridge - Broken String Biosciences ("Broken String"), a genomics company developing a technology platform to make the development of cell and gene therapies safer, today announced that it has closed a $15 million Series A funding round. The round was co-led by Illumina Ventures and Mérieux Equity Partners and received contributions from HERAN Partners and existing investors Tencent and Dieter von Holtzbrinck Ventures (DvH Ventures). As part of the round, Yoann Bonnamour of Mérieux Equity Partners and Arnaud Autret of Illumina Ventures join the company's board.

Clinical progress of cell and gene therapies is hampered by safety concerns regarding off-target effects - we recognize the power of Broken String Biosciences' technology to drive advances in safe genome editing, genomics and genetic toxicology, and optimize drug program development.

Arnaud Autret, PhD, Principal at Illumina Ventures

The Series A funding will be used to develop Broken String's next-generation sequencing (NGS)-based DNA break mapping technology, INDUCE-seq™, into a scalable "platform as a service" (PaaS) solution and expand its capabilities beyond gene editing. This expands the commercialization strategy and drives commercial traction. The investment also supports the company's continued growth, including recruitment for the UK team at the Wellcome Genome Campus in Cambridge and the establishment of an office in the US.

The Broken String Biosciences team has the technical expertise and resources, coupled with its strong connection to a world-leading genomics research institute, to advance this platform and transform the way gene editing programs are designed and developed.

Yoann Bonnamour, Investment Manager at Mérieux Equity Partners

Advances in cell and gene therapies based on genome editing technologies such as CRISPR-Cas9 require rigorous preclinical assessments of off-target editing operations. INDUCE-seq enables researchers to evaluate the specificity of genome editing tools and examine associated off-target genetic outcomes. The platform technology addresses the limitations of existing measurement approaches for off-target gene editing and uses a novel polymerase chain reaction (PCR)-free approach to directly measure and quantify DNA double-strand breaks using NGS (1). It provides data-driven, actionable insights at discovery, preclinical, and clinical development stages to identify novel therapeutic targets in the genome and advance gene editing programs.

Broken String Biosciences' INDUCE-seq technology platform is a breakthrough innovation for off-target genome break characterization.

Raf Roelands, Investment Director at HERAN Partners

Felix Dobbs, PhD, Chief Executive Officer of Broken String Biosciences, stated, "Our vision is a future where cell and gene therapies are safer, more efficient and more affordable for patients. Our INDUCE-seq platform, working at the intersection of biology, bioinformatics and data science, provides an unbiased, end-to-end solution that accelerates the measurement and evaluation of off-target gene editing during therapy development. This provides the information necessary to advance therapeutic programs based on gene editing and minimize potential risks that may lead to subsequent clinical failures. By developing a deployable PaaS solution, we have the opportunity to provide this much-needed solution to the cell and gene therapy community and achieve rapid market growth." He continued, "The support Broken String has received from leading life sciences and genomics investors demonstrates the potential of our technology and its ability to deliver on the therapeutic promise of gene editing."

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectTake care, give care

Did this news inform or entertain you? Then we would be happy if you tell your network about it.

Share on Linkedin Share on Facebook Share on XingRelated companies

Investor

2014

Köln

Investor

2014

Köln

Investor

2017

München

Investor

2017

München

FYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?