TVM Capital Life Science leads $16 million Series A financing round for Vektor Medical

Focusing on the distribution of vMap®, an AI platform, Vektor Medical plans to optimize cardiac arrhythmia treatments

Munich and Montreal - February 6, 2024 - TVM Capital Life Science ("TVM"), an international venture capital firm focused on investing in life sciences innovation, today announced a $16 million Series A financing for Vektor Medical, a pioneer in non-invasive, AI-based cardiac arrhythmia analysis technology. TVM co-led the round with Solas BioVentures. The funds will support the commercialization of vMap®, Vektor's AI-based arrhythmia analysis tool that transforms the way electrophysiologists (EPs) approach ablation procedures. Dr. Luc Marengère, Managing Partner at TVM, will join Vektor Medical's Board of Directors, and Dr. Sascha Berger, General Partner at TVM, will serve as an observer on the Board.

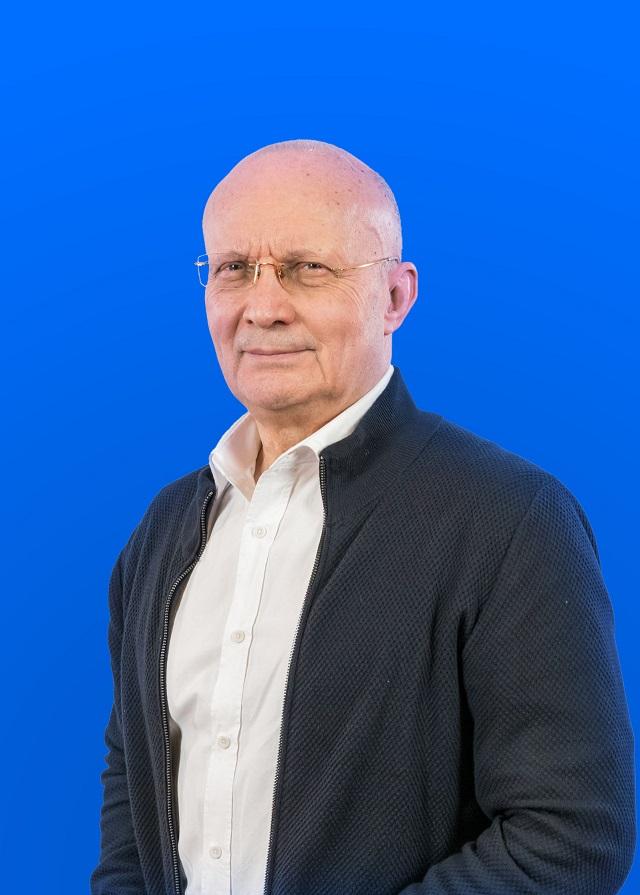

Changing the standard of care requires a unique and transformational approach. vMap has been well received by EPs focused on excellence.

Dr. Luc Marengère, Managing Partner at TVM Capital Life Science

Vektor's vMap is the only FDA-cleared non-invasive AI solution for arrhythmia localization and analysis, seamlessly leveraging only a 12-lead ECG. vMap provides information to better understand the source(s) of the arrhythmia, allowing physicians to optimize their procedures and treat their patients more efficiently.

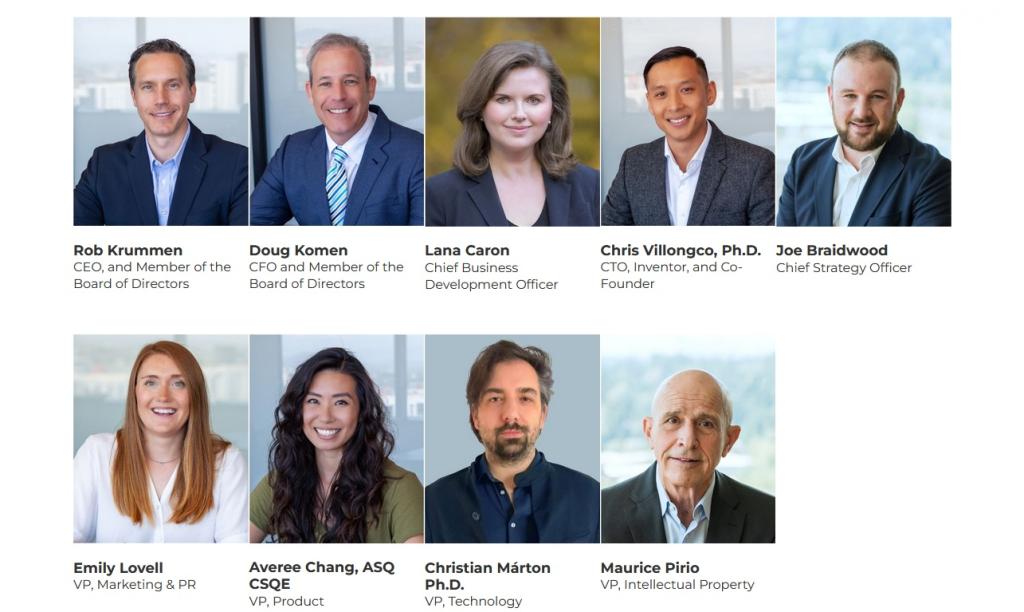

Leading EPs in the U.S. are using vMap to optimize ablation procedures and improve patient outcomes.

Rob Krummen, CEO of Vektor Medical

About Vektor Medical & TVM Capital Life Science

Based in San Diego, Vektor Medical is on a mission to revolutionize arrhythmia treatment for millions of people affected by atrial fibrillation and other cardiac arrhythmias. Through its AI-based, non-invasive arrhythmia analysis technology, vMap, the company aims to improve cardiac ablation outcomes, optimize workflows and increase procedural efficiency.

TVM is a leading international venture capital firm focused on investing in life sciences innovation. The company has a transatlantic investment team and approximately $900 million under management. TVM's portfolio focuses on therapeutics and medical technologies from North America and the EU that represent differentiated first-in-class or best-in-class assets and have the potential to transform the standard of care.

Newsletter

Startups, stories and stats from the German startup ecosystem straight to your inbox. Subscribe with 2 clicks. Noice.

LinkedIn ConnectTake care, give care

Did this news inform or entertain you? Then we would be happy if you tell your network about it.

Share on Linkedin Share on Facebook Share on XingFYI: English edition available

Hello my friend, have you been stranded on the German edition of Startbase? At least your browser tells us, that you do not speak German - so maybe you would like to switch to the English edition instead?

FYI: Deutsche Edition verfügbar

Hallo mein Freund, du befindest dich auf der Englischen Edition der Startbase und laut deinem Browser sprichst du eigentlich auch Deutsch. Magst du die Sprache wechseln?